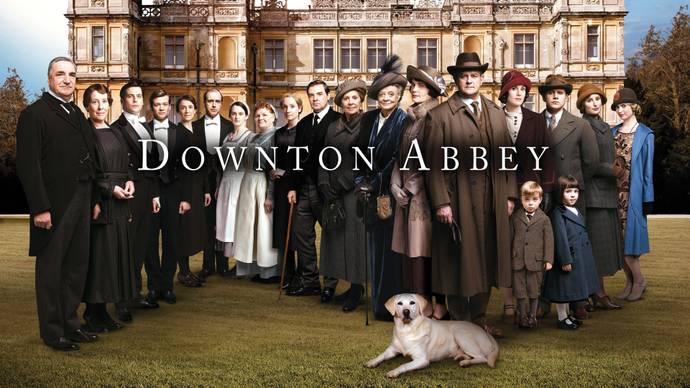

More Money Lessons from “Downton Abbey”

We’re big fans of “Downton Abbey”, the television show that follows an aristocratic British family in the early decades of the 20th century.

We’re big fans of “Downton Abbey”, the television show that follows an aristocratic British family in the early decades of the 20th century.

Over the five seasons that the show has graced PBS’ “Masterpiece”, a number of money lessons have been showcased — mostly what NOT to do!

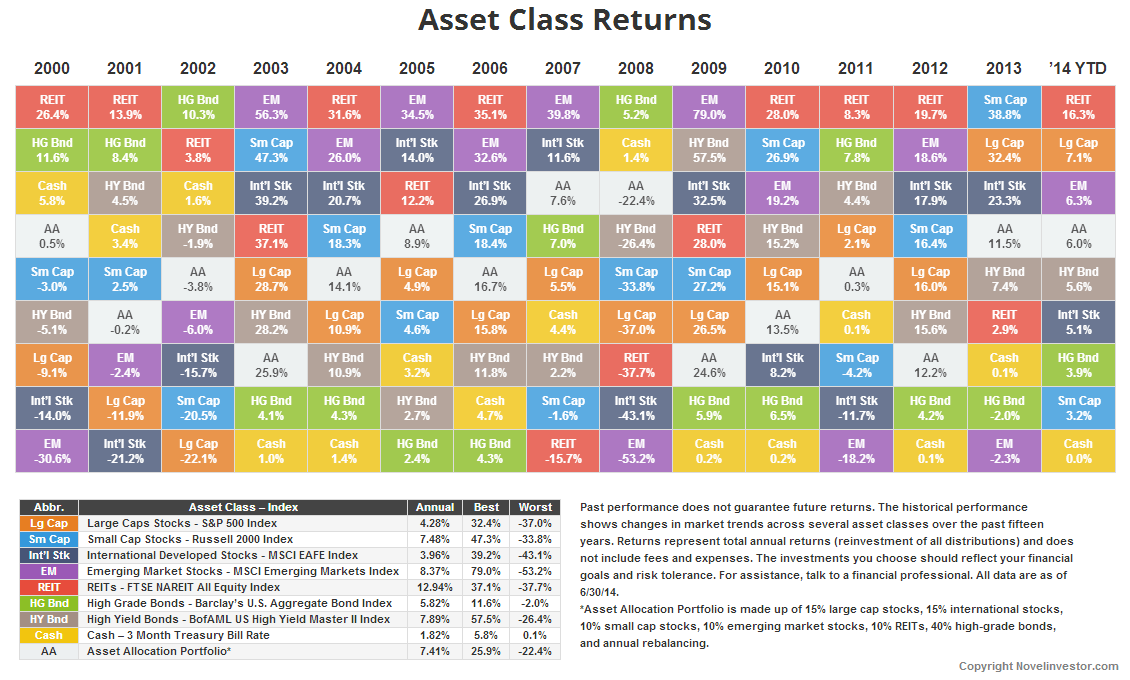

For example, don’t bet the family fortune on a railroad thousands of miles away (i.e., massive lack of diversification). A professional advisor working in concert with the Earl of Grantham probably would have prevented him from concentrating so much capital in a Canadian railway!

Downton’s money lessons include financial and estate-planning disasters, bad investments, messy trusts, and inadequate business succession plans.

Here are some key takeaways and tie-ins:

- Spell out control and ownership when passing the baton of a family company

(the generational transfer of Downton Abbey from Robert to Matthew) - Use trusts to protect the family fortune

(to protect Robert Crawley’s from his own poor decisions) - Make a will before giving birth

(think of Matthew Crawley’s untimely demise) - Set up a medical directive

(the terrible struggle of how to handle Sybil in childbirth)

We can’t wait for more Dowton Abbey and money lessons as season 5 continues!