10 Most Common Behavior Biases of Investors

Robert Seawright with Madison Avenue Securities assembled this list of the ten most common behavioral biases that hinder investors:

- Confirmation bias – we gather facts and see those facts in a way that supports our pre-conceived conclusions

- Optimism bias – our confidence in our judgement is usually greater than our objective accuracy

- Loss aversion – the pain of losing $100 is at least twice as impactful as the pleasure of gaining $100 (causes investors to hold onto their losing stocks too long)

- Self-serving bias – the good stuff that happens is my doing while the bad stuff is somebody else’s fault

- Planning fallacy – overrate our own capacities and exaggerate our abilities to shape the future

- Choice paralysis – we are readily paralyzed when there are too many choices

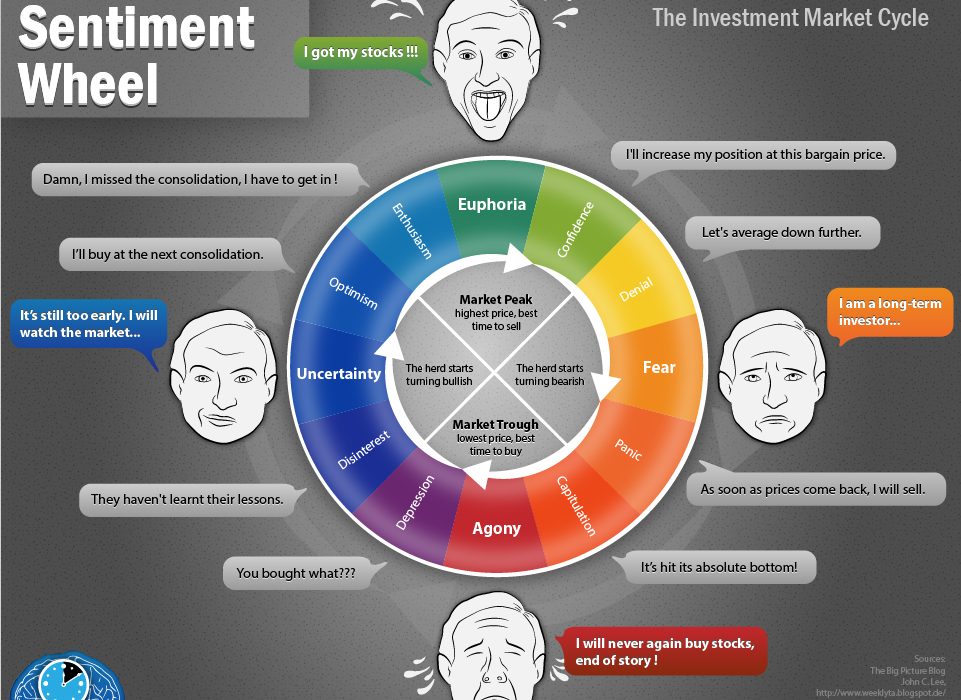

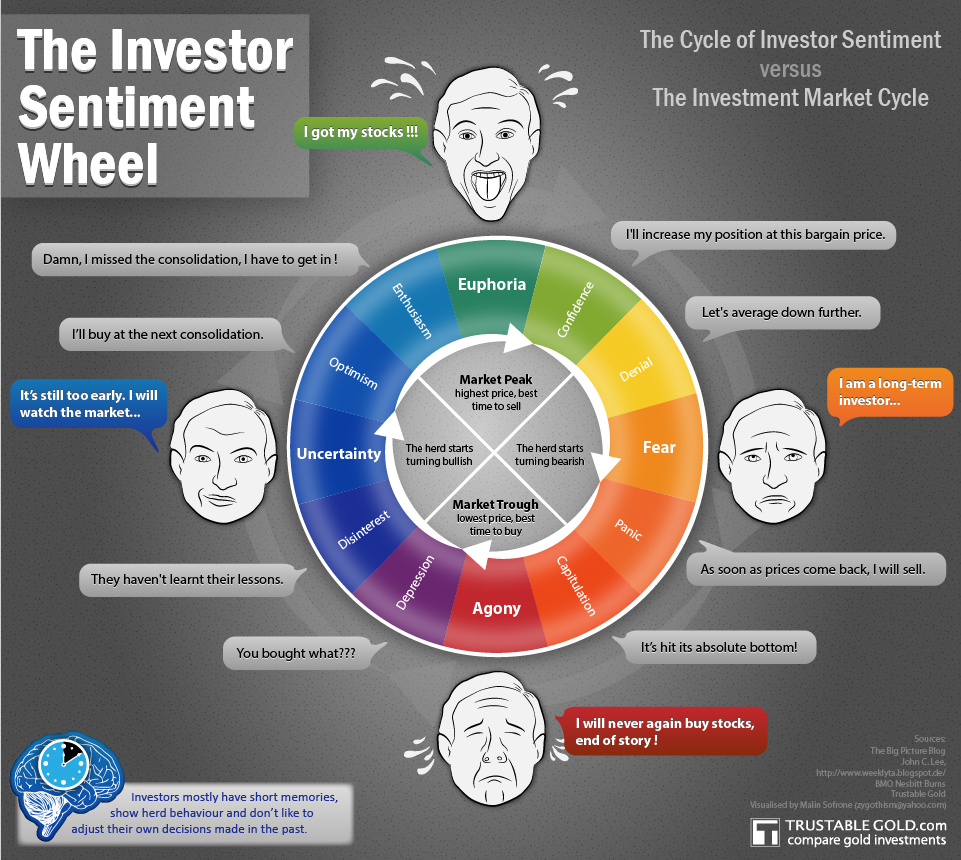

- Herding – we run in herds, latching onto the group think and moving in lock step

- We Prefer Stories to Analysis – people love a good narrative and prefer to be swept up by the story rather than work through the definitive numbers

- Recency bias – we tend to extrapolate recent events into the future indefinitely

- Bias blind-spot – the inability to recognize that we suffer from the aforementioned cognitive distortions!