What will the new administration do first?

Now that the election is over, what will the new administration prioritize in the new year?

Here are a few things we’re watching in the months ahead:

The debt ceiling debate may reignite in early 2025.

The debt ceiling, the cap on the total amount of debt the U.S. can hold, has been suspended as part of a deal made in the last Congressional fight.1

When the cap returns in January, it may kick off a fresh round of debates and draw attention to the more than $35 trillion the U.S. holds in debt.2

Will lawmakers take action to stem deficit spending? Or will they continue to kick the can down the road?

We’ll have to wait and see.

Tax cuts may be extended past 2025.

A number of popular individual and small business tax breaks are scheduled to expire at the end of 2025, which would trigger higher individual income tax rates and increase estate taxes.3

President-elect Trump may extend or make some or all of these provisions permanent as part of his 2025 priorities.

However, tax cuts lead to lost revenue for the federal government, which would end up adding to the national debt.

It’s hard to know how lawmakers will square these competing priorities, but we’re keeping a close eye on it and will keep you informed.

Tariffs could become a key issue for businesses.

The new administration has announced plans for broad tariffs on imports, especially on goods from China.4

Tariffs can impact inflation and business earnings by increasing the cost of goods and supplies from overseas.

If trading partners respond by adding their own tariffs on U.S. goods, it could hurt overseas demand by making our products more expensive.

How deep or broad those tariffs could be is a big source of uncertainty going into the new year.

However, it’s likely that any new policies would come with many rounds of debate, so the actual impact of tariffs may be much less than the worst-case scenarios.

We’ll keep you updated.

Markets may become volatile with uncertainty.

While the uncertainty of the election has faded, new uncertainty around policy priorities has replaced it.

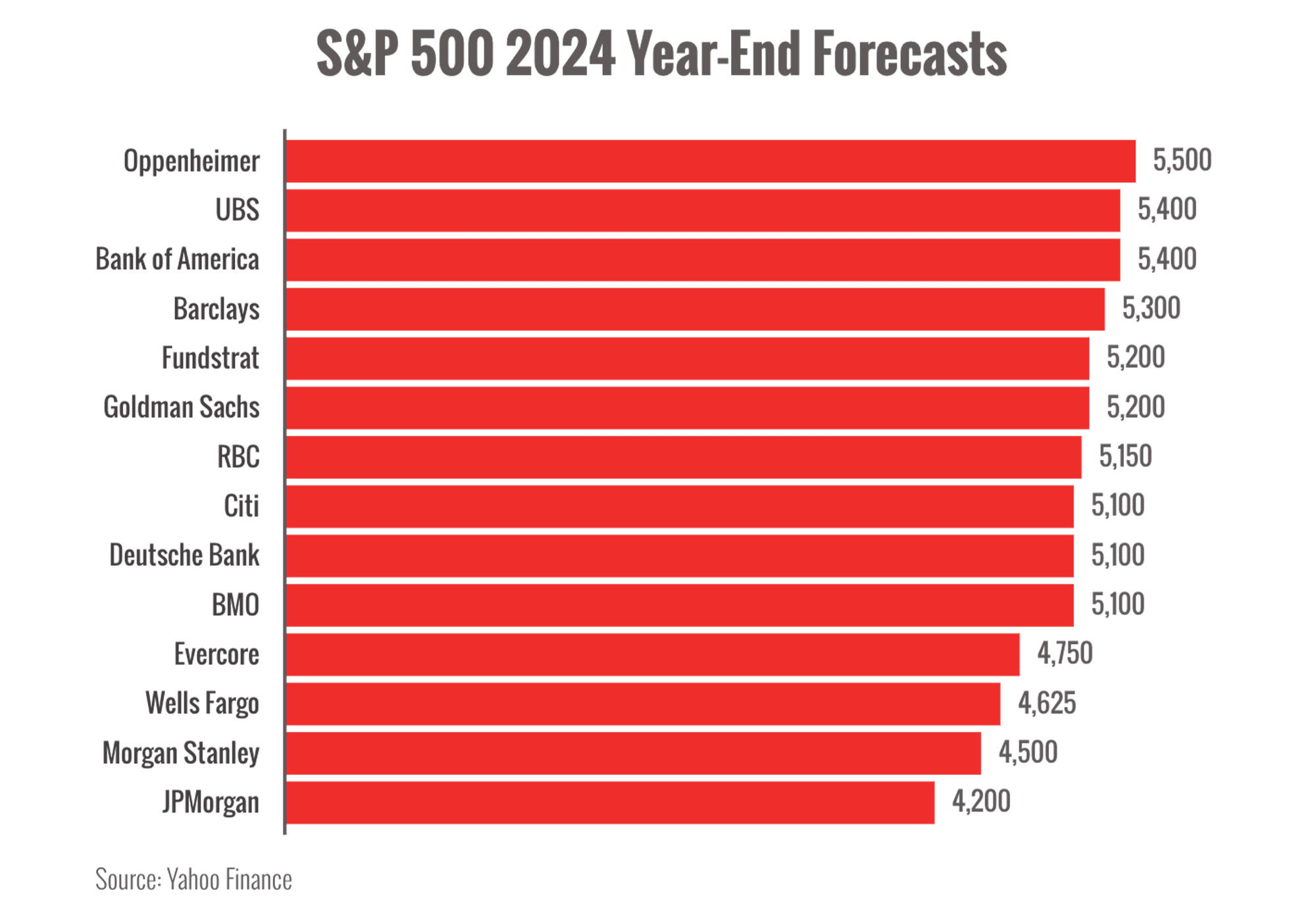

We’re expecting volatility ahead as analysts digest reports and adjust their positions ahead of the new year.

Investors are also watching data for hints about where the economy is headed next.

The bull market is now over two years old. Should we be worried that a bear market is around the corner?

Probably not.

The chart below shows you the average age of recent bull markets.

While the past doesn’t predict the future, we can see that two years isn’t historically long for a bull market. In fact, the longest bull market on record lasted more than 12 years.5

A sudden turn to a bear market is not likely at this point.

On the other hand, there are a lot of risks in this environment that could shake things up.

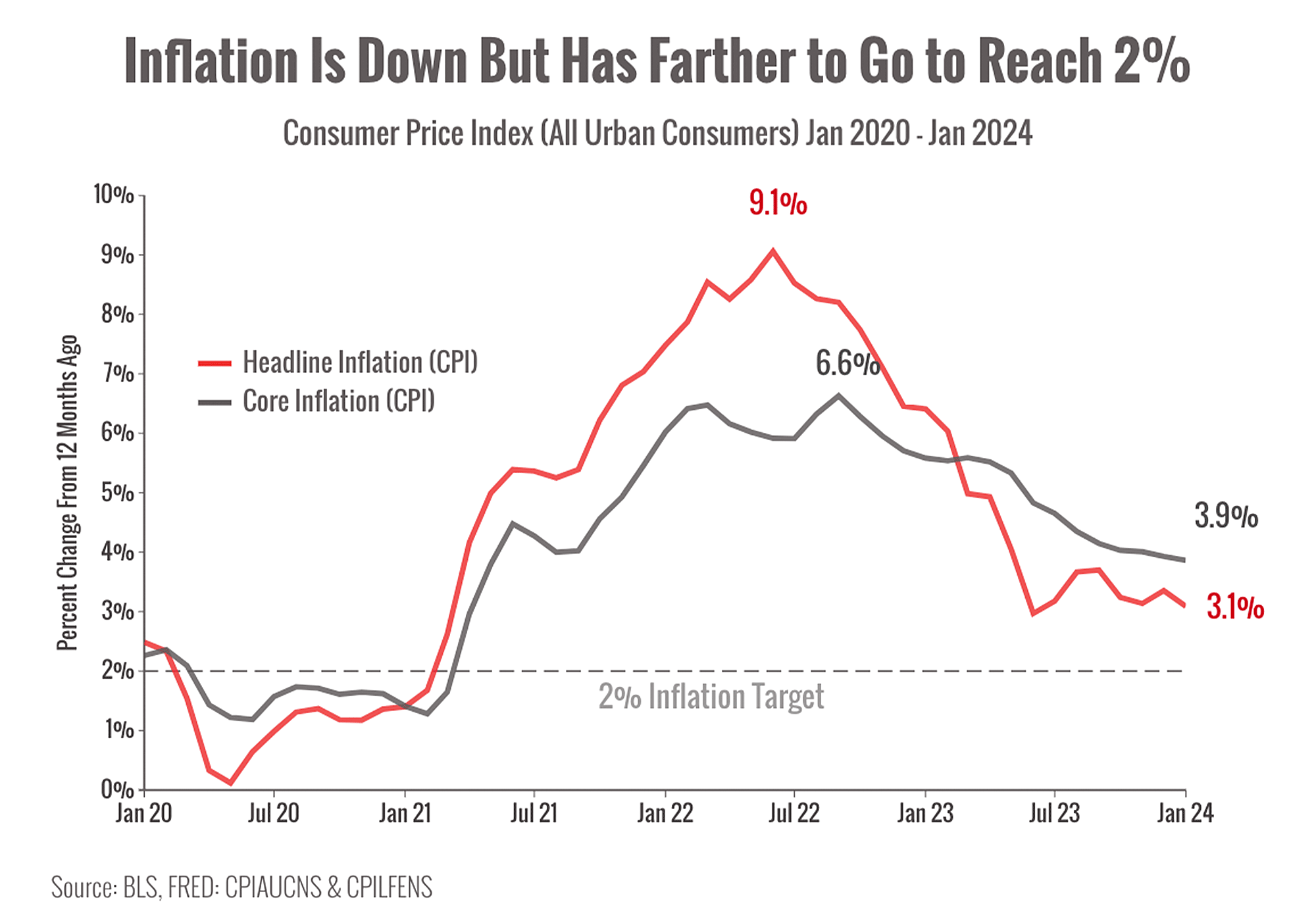

If geopolitical issues flare, inflation rebounds, or the business environment starts to look dicey, we can expect markets to correct.

Sources:

1. https://bipartisanpolicy.org/blog/debt-limit-2025-treasury-cash-on-hand/

2. https://fiscaldata.treasury.gov/americas-finance-guide/national-debt/

3. https://tax.thomsonreuters.com/blog/what-to-know-about-tcja-expiration/

4. https://www.yahoo.com/news/trumps-proposed-tariffs-raise-prices-205300785.html

Chart sources: https://finance.yahoo.com/news/the-bull-market-is-2-years-old-heres-where-wall-street-thinks-stocks-go-next-100050648.html?guccounter=1

*Current bull market as of 11/20/24