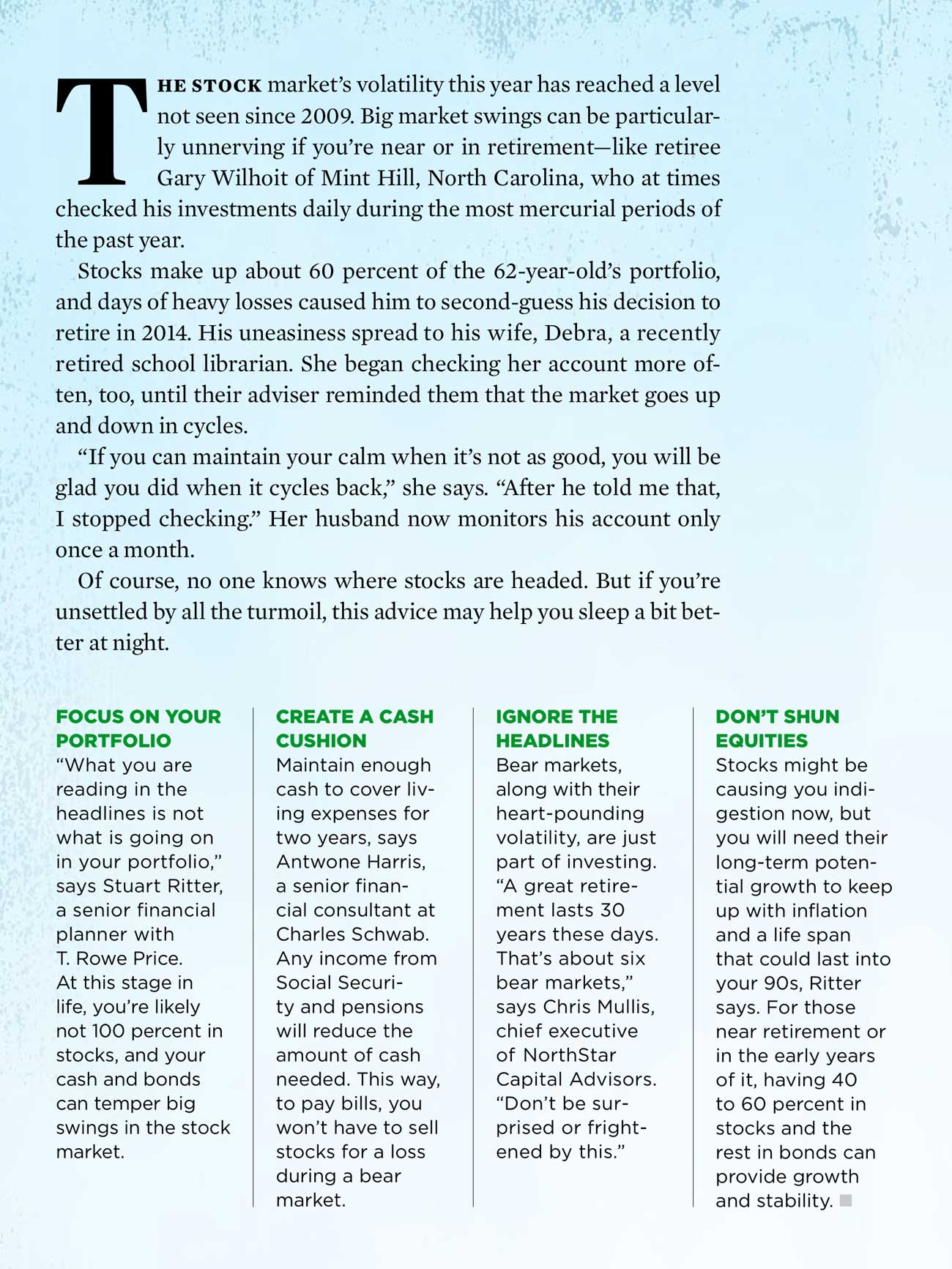

NorthStar Client Family Featured in AARP The Magazine

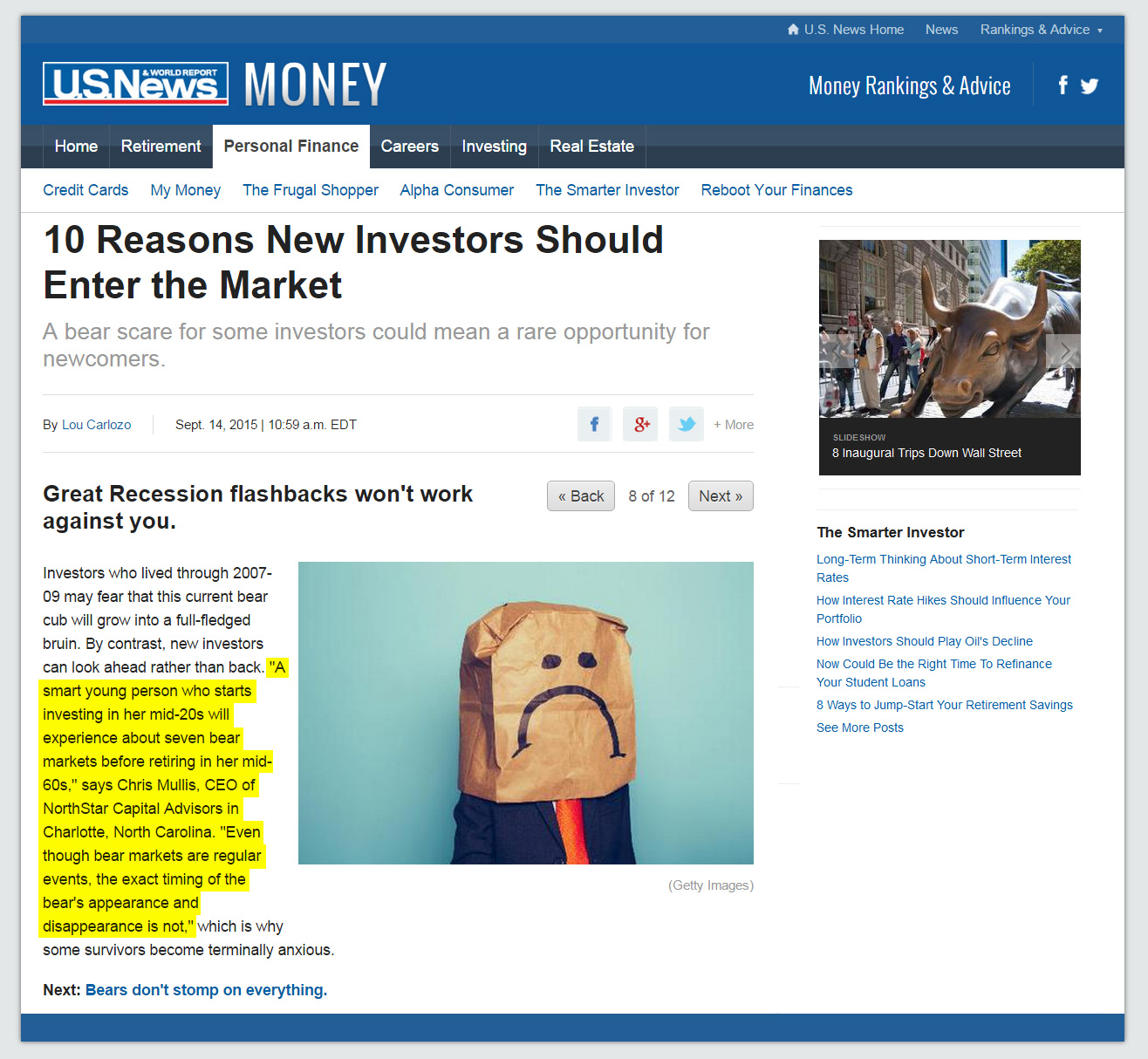

Debra and Gary Wilhoit, a NorthStar client family, are featured in the June/July 2016 issue of AARP The Magazine. Dr. Chris Mullis, CEO and senior planner at NorthStar, is quoted in the article alongside senior advisors from Charles Schwab and T. Rowe Price.

Kudos to the Wilhoits for candidly sharing their early-retirement anxieties and the actions they have taken to ultimately reach greater peace of mind and long-term success. Millions of Americans who are transitioning toward and into retirement can immediately relate to the Wilhoits’ experience. And millions of Americans can benefit by adopting the Wilhoits’ long-term perspective and positive investor behavior.

AARP The Magazine addresses the evolving life stages of 50+ Americans and is the largest circulation magazine in the United States (35.9 million readers).