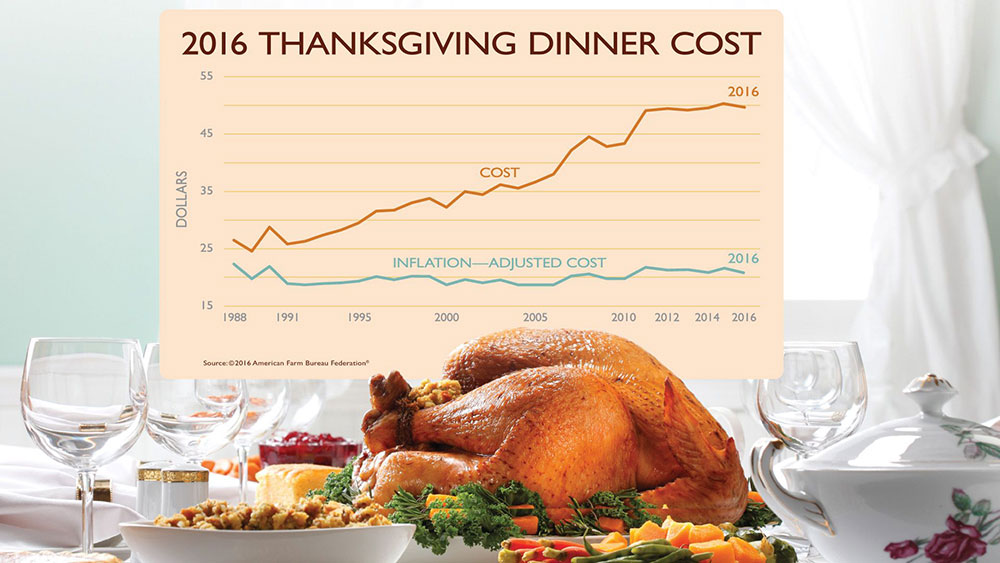

Turkey Hovers at $50

This year’s turkey dinner will cost you 24 cents less or -0.5% compared to last year. The average cost of a classic Thanksgiving Dinner for 10 people is $49.87 according to the American Farm Bureau Federation’s survey. The relative price stability of the turkey index mirrors the government’s Consumer Price Index for food eaten at home which decreased 2% over the past year.

This year’s turkey dinner will cost you 24 cents less or -0.5% compared to last year. The average cost of a classic Thanksgiving Dinner for 10 people is $49.87 according to the American Farm Bureau Federation’s survey. The relative price stability of the turkey index mirrors the government’s Consumer Price Index for food eaten at home which decreased 2% over the past year.

The bird soaks up the lion’s share of the budget at 46% of the meal’s cost. The 16-pound turkey came in at $22.74 this year or $1.42 per pound. The price of most ingredients was quite stable compared to last year. Biggest losers: turkey down $0.30 (-1.3%) and miscellaneous ingredients down $0.37 (-11.6%). Biggest gainers: pie shells up $0.12 (4.9%) and rolls up $0.21 (9.3%).

The average cost of a turkey dinner has hovered around $50 since 2011.

Happy Thanksgiving!

Source: AFBF