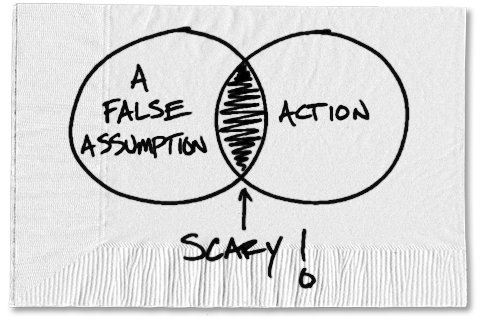

Two Deadly Assumptions

We live in a world that is replete with financial scams. Here are two classic and deadly assumptions that can rapidly separate you from your money.

We live in a world that is replete with financial scams. Here are two classic and deadly assumptions that can rapidly separate you from your money.

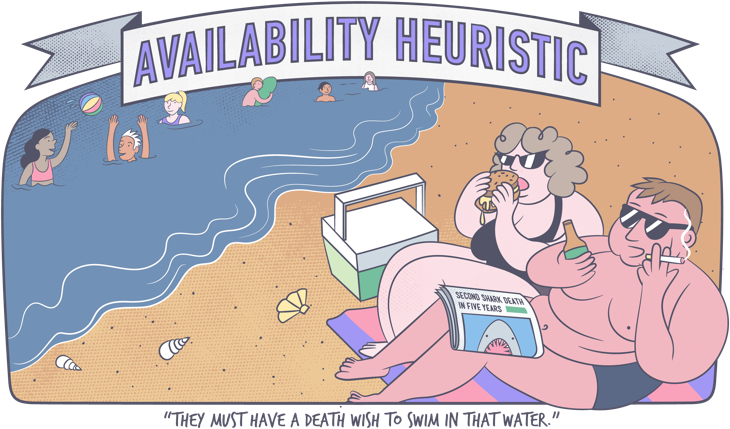

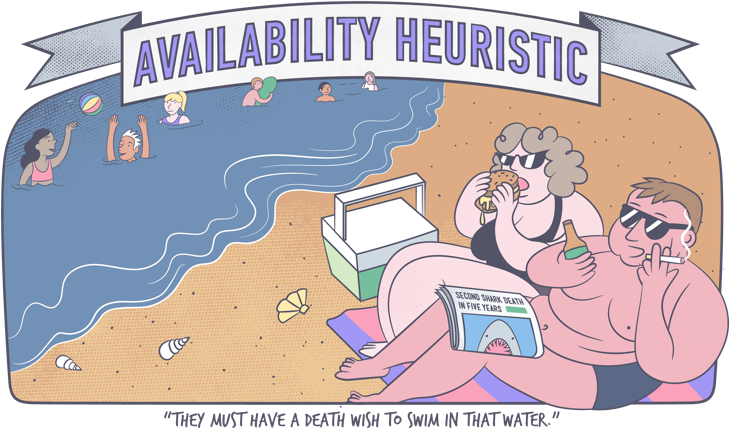

Deadly Assumption #1 — The guy belongs to my church / temple / country club / ethnic group, of course he’ll look out for me.

Maybe he will, but is affinity a good enough reason to trust a financial advisor? Quarterback Mark Sanchez found out the hard way that this sort of thinking can easily lead one into the arms of a predator…

From ThinkAdvisor:

Former New York Jets quarterback Mark Sanchez and other professional athletes said they were cheated out of millions of dollars in a Ponzi-like scheme orchestrated by an investment advisor who appealed to their Christian faith.

Sanchez and Major League Baseball pitchers Jake Peavy and Roy Oswalt were defrauded out of about $30 million, according to a recently unsealed U.S. Securities and Exchange Commission lawsuit in Dallas federal court. The athletes all used the same broker, Ash Narayan, formerly of RGT Capital Management. The advisor gained their trust through religion and their interest in charitable works, the SEC said.

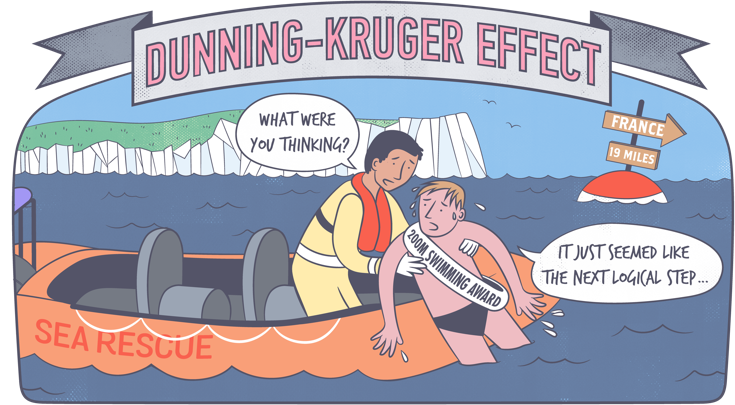

Deadly Assumption #2 — This advisor works for a big, prestigious firm and the product is very sophisticated, I deserve this special access.

Structured products are a minefield for the wirehouse wealth management client because the firms’ “producers” are highly incentivized to sell them. Anything being pushed on the brokerage sales force by the home office is, by definition, perilous for the client. Because if it were so good, then no commission would be necessary – the product would be found by savvy investors and there would be no need for extra compensation. But structured products are unnecessary for most investors, although profitable for the firms that create them, hence the degree to which they’re sold to people.

As proof of this, you almost never hear of a fiduciary advisor recommending this stuff. It’s not even in the lexicon for a client-centric practice or an unconflicted advisor.

Source: TRB