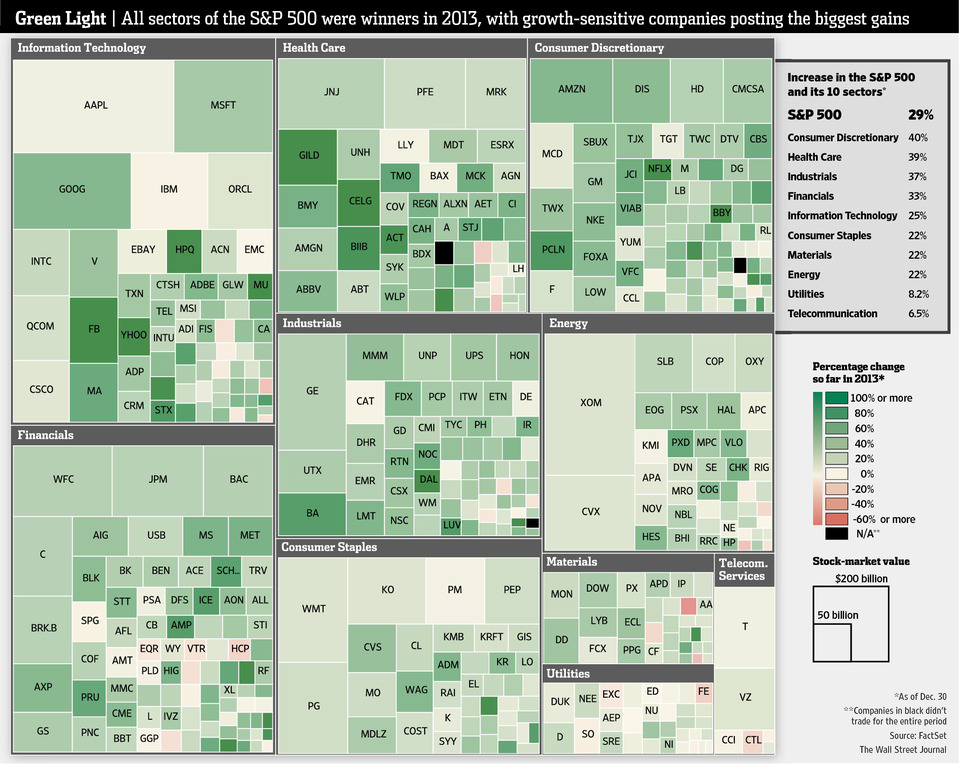

All 10 Stock Sectors Post Gains in Big Year

All 10 of the S&P 500’s stock sectors finished 2013 in positive territory. Stocks most closely tied to economic growth fared best in 2013, while those typically regarded as the safest bets logged the year’s smallest gains.

Source: WSJ