Guessing at Retirement?

Here are some startling facts when it comes to retirement planning:

Here are some startling facts when it comes to retirement planning:

- 75% of middle-class Americans say their estimates of their retirement needs are based on “some sort of guess”.

- Middle-class American believe the median cost of their out-of-pocket health care in retirement will be $47,000 when the actual number according to the Center for Retirement Research is $260,000.

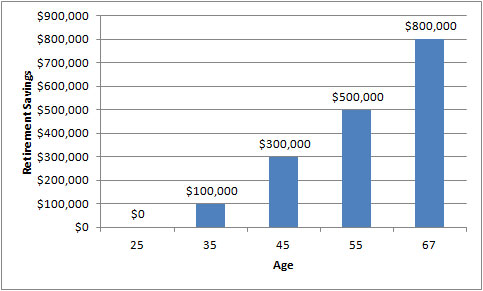

- On average, middle-class American expect to withdraw 10% of their nest egg annually in retirement. Most experts recommend annual withdrawal rates of only 3% to 4%.

- 34% of middle-class Americans expect to live off of 50% or less of their pre-retirement income. Since the median household income is ~$50,000, these folks are planning on living off of less than $25,000 per year.

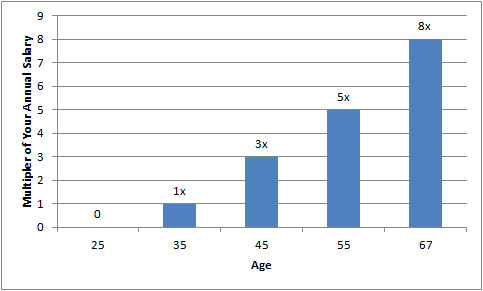

Are you playing the guessing game or have you done detailed calculations of your retirement needs?

Source: New York Times