Why Brokers Still Needn’t Put Clients First

The battle over your broker’s “fiduciary” role has moved in a new direction — away, some say, from a lot of clients’ best interests.

The battle over your broker’s “fiduciary” role has moved in a new direction — away, some say, from a lot of clients’ best interests.

A major push by consumer advocates to hold stockbrokers to the same client-comes-first standard of care required of investment advisers — the so-called fiduciary standard — seemed close to success only a year ago.

The Securities and Exchange Commission had called for the new rules, despite brokers arguing that dispensing advice was only a part of their business model and they shouldn’t be held to the same standard as advisers in all situations.

Now, the SEC is saying it won’t write any new rules until it studies how much they might cost the industry.

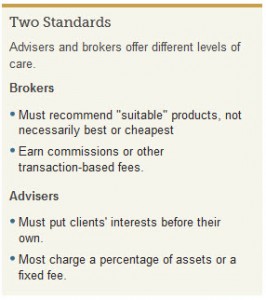

Under current rules, brokers only need to ensure the products they sell their clients are “suitable,” and not necessarily the best possible or least expensive option. For example, a broker can sell a client a variable annuity that comes with a generous commission over a cheaper product, says Andrew Stoltmann, a Chicago-based securities lawyer who represents investors in arbitration and litigation. Advisers, on the other hand, are held to a fiduciary standard that requires them to recommend the less-pricey option, he says.

Under current rules, brokers only need to ensure the products they sell their clients are “suitable,” and not necessarily the best possible or least expensive option. For example, a broker can sell a client a variable annuity that comes with a generous commission over a cheaper product, says Andrew Stoltmann, a Chicago-based securities lawyer who represents investors in arbitration and litigation. Advisers, on the other hand, are held to a fiduciary standard that requires them to recommend the less-pricey option, he says.