Providence Day School Commencement Address

The following is the commencement address by Dr. Chris Mullis to the graduating class of Providence Day School on May 31, 2013.

The following is the commencement address by Dr. Chris Mullis to the graduating class of Providence Day School on May 31, 2013.

Good morning. Thank you, Mrs. Hinson for your kind introduction. It’s hard to believe more than a quarter-century has passed, but I still have great Providence Day memories and, in particular, three distinct Bobbie Hinson memories: #1 dissecting pigs in your biology class, #2 the time you were injured by a sea urchin in Puerto Rico during our science fair trip, and finally, #3 the day you showed up at school vividly dressed up as Dolly Parton. Great memories! I’m certain our graduates have their own Providence Day memories being replayed in their heads on this special morning.

I want to thank the Commencement Committee for allowing me to address and celebrate Providence Day’s Class of 2013. I am deeply honored to be here. A few weeks ago I had the pleasure and opportunity to meet with Head of School and your class officers to learn more about the spirit and the accomplishments of your outstanding group of 135 scholars.

- This fall you will be fanning out across 20 states and the District of Columbia to attend 63 institutions of higher learning.

- 76% of you have been offered merit scholarships and honors programs

- These include the prestigious Morehead-Cain Scholarship, the Goodnight Scholarship, the Presidential Merit Scholarship, and the Centre Fellowship

- You collectively earned $5.9M in scholarships funds

- There are 4 National Merit Finalists and 7 Commended Scholars amongst you.

- 27 of your class will play NCAA intercollegiate sports in football, basketball, baseball, golf, tennis, field hockey and track.

I am impressed by the depth and breadth of these and your many other accolades. To each and every one of you I say well done and congratulations.

I want you to recognize the incredible milestone that you have achieved today and yes bask a bit in that well-deserved glory. But I want you to also reflect on how you got here. Look up in the stands at these people all around you. Think of the countless hours your parents have spent shuttling you to and from school and extracurricular activities. Think of the financial sacrifices that your parents have made to give you the Providence Day opportunity. You don’t know how truly special this gift is now, but you will grow to understand this in the decades to come. Class of 2013, please rise up and show your appreciation by giving your parents, your grandparents and the rest of your family a round of applause for their love and support. This is their moment too.

Finally I want you to think about a group of exceptional professionals, many of whom are seated directly behind you. I want you to recognize the extremely dedicated and talented educators who have worked with you every step of the way over the years – some of you for 13 or 14 years here at Providence Day. Class of 2013, please stand and honor the excellence of the faculty, staff and administration of Providence Day School.

When Mrs. Gill reached out to me with the invitation to speak, my first thought was, I’m no Scott Carpenter. Scott Carpenter was a NASA astronaut…in fact one of the original 7 Mercury astronauts…the ones lionized in Tom Wolfe’s book and the movie, “The Right Stuff”. Scott Carpenter was the 2nd American to orbit the Earth, the 4th American to go into space, and a trailblazer toward putting man on the Moon. Carpenter was also Providence Day’s commencement speaker for the Class of 1990, the year I graduated!

As an astrophysicist, I’ve had the opportunity to launch experiments on the Space Shuttle, collaborate with Nobel laureates, and use the largest telescopes on Earth and in space to probe the boundaries of the Universe. But those obviously pale in comparison to the historic achievements of a person like Scott Carpenter. So what can I offer you, the members of the Class of 2013? The rationale exercised by the Commencement Committee for inviting alums like myself is the fact that you and I are walking down the same path of life and have spent our foundational years growing in the same environment of excellence. You, I, all of us are the ultimate product of this community of learning that we call Providence Day. We are part of the same extended family. We have been shaped by many of the same great educators. People like,

- Bobby Hinson

- Jeff Lucia

- Sam Caudill

- Debra Wilhoit

- Phyllis Gill

- Roberta McKaig

- Roy Garrison

These are 7 of the distinguished faculty here today that span our generations at Providence Day, having taught the Classes of 1990 and 2013.

My intent for a few short minutes is to share some perspective as someone that’s just a little further down that path that we share.

One of the most defining decisions that you will make in the next few years is your career choice. I want to urge you to optimize passion before paycheck in making that decision. Notice my choice of words, “optimize”. I’m not saying totally disregard the economics of your career choices, but rather put more weight on the profession that resonates most with your heart instead of the one that most fattens your wallet. My premise is that you will go farther, contribute more to society, and have more happiness by putting passion ahead of paycheck.

I wrestled with this career decision relatively early in life. It was during my senior year at Providence Day. I felt a calling toward astronomy, loved doing the research and was already publishing papers. There were many mornings that I would struggle to show up for school because I had stayed up the previous night collecting data at the telescope. This was my passion and the only option for me in my mind. Of course my parents were very supportive, but I’m sure my father, a successful business owner, had some reservations about the modest compensation associated with an academic career. My astronomy mentor, Gayle Riggsbee, was characteristically much more direct. He in no uncertain terms advised me to do astronomy as an avocation and not a vocation. He said to go out and get a good-paying job and do astronomy as a hobby. It was with great trepidation that I respectfully disregarded his guidance and barreled full on into professional astronomy. That decision to follow my passion yielded 17 incredibly rewarding years of service through science. It took me places, physically and metaphysically, and forged friendships with people around the world that I would have never experienced had I followed a more traditional career path.

Now if you do some fast math around my career advice, you may conclude that the recommended trajectory will make you wealthy in life experiences but may impede your financial success. My second piece of advice will more than compensate for that potential shortcoming.

Over the years I’ve flown on countless commercial jets. There was a time when I was simultaneously working in both science and finance. If my neighbor on the plane asked about my line of work, sometimes I would say astronomy and sometimes I would say finance. When I disclosed my astronomer persona, it invariably led to a long and lively discussion on black holes, the Big Bang and similar topics. Whereas, when I went with the finance guise, the conversation wrapped up rather quickly. It’s a shame that we don’t have more in depth discussions around personal finance. Managing your money is not a sexy topic but doing it well will have a profoundly positive impact on your life and the lives of those around you.

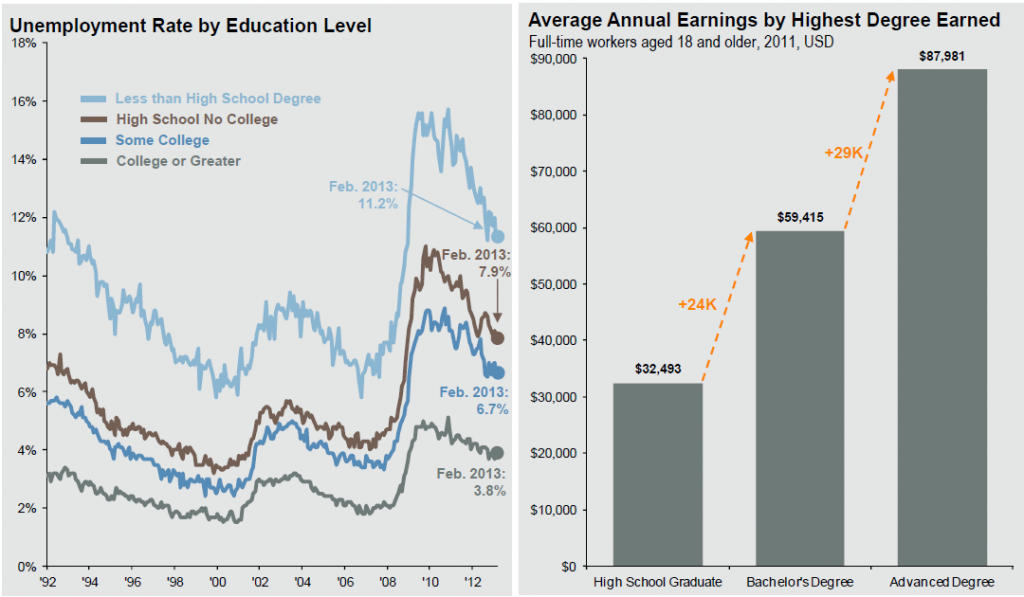

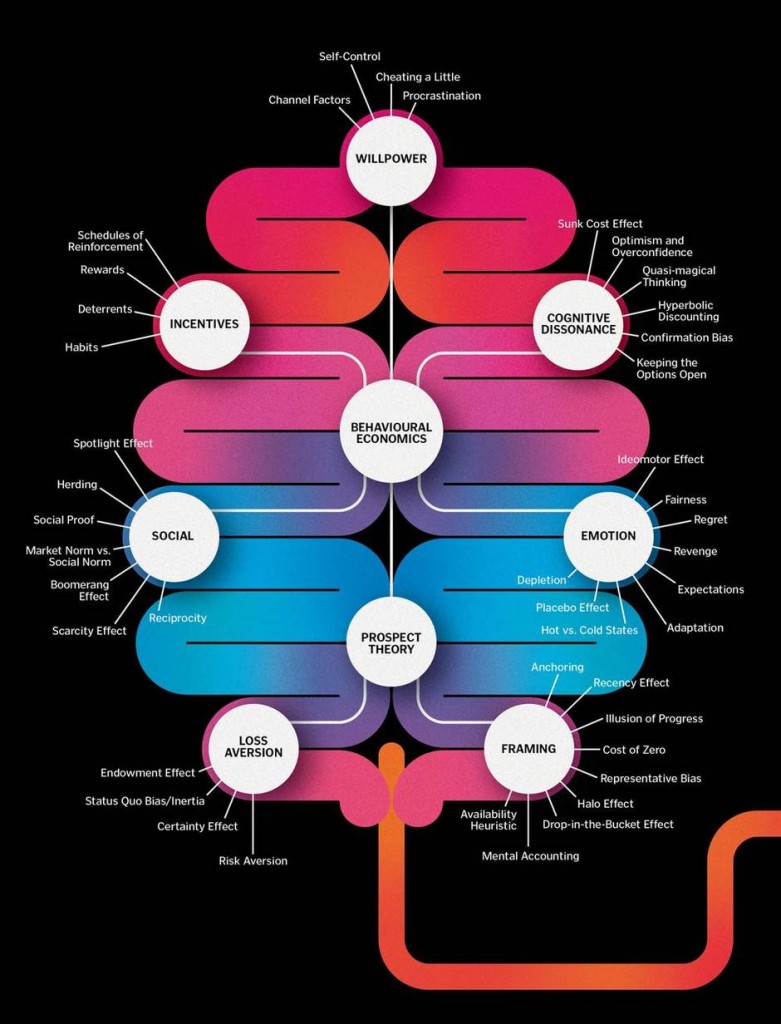

At my investment advisory firm, we developed complex computer algorithms and use them to manage our clients’ investment portfolios. But the basic steps you to need to take to manage your own money well are deceptively simple. First, live within your means and avoid being caught up in rapid lifestyle inflation. You will not live like your parents when you first start out. Second, save and invest your money wisely. Let me elaborate on this point.

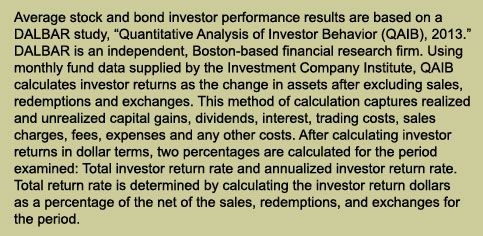

Wealth accumulation depends on three factors: how much you save, the rate at which your money grows, and how long you save. That last factor, time, is very, very important. There’s an urban legend that Albert Einstein once said that compounding interest is the most powerful force in the Universe. That quote is likely misattributed but the message is spot on. If you save $5,000 a year for 40 years and earn 8% annually, you will eventually have $1.3M. But if you delay starting for merely 5 years, your results after 35 years will be only $860k. That 5-year delay preserved $25k of short-term capital but ultimately cost you >$400k in the long run. Time is the most powerful lever in the machinery of investing. Nothing else comes close to it.

So what do you need to do? Start saving and investing right out of high school regardless of how hard you think it hurts or how unpleasant the tradeoffs. Even if you set aside only 5% of your paycheck starting out, do it to get into the habit of saving. Delaying getting serious about investing until my 30s was a significant financial mistake on my part. No one ever sat me down and explained how important it is to start investing early. Now that we’ve had this little talk, you’ll never be able to say that no one told you.

Now on the remote chance you’ve drifted away from us over the last few minutes contemplating your post-graduation vacation, this is the time that you’ll want to tune back in for the CliffsNotes version of my speech. These are the key takeaways: follow your career passion and take charge of your financial security by being a young and informed investor. With the excitement of the moment I know that most of my words may wash past you. I sat where you sat 23 years ago and unfortunately have zero recall of what astronaut Scott Carpenter told the Class of 1990. But our relationship is different. We share a common bond as fellow alums walking the same path. If you need any help recalling my suggestions or if I can be of any service to you on your journey, please don’t hesitate to reach out to me, a fellow Charger.

Let me leave you with these final thoughts:

- Seek out opportunities to live overseas to continue to develop a global perspective that appreciates different ways of thinking and living.

- Continue to develop your critical thinking skills and apply them in your daily life and in your contributions to society.

- Maintain your passion for learning; the truly successful are lifelong learners.

- And finally, do great things with the gifts that Providence Day School has nurtured in you.

Class of 2013, congratulations on your achievements and good luck on your future endeavors.

Thank you