Temperament over Intellect

Warren Buffett once said, “The most important quality for an investor is temperament not intellect.”

Warren Buffett once said, “The most important quality for an investor is temperament not intellect.”

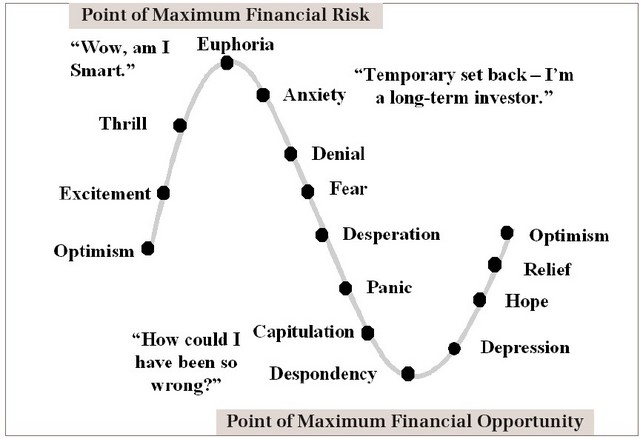

Investors very often buy at high prices when the market is hot and attractive, and sell at low prices after observing periods of poor performance.

This leads average investors to severely trail both the S&P 500 index and the Barclays Aggregate Bond Index over long time periods. This is why investors are very often their own worst enemy.

CBS MoneyWatch author Larry Swedroe recommends in a recent article that you ask yourself if you believe that you’re best served by being your own advisor:

- Do I have the temperament and the emotional discipline needed to adhere to a plan in the face of the many crises I will almost certainly face?

- Am I confident that I have the fortitude to withstand a severe drop in the value of my portfolio without panicking?

- Will I be able to re-balance back to my target allocations (keeping my head while most others are losing theirs), buying more stocks when the light at the end of the tunnel seems to be a truck coming the other way?