Thanksgiving Dinner Cost Drops Third Straight Year

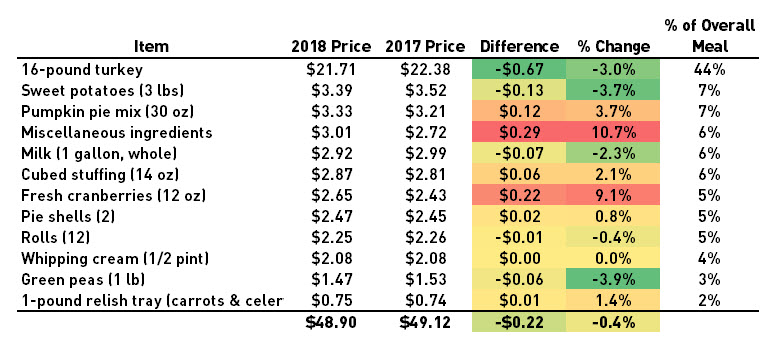

This year’s turkey dinner will cost you 22 cents less or -0.4% compared to last year. The average cost of a classic Thanksgiving Dinner for 10 people is $48.90 according to the American Farm Bureau Federation’s survey. The very mild decrease in the turkey index is not too different than the the government’s Consumer Price Index for food eaten at home which increased slightly 0.1% over the past year.

The bird soaks up the lion’s share of the budget at 44% of the meal’s cost. The 16-pound turkey came in at $21.71 this year or $1.36 per pound. The price of most ingredients was quite stable compared to last year. Biggest losers: turkey down $0.67 (-3.0%) and sweet potatoes down $0.13 (-3.7%). Biggest gainers: miscellaneous ingredients up $0.29 (10.7%), fresh cranberries up $0.22 (9.1%), and pumpkin pie mix up $0.12 (3.7%).

This is the third consecutive year that the average cost of a turkey dinner decreased and it’s the lowest cost in six years.

Happy Thanksgiving!

Source: AFBF