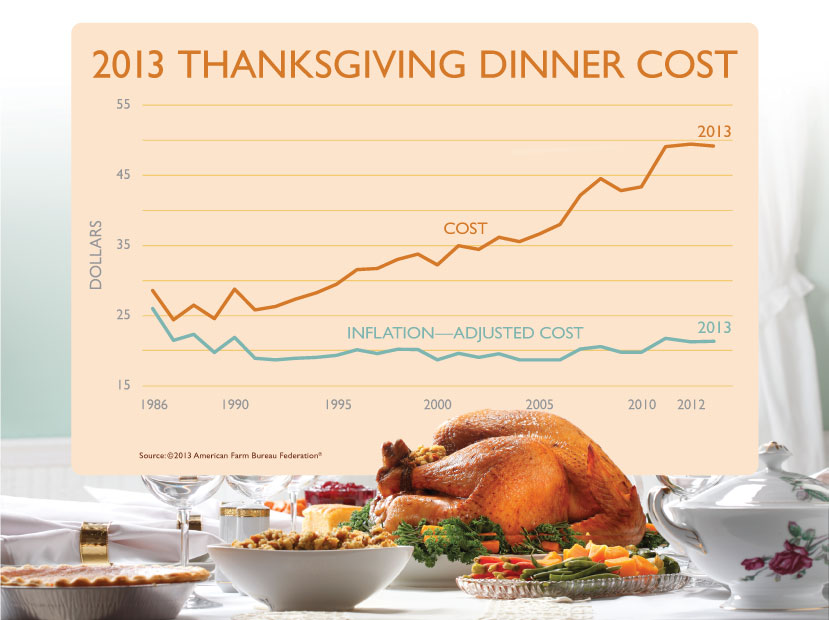

Thanksgiving Dinner Costs Less in 2013

This year’s turkey dinner won’t cost you any more than last year’s. The average cost of a classic Thanksgiving Dinner for 10 people is $49.04 according to the American Farm Bureau Federation’s survey. That’s a 44-cent or 0.9% price decrease from last year.

This year’s turkey dinner won’t cost you any more than last year’s. The average cost of a classic Thanksgiving Dinner for 10 people is $49.04 according to the American Farm Bureau Federation’s survey. That’s a 44-cent or 0.9% price decrease from last year.

The bird soaks up the lion’s share of the budget at 44% of the meal’s cost. The 16-pound turkey came in at $21.76 this year or $1.36 per pound. The biggest year-over-year change on a percentage basis were the sweet potatos whose cost increased 6.7%. Green peas contributed the biggest percentage drop at -7.2%.

The average cost of a turkey dinner has hovered around $49 since 2011. The relative price stability of the turkey index mirrors the government’s Consumer Price Index for food eaten at home which increased only 1% compared to last year.

Happy Thanksgiving!

Source: AFBF