Trouble ahead? (debt downgrade)

|

You might have heard that Fitch downgraded the U.S. government’s credit rating in August.1 What does that mean for you? Let’s discuss. Who is Fitch Ratings, anyway? When companies and governments issue bonds, the bonds get rated by one of three agencies: Fitch Ratings, Moody’s, and Standard & Poor’s. The rating represents the agency’s evaluation of the bond issuer’s ability to repay interest and principal and avoid default. The higher the rating, the safer the bonds are considered to be. Fitch downgraded U.S. long-term debt from AAA (the highest possible rating) to AA+ (one grade below). Why did the U.S. get its credit rating cut? A few things are behind the change. A few months ago, the U.S. just avoided defaulting on its debt during another dramatic showdown in Congress. Unfortunately, this partisan dynamic is not new, and Fitch stated that it had lost confidence in U.S. governance after repeated political standoffs on debt. Fitch analysts are also concerned about U.S. deficit spending and our growing national debt. |

|

|

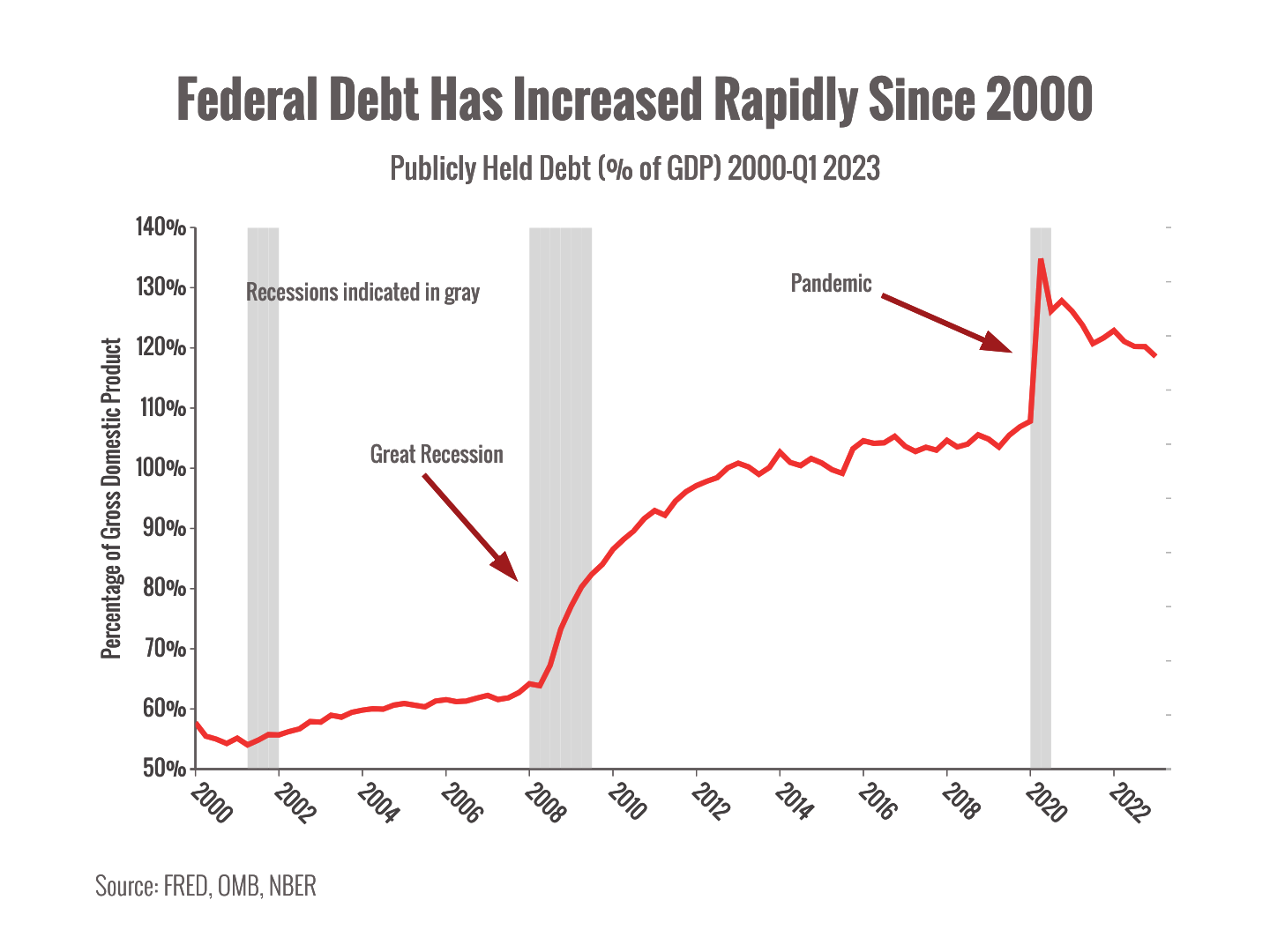

Publicly held U.S. debt skyrocketed to over 130% of GDP during the pandemic. While it has dropped since then, it is still over 100% of GDP.2 Analysts are concerned that the U.S. doesn’t have a plan to rein in its spending and balance its budget in the years to come. You can see in the chart below that federal spending is projected to far outstrip revenue over the next decade.3 |

|

|

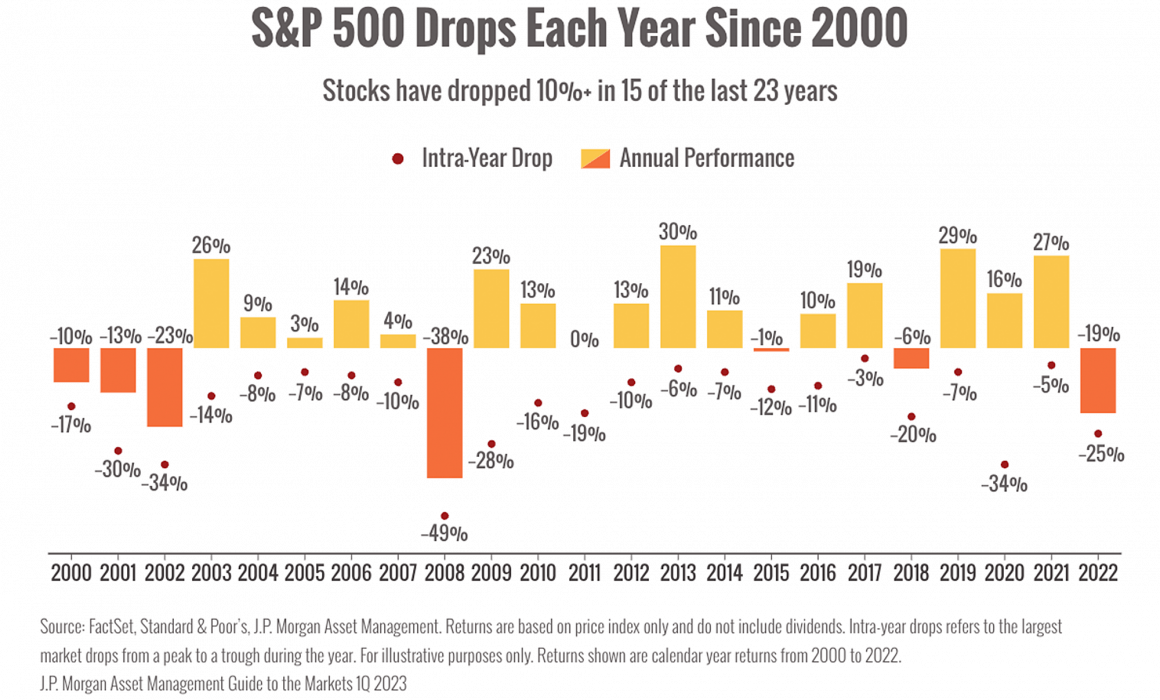

Has a downgrade ever happened before? Yes. In 2011, Standard & Poors downgraded the U.S. from AAA to AA+ after another contentious debt ceiling debate in Congress.1 Since S&P still holds its AA+ rating on U.S. debt, the U.S. has lost its top-shelf status with two out of the three agencies. Will the downgrade hurt the economy? The most obvious consequence is that the U.S. will have to pay higher interest on future debt, increasing its debt load even more.4 Since interest payments form a significant percentage of federal expenditures, this may become a bigger issue in the future.2 However, the economy remains strong, and the downgrade alone is unlikely to spell recession or other dire consequences. Should I be worried? Not really. U.S. Treasury bonds are among the world’s highest quality and most liquid bond investments despite the downgrade. It’s unlikely that will change any time soon. However, we might see some additional stock market volatility as investors digest the implications of the new rating. We can also expect to see higher rates on mortgages, car loans, credit cards, and other types of debt to account for the change. On the flip side, we’ll likely see higher yields on bonds and savings accounts to compensate for the added risk. Bottom line, this downgrade certainly isn’t good news. However, it’s not likely to impact the average American in any significant way.

|

Losing a job can feel devastating (especially when you didn’t see it coming).

Losing a job can feel devastating (especially when you didn’t see it coming).

529 accounts are getting a lot more powerful with the recent SECURE Act 2.0 legislation that went into effect on January 1st.

529 accounts are getting a lot more powerful with the recent SECURE Act 2.0 legislation that went into effect on January 1st.

After months of debate, Congress finally passed some major changes to retirement laws at the end of 2022.1

After months of debate, Congress finally passed some major changes to retirement laws at the end of 2022.1