Younger Generation Faces a Savings Deficit

According to the Wall Street Journal,

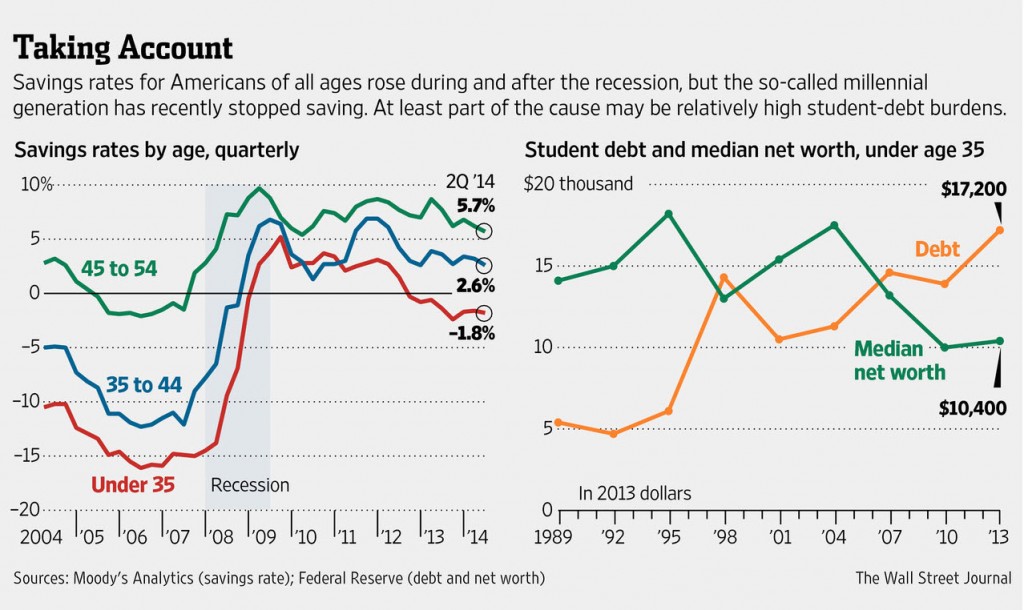

“Adults under age 35—the so-called millennial generation—currently have a savings rate of negative 2%, meaning they are burning through their assets or going into debt, according to Moody’s Analytics. That compares with a positive savings rate of about 3% for those age 35 to 44, 6% for those 45 to 54, and 13% for those 55 and older.

The turnabout in savings tendencies shows how the personal finances of millennials have become increasingly precarious despite five years of economic growth and sustained job creation. A lack of savings increases the vulnerability of young workers in the postrecession economy, leaving many without a financial cushion for unexpected expenses, raising the difficulty of job transitions and leaving them further away from goals like eventual homeownership—let alone retirement.”

Source: WSJ