Mortgage Rates Hit All-Time Low (time to refi? let’s do the math)

Growing your wealth is a combination of making money and saving money. Today we’re focused on the latter half of that equation. Current trends in the debt market could save thousands of dollars per year for mortgage borrowers.

Growing your wealth is a combination of making money and saving money. Today we’re focused on the latter half of that equation. Current trends in the debt market could save thousands of dollars per year for mortgage borrowers.

Mortgage rates fell to their lowest level on record today, pulled down by fears that the spread of the coronavirus could weigh on the U.S. economy.

The average rate on a 30-year fixed-rate mortgage fell to 3.29% from 3.45% last week (see chart). This is its lowest level in its nearly 50-year history. The 15-year fixed-rate mortgage dropped to 2.79% from 2.95% the prior week.

Mortgage rates are closely linked to yields on the 10-year Treasury, which this week dropped below 1% for the first time following an emergency Federal Reserve rate cut on Tuesday. Expectations are that the 30-year fixed rate could even drop below 3% in the next few weeks.

These historically low interest rates represent a special opportunity to potentially save thousands of dollars per year by refinancing your mortgage.

Whether it makes sense to refinance depends on a host of factors.

We want to help you do the math and decide if you should refinance. We invite you to share the key parameters of your mortgage loan confidentially and securely using this link:

- Mortgage Loan Questionnaire

(if you own multiple properties, please submit one form per property)

We will dig into your data and make a detailed evaluation. We will come back and advise you on how much you could save now, or what’s your future trigger point for capturing significant savings as rates continue to evolve.

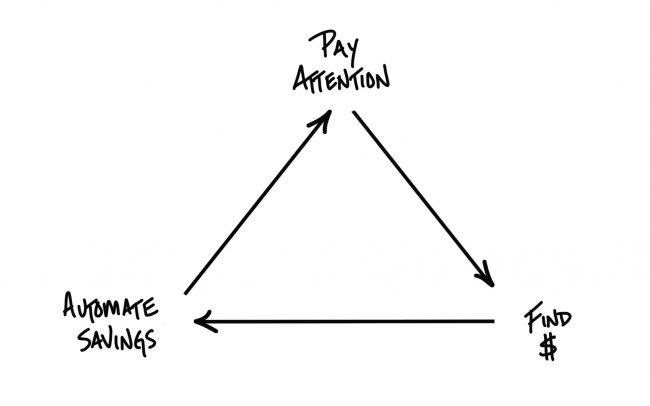

We’re strong believers in the abundance cycle. Please share this offer to family & friends and share the wealth!