Tuscan Sun or Fool’s Gold? Navigating Global Moves and Market Hype

Did you catch Episode #10 of the podcast?

- Is your retirement mission ready for a move to the Mediterranean?

- It seems like every time you turn on the news lately, gold is hitting another all-time high—But when a ‘shiny’ asset’s price sky-rockets, is it a signal to jump on board, or a warning that you’re about to buy into a bubble right before the engines cut out?

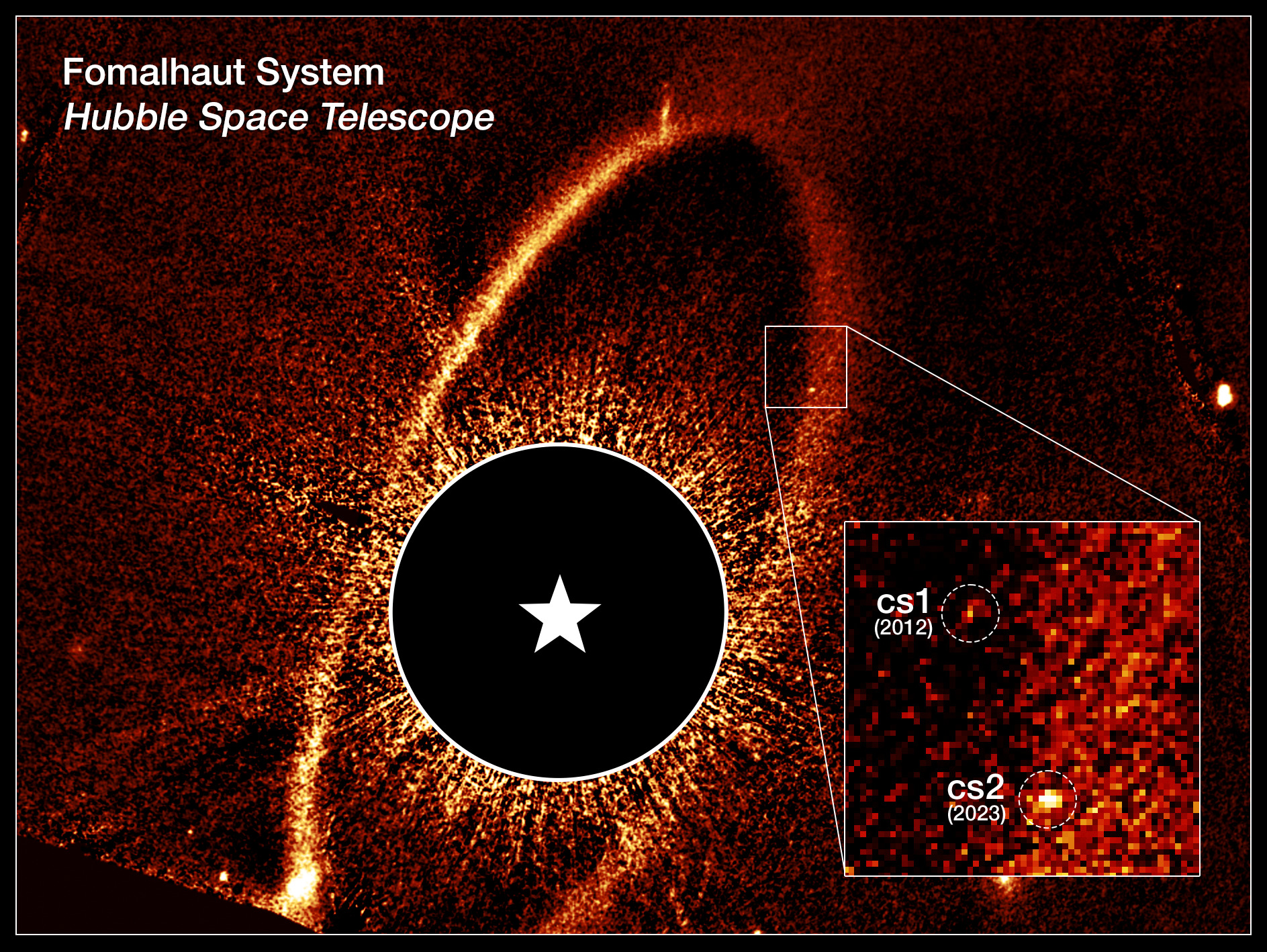

- And a special tribute to Gayle Riggsbee a talented engineer who mentored generations of Carolina skywatchers and left his name on both an observatory and an asteroid orbiting the Sun.

Listen now on: Apple | Spotify | website

Spend It or Lose It? The Truth About Early-Retirement Spending Habits

Did you catch Episode #9 of the podcast?

- Is your retirement plan ignoring your health? Why the “4% Rule” might be sabotaging your best years.

- How do you guess your ‘expiration date’ so you don’t accidentally run out of money in retirement?

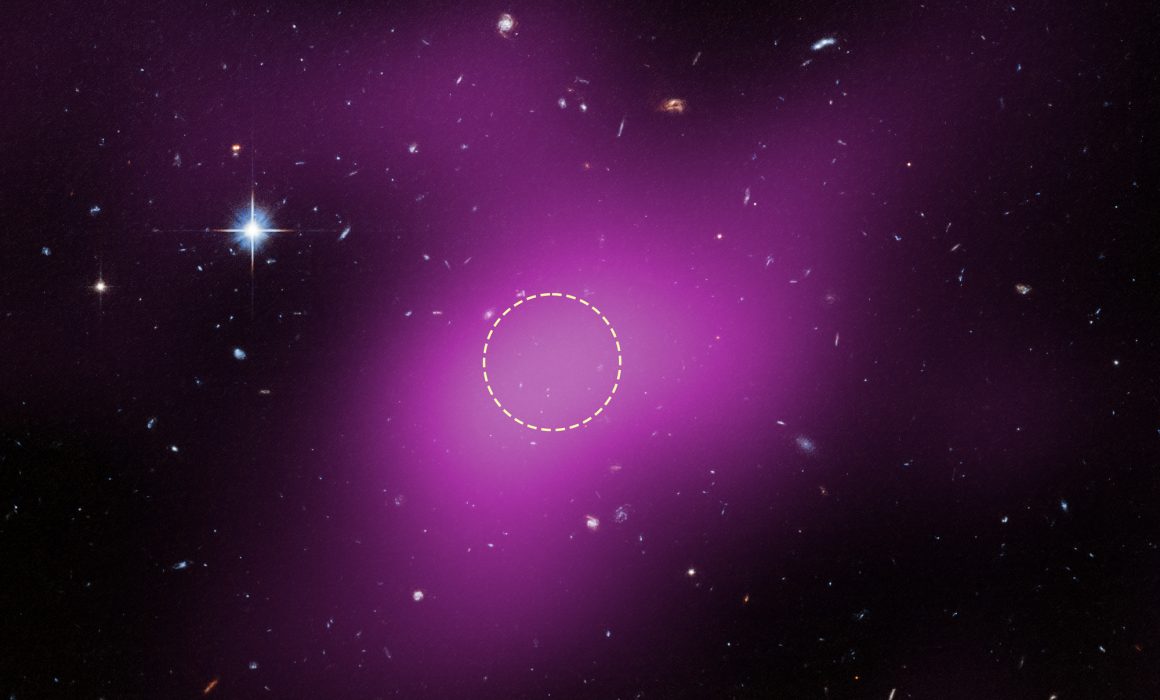

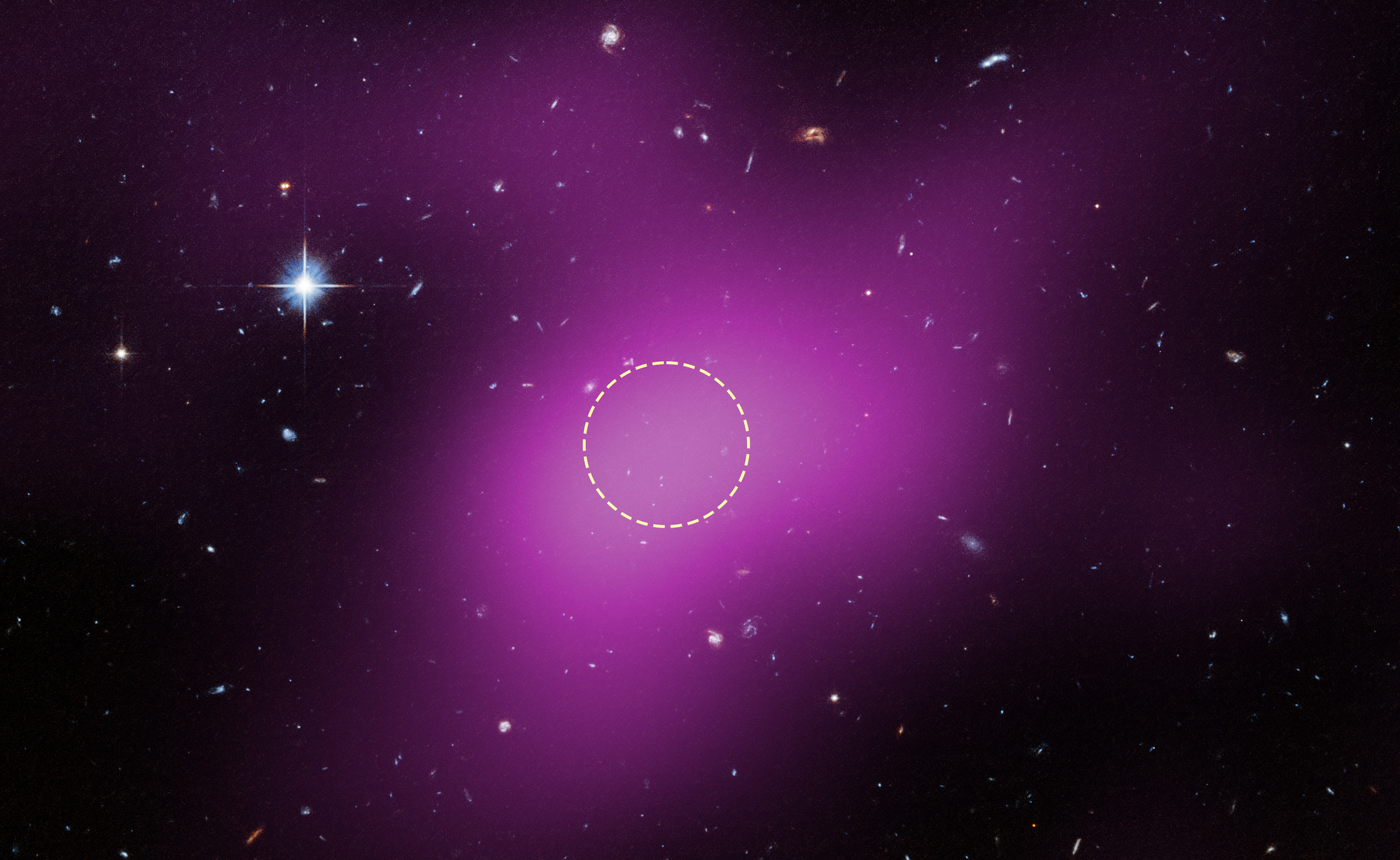

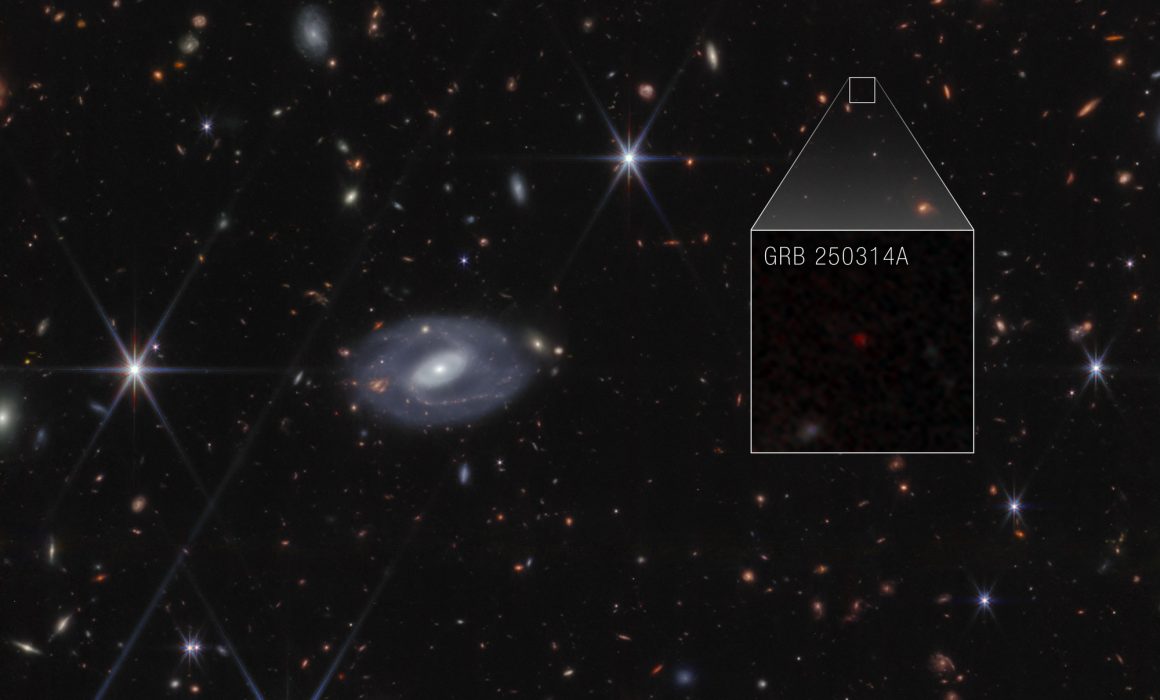

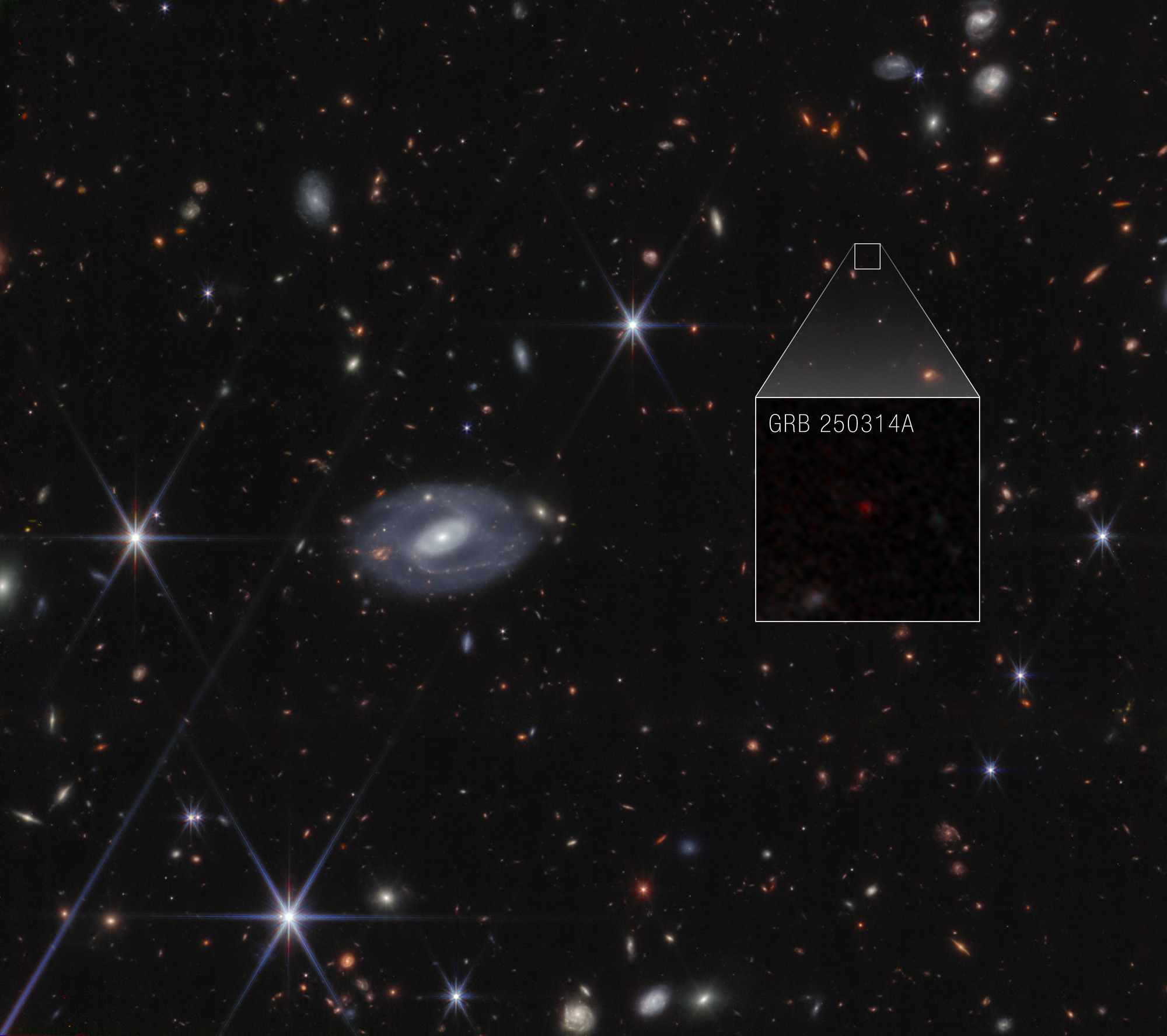

- And, the galaxy that never was: Why Astronomers Are on “Cloud-9” Over a Starless Void

Listen now on: Apple | Spotify | website

2026 Launch Codes: The Essential Numbers for Your Retirement Flight Plan

Did you catch Episode #7 of the podcast?

- Whether you’re saving for retirement or deep in, what are the important 2026 numbers you need to know?

- What are the best New Year’s resolutions for someone about to retire?

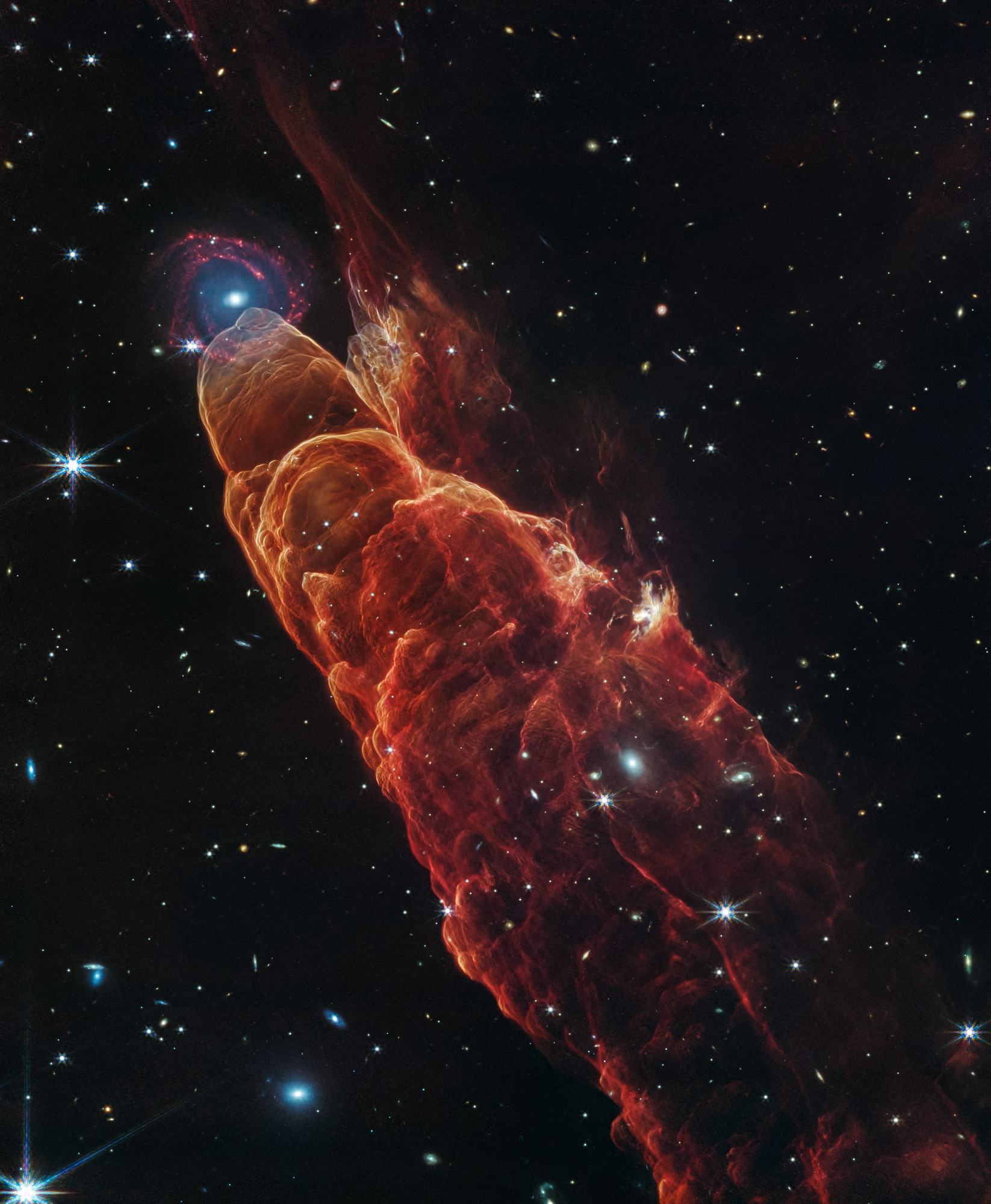

- And what happens when a cosmic tornado meets a distant neighbor?

Listen now on: Apple | Spotify | website

Hidden Insurance Gaps That Threaten Your Wealth

Did you catch Episode #6 of the podcast?

- How can a hidden gap in your insurance plans become a massive financial sinkhole?

- The Social Security Administration put out a press release this summer indicating new tax law essentially end taxes on Social Security benefits for most people. Is that true?

- And how did the James Webb Space Telescope just break the cosmic clock?

Listen now on: Apple and Spotify and website

Your Parents’ Money: A Guide to Financial Caregiving

Did you catch Episode #5 of the podcast?

- We walk through what you need to know about the complex world of financial caregiving so you can navigate this with confidence and loving care.

- New Social Security info came out this month – what to know about benefit changes

- And we take a look at devilish young star that is rebelling against its parent cloud.

Listen now on: Apple and Spotify and website

80% Rule for Retirement Income: Myth or Reality?

Did you catch Episode #4 of the podcast?

- Is the 80% rule for estimating retirement income a total myth?

- When can you switch to the 1040-SR – the U.S Tax Return for Seniors?

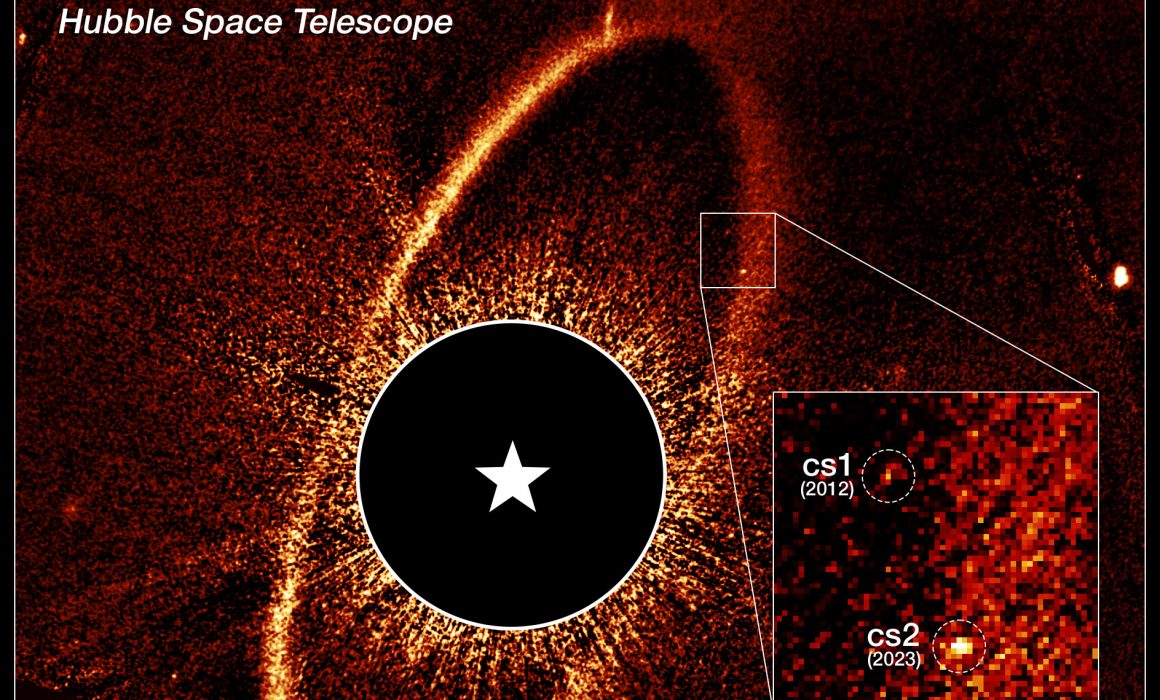

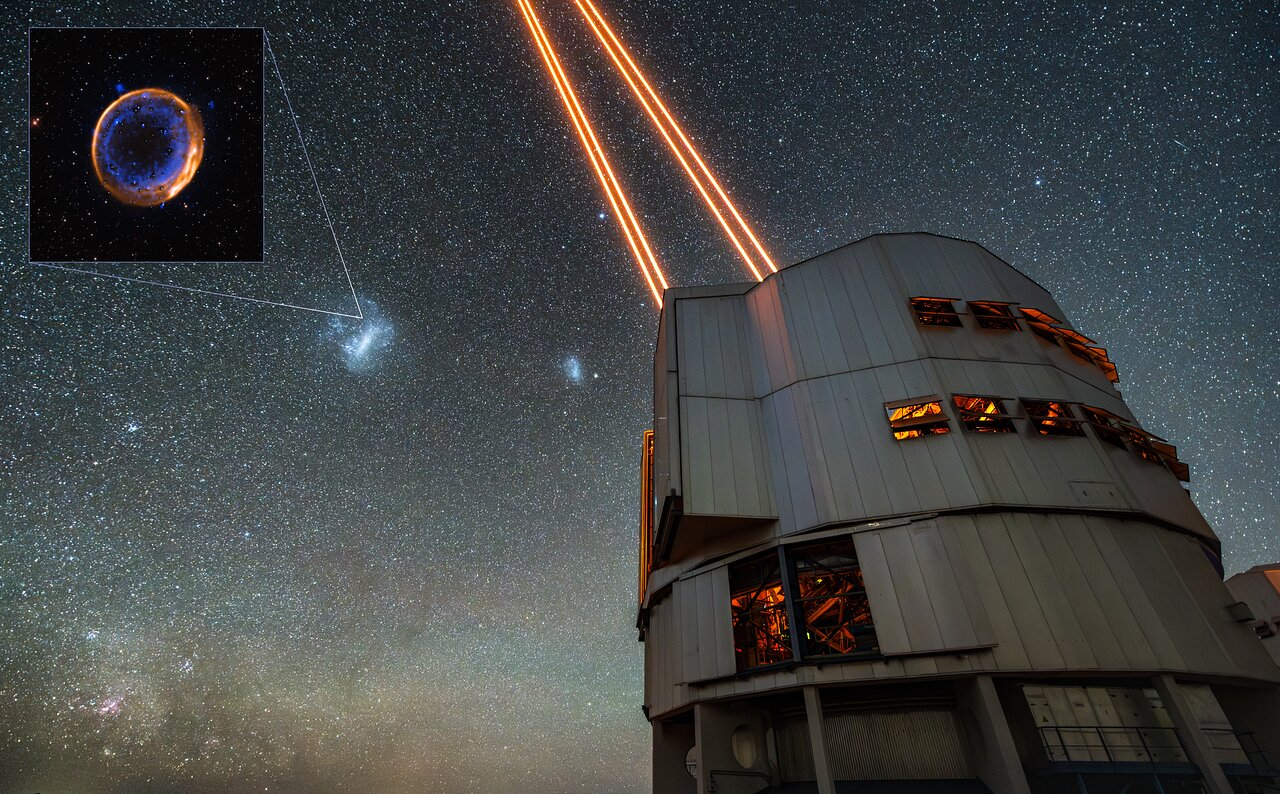

- And we head to the Atacama Desert to look at a star that exploded not once, but TWICE!

Listen now on: Apple and Spotify and website

Recent Posts

-

Don’t Make These Mistakes on Your Tax Return February 19,2026

-

Estimated Taxes, Marriage 2.0 and Cosmic Bumper Cars January 8,2026

Archives

- February 2026

- January 2026

- December 2025

- November 2025

- October 2025

- September 2025

- August 2025

- July 2025

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- May 2022

- April 2022

- March 2022

- February 2022

- December 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- November 2019

- October 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- November 2010

- October 2010

- September 2010

- August 2010

Categories

- 401(k)

- Annuities

- Behavior

- Best Practices

- Bonds

- Charitable Donations

- Economy

- Fees

- Fiduciary

- Financial Planning

- Investing 101

- Live Well

- Market Outlook

- Mutual Funds

- NorthStar

- Performance

- Personal Finance

- Planning

- Retirement

- Saving Money

- Scams & Schemes

- Seeking Prudent Advice

- Tax Planning

- Uncategorised

- Uncategorized

- Weekly Market Review