Lucrative Social Security Strategy Ends

A new budget bill passed by Congress last week will end a lucrative maneuver that retiring couples have used to maximize their Social Security benefits. The file-and-suspend and restricted application option that has been available since 2000 will go away in 2016. Smart use of this strategy can add tens of thousands of dollars to a couple’s lifetime retirement income by permitting one spouse to claim as many as four additional years of spousal benefits. The cornerstone of this approach is the advantage of accessing delayed retirement credits which increase earned benefits by 6% to 8% for each year the claim is deferred.

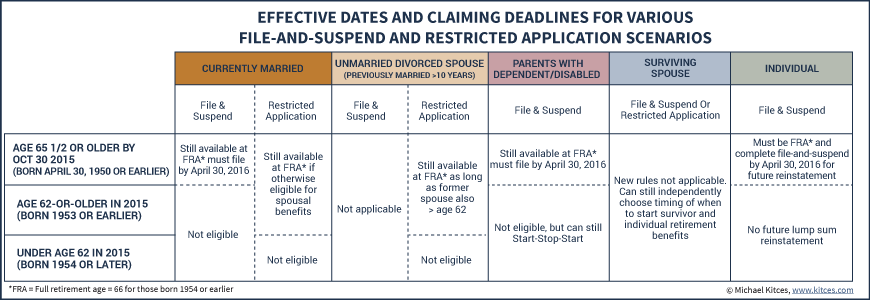

Social Security will no longer allow family members to submit a new claim for spousal benefits on a suspended benefit starting 6 months after the budget bill goes into effect. If you are 66 or older now or will turn 66 within the next 6 months, you should consider the potential benefit in filing and immediately suspending your benefit. Also, if you turned 62 this year or are older, you will still be able to file a restricted application when you turn 66. Families already using the strategy will be grandfathered and their benefits won’t change.

The devil is in the details so reach out to your financial advisor for assistance in evaluating your options.