Asset Management vs. Financial Planning

At a 100,000-ft level, we do two things in our financial advisory practice: Asset Management* and Financial Planning. Although these two functions are distinct, they are very much interrelated. Both are essential components for our client families’ long-term success, but it’s important to understand and appreciate the differences:

At a 100,000-ft level, we do two things in our financial advisory practice: Asset Management* and Financial Planning. Although these two functions are distinct, they are very much interrelated. Both are essential components for our client families’ long-term success, but it’s important to understand and appreciate the differences:

(* Asset Management also falls under the monikers of “investment management” or “portfolio management”)

Asset management is about asset allocation, expected returns, risk tolerance and time horizons.

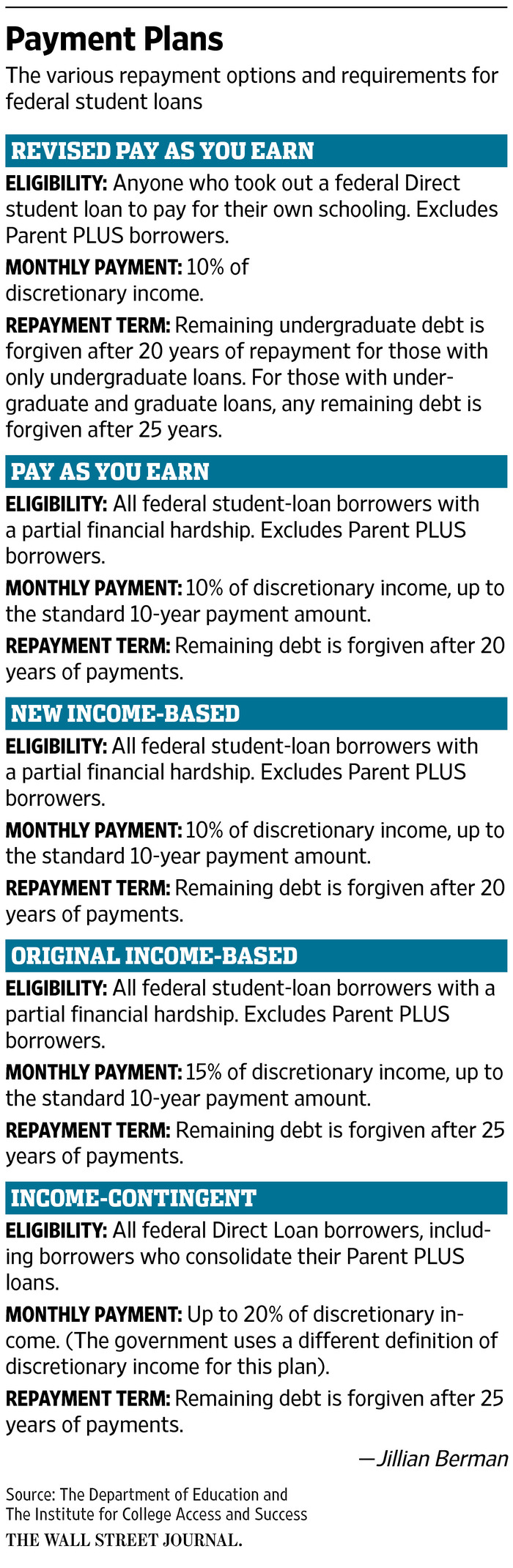

Financial planning is about making wise choices about the use of debt, setting up college savings plans, tax efficiency, estate planning and ensuring your insurance needs are taken care of.

Asset management is about managing investments.

Financial planning is about managing investors.

Asset management is about portfolio construction and risk management.

Financial planning is about comprehensive planning and emotional management.

Asset management is about measuring portfolio performance by comparing results to predetermined index benchmarks.

Financial planning is about measuring your performance against your true benchmark — your goals.

Asset management is about allowing your money to work for you to help you reach your financial goals.

Financial planning is about helping people define their goals, dreams, desires and fears.

Asset management is about creating a process that guides your actions in a wide variety of market environments.

Financial planning is about implementing a plan and making corrections along the way as life or market and economic forces intervene.

Asset management is about creating a portfolio that can survive severe market disruptions.

Financial planning is about creating a financial plan that can survive severe life disruptions.

Asset management deals with financial capital.

Financial planning deals with human capital.

Asset management is about growing and/or preserving your wealth.

Financial planning is about understanding why money is important to you personally.

Asset management is about where to invest a lump sum.

Financial planning is about how and when to invest a lump sum.

Asset management is about asset allocation.

Financial planning is about asset location.

Asset management is about creating policies to guide your actions in the face of economic and market uncertainty.

Financial planning is about helping people make better decisions with their money in the face of uncertainty that is impossible to reduce.

Asset management helps you understand how much you need to earn on your investments to meet your future spending needs.

Financial planning helps you understand how much you need to save meet your future spending needs.

Asset management helps you figure out where to take your money from when you need to spend it.

Financial planning helps you figure out where to spend your money in a way that makes you happy.

Asset management helps you grow your savings to meet future consumption needs.

Financial planning helps you plan and budget for future consumption needs.

Asset management is about creating a long-term process to guide your actions in the markets.

Financial planning is about creating systems that allow you to spend less time worrying about your money.

Asset management is about reducing the anxiety that comes from the volatile nature of the markets.

Financial planning is about reducing the anxiety that comes from making important decisions with your money.

Asset management involves growing your wealth so some day you can become wealthy.

Financial planning involves figuring out what a wealthy life means to you.

To get the most benefit from asset management, you really need comprehensive, well thought-out financial planning.