6 Investing Mistakes To Avoid

Roger Wohlner is a fee-only financial advisor and one of our favorite financial bloggers. He wrote an article this week for U.S. News and World Report focusing on 6 mistakes to avoid in investing:

- Inability to take a loss and move on.

- Not selling winners.

- Not setting price targets.

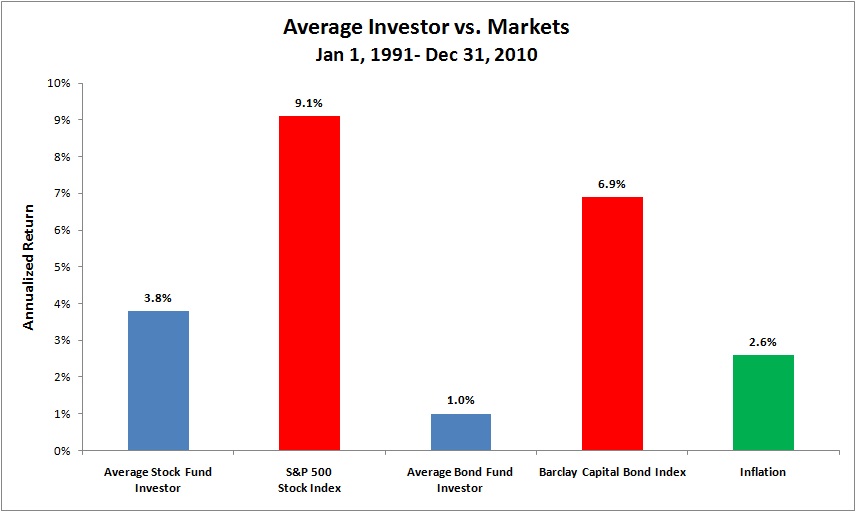

- Trying to time the market.

- Worrying too much about taxes.

- Not paying attention to your investments.

Roger concludes, “If you are uncomfortable reviewing your investments, it may make sense for you hire a financial professional to take an independent look at your portfolio.”

Learn more in Roger’s article: