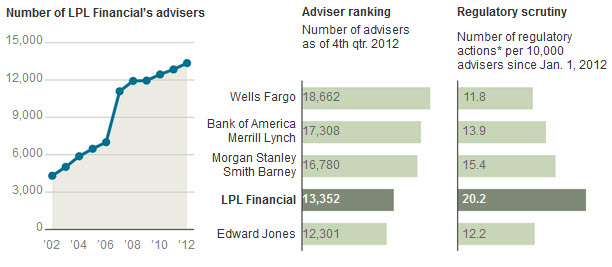

LPL Runs Afoul of Regulators Unusually Often

A New York Times article published last Friday tells the story of the 4th largest brokerage firm in America and its frequent run-ins with regulators.

A New York Times article published last Friday tells the story of the 4th largest brokerage firm in America and its frequent run-ins with regulators.

Here are some key excerpts:

LPL Financial, has 13,300 brokers, 6,500 offices, 4.3 million customers — and a growing list of problems with regulators.

State and federal authorities have censured the company and its brokers with unusual frequency.

State and federal authorities have censured the company and its brokers with unusual frequency.

LPL brokers have been penalized for selling complex investments to unsophisticated investors, for speculative trading in customer accounts, and, in a few cases, for outright stealing from clients.

“LPL is on our radar screen more than any other firm,” said Lynne Egan, who oversees securities regulation in Montana.

Since the financial crisis hit in 2008, prominent firms like Merrill, which long catered to individual investors, have lost brokers and customers. Many investors have turned instead to independent brokerage firms like LPL. Unlike employees of the industry giants, LPL brokers are essentially contractors. They get LPL e-mail addresses and come under LPL compliance but pay for office space and staff.

LPL’s most serious case in Montana was resolved in 2009, when Donald Chouinard, an LPL broker in Kalispell, was sentenced to 10 years in prison for operating a Ponzi scheme. LPL paid Mr. Chouinard’s clients $1.3 million, and Ms. Egan’s office a $150,000 fine.

William F. Galvin, the Massachusetts secretary of the commonwealth, came to a $2.5 million settlement with LPL in February for selling the same product to investors in his state. Mr. Galvin said LPL had failed to properly examine who the products were being sold to, and had pushed the investments without mentioning that they provided big commissions to LPL and its brokers.

“What we really saw was a complete lack of supervision,” Mr. Galvin said.