Six College Loan Mistakes

Managing college loan debt smartly has never been more important than it is now. Total college debt in the U.S. is five times higher than 20 years ago. As with many things financial, good results come by simply avoiding the common mistakes. The best golfers aren’t the ones that make the most killer shots – they’re the ones that make the fewest bad shots. With that in mind, here are six common college loan mistakes to avoid:

Managing college loan debt smartly has never been more important than it is now. Total college debt in the U.S. is five times higher than 20 years ago. As with many things financial, good results come by simply avoiding the common mistakes. The best golfers aren’t the ones that make the most killer shots – they’re the ones that make the fewest bad shots. With that in mind, here are six common college loan mistakes to avoid:

MISTAKE NO. 1: Failing to consider income-driven repayment plans

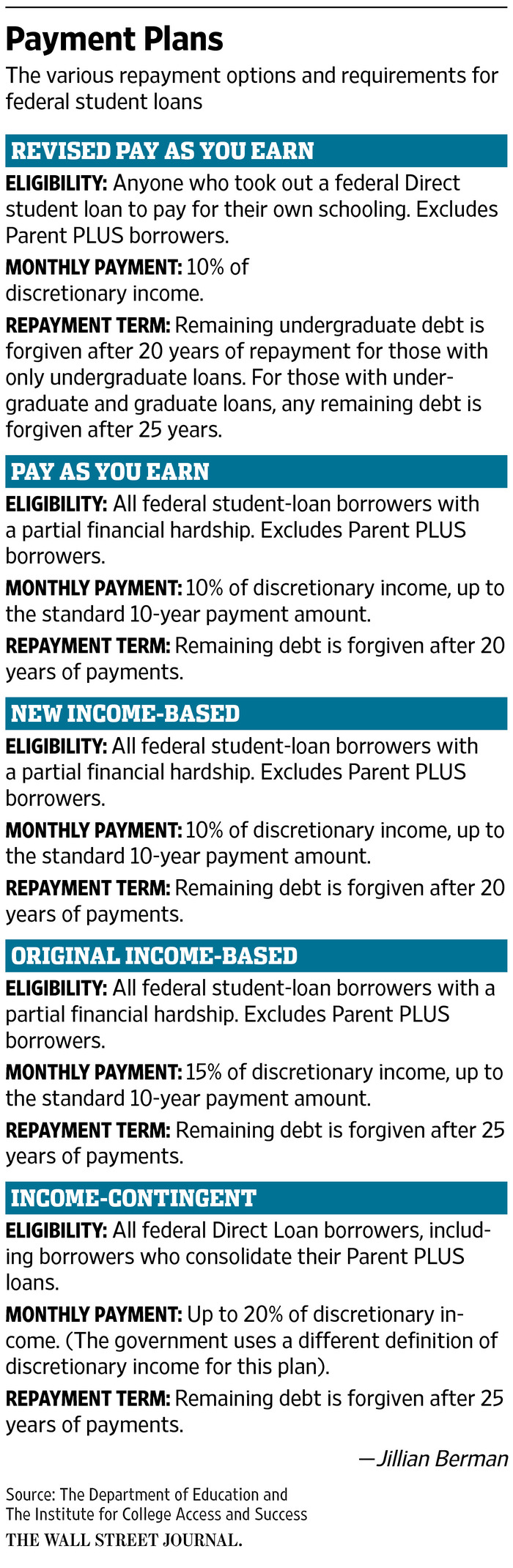

Federal student loans have many payments options (check out the infographic below). Don’t just assume the default payment plan is best for you.

MISTAKE NO. 2: Failing to understand the loans

There are two basic types of student loans: federal and private. They come with different interest rates and different repayment options. It pays to know the differences and options to make the best choice for your needs.

MISTAKE NO. 3: Failing to research student-loan forgiveness programs

Borrowers with federal loans are eligible for debt relief under the Public Service program for a range of careers including teachers, law enforcement, doctors, lawyers and others. Some employers even help pay employee student loans including the U.S. military, PWC, and Fidelity.

MISTAKE NO. 4: Prioritizing student loans at the expense of retirement savings

Prioritizing debt payment ahead of retirement savings is a mistake. For example, if your employer provides a matching contribution to your 401(k), that’s free money that you need to capture.

MISTAKE NO. 5: Automatically refinancing or consolidating

Consolidate carefully! You can capture a lower overall interest rate. However, you may be giving up flexible payment options and other opportunities.

MISTAKE NO. 6: Failing to automate payments

Make it easy and automatic. You don’t want to accidentally miss a payment and blow up your credit score or compromise your eligibility for loan forgiveness.

Source: WSJ

Source: WSJ