4 Weeks Until an Important Deadline

Here’s an important reminder if you have an individual retirement account (IRA) or are considering opening an IRA. 2014 contributions to IRAs can still be made up through April 15, 2015.

Here’s an important reminder if you have an individual retirement account (IRA) or are considering opening an IRA. 2014 contributions to IRAs can still be made up through April 15, 2015.

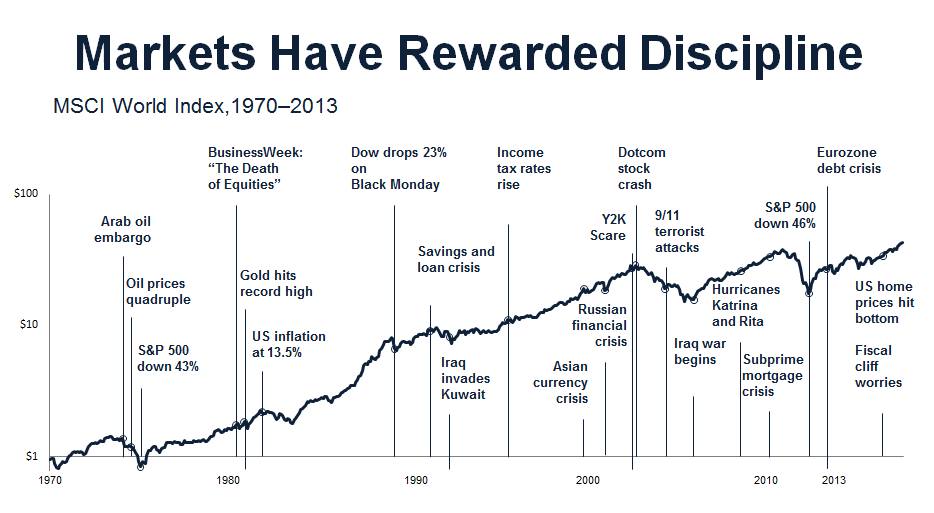

Make it a double? If you really want to make the most of the growth potential that retirement accounts offer, you should consider making a double contribution this year: a last-minute one for the 2014 tax year and an additional one for 2015, which you’ll claim on the tax return you file next year. That strategy can add much more to your retirement nest egg than you’d think.

2014/2015 Annual IRA Contribution Limits*

- Traditional/IRA Rollover: $5,500 ($6,500 if you are 50 years old or older)

- Roth IRA: $5,500 ($6,500 if you are 50 years old or older)

- SIMPLE IRA: $12,000 (2014), $12,500 (2015) ($14,500/$15,500 if you are 50 years old or older)

- SEP IRA: $52,000 (2014), $53,000 (2015)

*Note: The maximum contribution limit is affected by your taxable compensation for the year. Refer to IRS Publication 590 for full details.

The savings, tax deferral, and earnings opportunities of an IRA make good financial sense. The sooner you make your contributions, the more your money can grow.

If you have any questions or would like to make an IRA contribution give us a call at (704) 350-5028 or email info@nstarcaptical.com.