Chasing Past Performance is Expensive

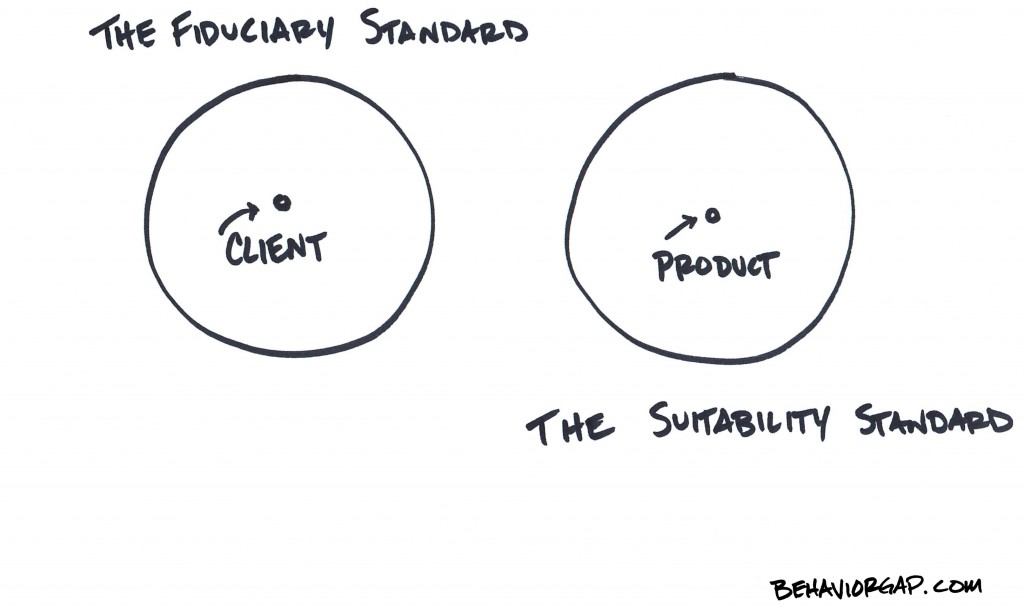

A rigorous study from Vanguard demonstrates that chasing the hot mutual fund is an inferior investing strategy compared to good, old-fashioned buy and hold.

A rigorous study from Vanguard demonstrates that chasing the hot mutual fund is an inferior investing strategy compared to good, old-fashioned buy and hold.

Vanguard analyzed a decade of data ending December 31, 2013 across nine asset classes. In every case the investor would have been significantly better off just sticking with the index. On average the indexes generated 50% higher returns than the performance-chasing strategy!

Buy and hold may not be perfect, but it can be a lot better than flitting from mutual fund to mutual fund.