Do I need to worry about the “fiscal cliff”?

This is a frequent question that we have heard from our clients and friends lately. Do I need to worry about the “fiscal cliff”?

We don’t think the fiscal cliff represents a long-term concern to investors’ portfolios. The market may make a temporary move down if a compromise is not reached before January 1st. However, an agreement is inevitable and the market should move forward with renewed confidence.

There are so many unknowns involved that the best course of action is likely no action at all. We are not making any special changes to our NorthStar client portfolios (FYI: our stock portfolio is up over 30% YTD for 2012; see details and performance disclosures).

It’s interesting to note that retail investors (aka individual, “mom and pop” investors) have been selling and fleeing the market in response to the fiscal cliff hype-a-palooza. Meanwhile, professional investors (institutions and hedge funds) have been strong buyers. See the chart below.

Can Your Edward Jones Financial Advisor Really Serve Your Best Interests?

For full disclosure, NorthStar Capital Advisors is a registered investment advisor that operates under the fiduciary standard of care for its clients.

A comprehensive examination of Edward Jones’ business model was published yesterday: Can Your Edward Jones Financial Advisor Really Serve Your Best Interests? (The Motley Fool)

A comprehensive examination of Edward Jones’ business model was published yesterday: Can Your Edward Jones Financial Advisor Really Serve Your Best Interests? (The Motley Fool)

The authors’ main thesis is the broker-dealer model that Edward Jones operates is generally inferior to a fiduciary model for individual investors seeking advice.

The authors feel Edward Jones advisors can’t really serve their customers’ best interests because of the multitude of ways they can get paid to preferentially push high-fee products. Here are some of the components of its financial advisor’s compensation:

The authors conclude: “investors are at greater risk of being taken advantage of when their advisor is not required to put them first, has strong economic incentives to generate fees, and doesn’t need to disclose those conflicts of interest in a particularly clear way.”

To its credit, Edward Jones does an outstanding job of disclosing how its financial advisors get paid in this 46 page document.

Please refer to the original article for a thorough vettting of Edward Jone’s approach.

Ameriprise Employees Seek Class-Action Lawsuit Against Ameriprise for Bad 401(k)

Employees of Ameriprise Financial Inc. are suing their employer claiming Ameriprise loaded up the company 401(k) with its own expensive, underperforming mutual funds and charging employees excessive fees.

Employees of Ameriprise Financial Inc. are suing their employer claiming Ameriprise loaded up the company 401(k) with its own expensive, underperforming mutual funds and charging employees excessive fees.

“Of any company, Ameriprise should know what is a good financial product,” said plaintiff’s lawyer Jerome Schlicter. Ameriprise is the largest employer of certified financial planners in the nation with over 14,000 employees.

Lawyers for Ameriprise argued there were sufficient non-Ameriprise fund choices. U.S. District Judge Susan Richard Nelson dismissed this rationale saying, “Merely including a sufficient mix of prudent investments along with imprudent options does not satisfy a fiduciary’s obligations.”

Most of Ameriprise’s in-house funds were labeled RiverSource funds before being rebranded Columbia after Ameriprise purchased the Columbia Management fund business from Bank of America.

The lawsuit also claims that Ameriprise used worker retirement assets to seed new and untested mutual funds to make the funds more marketable to outside investors and thus generate more profit for the company.

Source: The Star Tribune

Smart Money Newsletter ~ November 2012

The latest issue of Smart Money is hot off the press!

The latest issue of Smart Money is hot off the press!

Smart Money is a NorthStar publication that covers financial education, money management, and investment strategies.

Here’s what you’ll find in the latest issue:

Financial Readiness — As Critical As Fully Charged Batteries

In light of the incredible impact of Megastorm Sandy last month, we want to spotlight the importance of “financial readiness” when it comes to disaster preparedness. It’s just as critical as filling the gas tank in your car and making sure you’ve got plenty of batteries ahead of an emergency.

What to Do With Your Old 401(k)?

Be it from changing jobs or retiring, it’s very common to have at least one old 401(k) account accumulating cobwebs in a dark corner of your financial closet. Shine a light there and make sure you’re doing the right thing. Here’s a quick overview of how to make a savvy decision with managing your old retirement accounts. Want more details? Check out our in-depth companion article on 401(k) choices available here.

Click the cover image to view or click here to download it directly. You can always get the latest issue of Smart Money by visiting www.nstarcapital.com/newsletters.

Given the universal importance of financial readiness, please do your friends and family a favor by sharing this article with them.

![]()

10 Most Common Behavior Biases of Investors

Robert Seawright with Madison Avenue Securities assembled this list of the ten most common behavioral biases that hinder investors:

- Confirmation bias – we gather facts and see those facts in a way that supports our pre-conceived conclusions

- Optimism bias – our confidence in our judgement is usually greater than our objective accuracy

- Loss aversion – the pain of losing $100 is at least twice as impactful as the pleasure of gaining $100 (causes investors to hold onto their losing stocks too long)

- Self-serving bias – the good stuff that happens is my doing while the bad stuff is somebody else’s fault

- Planning fallacy – overrate our own capacities and exaggerate our abilities to shape the future

- Choice paralysis – we are readily paralyzed when there are too many choices

- Herding – we run in herds, latching onto the group think and moving in lock step

- We Prefer Stories to Analysis – people love a good narrative and prefer to be swept up by the story rather than work through the definitive numbers

- Recency bias – we tend to extrapolate recent events into the future indefinitely

- Bias blind-spot – the inability to recognize that we suffer from the aforementioned cognitive distortions!

Financial Readiness: As Critical as Fully Charged Batteries

In light of the incredible impact of Hurricane Sandy on the East Coast of the U.S. this week, we want to spotlight the following important FTC Consumer Alert:

In light of the incredible impact of Hurricane Sandy on the East Coast of the U.S. this week, we want to spotlight the following important FTC Consumer Alert:

Home is where most people feel safe and comfortable. But sometimes — say, when a hurricane, flood, tornado, wildfire, or other disaster strikes — it’s safest to pack up and go to another location.

The Federal Trade Commission (FTC), the nation’s consumer protection agency, says that when it comes to preparing for situations like weather emergencies, financial readiness is as important as a flashlight with fully charged batteries. Leaving your home can be stressful, but knowing that your financial documents are up-to-date, in one place, and portable can make a big difference at a tense time.

Here are some tips from the FTC for financial readiness in case of an emergency:

- Conduct a household inventory. Make a list of your possessions and document it with photos or a video. This could help if you are filing insurance claims. Keep one copy of your inventory in your home on a shelf in a lockable, fireproof file box; keep another in a safe deposit box or another secure location.

- Buy a lockable, fireproof file box. Place important documents in the box; keep the box in a secure, accessible location on a shelf in your home so that you can “grab it and go” if the need arises. Among the contents:

- your household inventory

- a list of emergency contacts, including family members who live outside your area

- copies of current prescriptions

- health insurance cards or information

- policy numbers for auto, flood, renter’s, or homeowner’s insurance, and a list of telephone numbers of your insurance companies

- copies of other important financial and family records — or notes about where they are — including deeds, titles, wills, birth and marriage certificates, passports, and relevant employee benefit and retirement documents. Except for wills, keep originals in a safe deposit box or some other location. If you have a will, ask your attorney to keep the

original document. - a list of phone numbers or email addresses of your creditors, financial institutions, landlords, and utility companies (sewer, water, gas, electric, telephone, cable)

- a list of bank, loan, credit card, mortgage, lease, debit and ATM, and investment account numbers

- Social Security cards

- backups of financial data you keep on your computer

- an extra set of keys for your house and car

- the key to your safe deposit box

- a small amount of cash or traveler’s checks. ATMs or financial institutions may be closed.

- Consider renting a safe deposit box for storage of important documents.Original documents to store in a safe deposit box might include:

- deeds, titles, and other ownership records for your home, autos, RVs, or boats

- credit, lease, and other financial and payment agreements

- birth certificates, naturalization papers, and Social Security cards

- marriage license/divorce papers and child custody papers

- passports and military papers (if you need these regularly, you could place the originals in your fireproof box and a copy in your safe deposit box)

- appraisals of expensive jewelry and heirlooms

- certificates for stocks, bonds, and other investments and retirement accounts

- trust agreements

- living wills, powers of attorney, and health care powers of attorney

- insurance policies

- home improvement records

- household inventory documentation

- a copy of your will

- Choose an out-of-town contact. Ask an out-of-town friend or relative to be the point of contact for your family, and make sure everyone in your family has the information. After some emergencies, it can be easier to make a long distance call than a local one.

- Update all your information. Review the contents of your household inventory, your fireproof box, safe deposit box, and the information for your out-of-town contact at least once a year.

Source: Federal Trade Commission

Rich Dad, Poor Dad, Bankrupt Dad?

You’ve probably heard of Robert Kiyosaki through his best-selling book series, Rich Dad, Poor Dad. Kiyosaki holds himself out as a self-made wealth guru who is happy to share the secret money-making strategies of the wealthy.

The tactics that he has advocated range from silly to illegal and include things like insider trading, buying multiple real estate properties for no money down, and buying stocks on margin via unfunded brokerage accounts.

Now add bankruptcy to Kiyosaki’s highly questionable list of strategies. One of Kiyosaki’s businesses, Rich Global LLC, filed for bankruptcy protection in August after it was ordered to pay a $24 million settlement. Kiyosaki will not be putting any of his personal fortune toward the settlement.

There is no evidence that Rich Dad, the man who allegedly imparted all these money-making secrets to Kiyosaki, ever existed. Nor is there any evidence that Kiyosaki amassed any significant wealth before the publication of Rich Dad, Poor Dad in 1997. Nonetheless, Kiyosaki is now reportedly worth $80 million!

In all likelihood, Kiyosaki did not get wealthy using the schemes he pushes in his books, but through proceeds of his book sales and personal appearances. He got wealthy selling the dream and illusion of get-rich-quick schemes.

source: Forbes

NBC’s Chris Hansen Investigates Annuity Sales to Seniors

NBC’s Chris Hansen conducted an undercover investigation focused on the predatory sales tactics used in the sale of equity-indexed annuities to senior citizens.

Watch the video below or read the transcript to,

- go behind the scenes to uncover the sales tactics insurance agents use

- inside free-dinner seminars to catch the questionable pitches

- inside training sessions to reveal insurance agents being taught to scare seniors and puff their credential with deceptive books, magazines and radio shows

Prominent in the program is Annuity University which trains insurance agents. Annuity University has been sued for running a dishonest scheme to deceive, coerce, and frighten the elderly. Read more about Annuity University in this Wall Street Journal article.

Minnesota Attorney General Lori Swanson, who reviewed NBC’s footage, and who has filed several suits alleging fraud in the sale of annuities to seniors, tells Hansen: “…what is tragic about it is when those agents go into the seniors’ homes, it is literally the wolf among the lambs.”

“Treat’em like blind 12-year olds”

Commentary: Annuities are a suckers bet

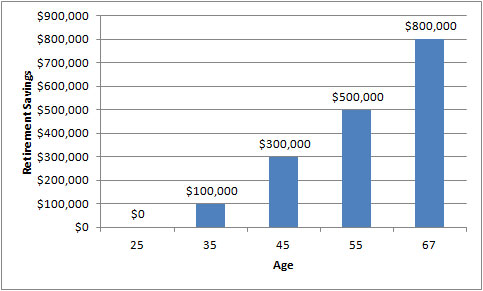

Quick Check: Are Your Retirement Savings On Track?

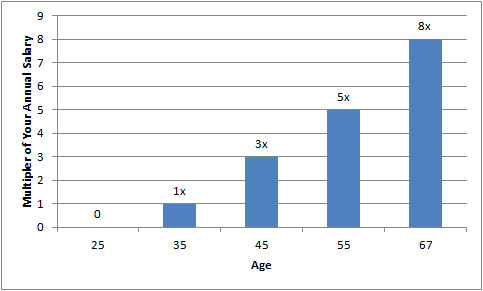

The two greatest impacts on your retirement savings over time are starting early and saving consistently. Beyond that, how do you know if you’re on track to have enough set aside to retire comfortably? Fidelity Investments recently published convenient “rule of thumb” that provides convenient, age-based targets to help you gauge your progress.

What’s the end game look like?

If you’ve saved eight times your annual salary by your last year of work before retiring, you should have enough money to replace 85% of your annual income for a 25-year period, including social security.

Age-based targets for retirement savings. For example, at age 35 you should have saved one times your annual salary. By age 55 you should have 5 times your salary. Ultimately retire at age 67 with eight times your annual salary set aside in retirement savings.

Here are the key milestones for getting to 8x and beyond:

- age 25: start saving for retirement beginning at 6% of annual salary and increasing this by 1% per year until it reaches 12%; employer provides a 3% matching contribution

- ages 31-67: setting aside 12% of annual income for retirement savings with an additional 3% matching contribution from the employer

- age 35: you should have saved one times your annual salary

- age 45: you should have saved three times your annual salary

- age 55: you should have saved five times your annual salary

- age 67: retire with eight times your annual salary in retirement saves

- age 67-92: live off your retirement savings

Recognize that this is a broad guide and each person’s requirements will vary by the specifics of their situation. Nonetheless, this provides a quick and easy reality check.

What if you check your actual retirement savings and you’re coming up short against these targets? Try to increase your retirement contributions to close the gap. Sit down with an investment advisor to review your investment portfolios and make sure they are optimized for success.

Source:

Fidelity Outlines Age-Based Savings Guidelines to Help Workers Stay on Track for Retirement

Recent Posts

-

Estimated Taxes, Marriage 2.0 and Cosmic Bumper Cars January 8,2026

-

Hidden Insurance Gaps That Threaten Your Wealth December 11,2025

Archives

- February 2026

- January 2026

- December 2025

- November 2025

- October 2025

- September 2025

- August 2025

- July 2025

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- May 2022

- April 2022

- March 2022

- February 2022

- December 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- November 2019

- October 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- November 2010

- October 2010

- September 2010

- August 2010

Categories

- 401(k)

- Annuities

- Behavior

- Best Practices

- Bonds

- Charitable Donations

- Economy

- Fees

- Fiduciary

- Financial Planning

- Investing 101

- Live Well

- Market Outlook

- Mutual Funds

- NorthStar

- Performance

- Personal Finance

- Planning

- Retirement

- Saving Money

- Scams & Schemes

- Seeking Prudent Advice

- Tax Planning

- Uncategorised

- Uncategorized

- Weekly Market Review