Behind the Curtain: Pro vs. Amateur Advisors

For most people, it is very difficult to discern a truly good advisor from a lackluster hack — a professional versus an amateur. To help you recognize the difference, we want to highlight a deeply insightful article penned by Josh Brown, aka The Reformed Broker. Here is Josh’s wisdom reformatted and mildly edited for easy consumption:

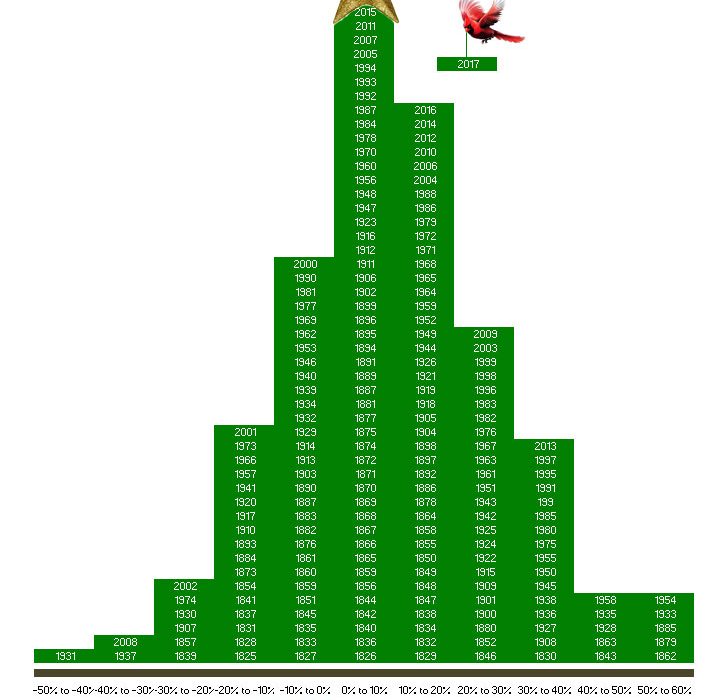

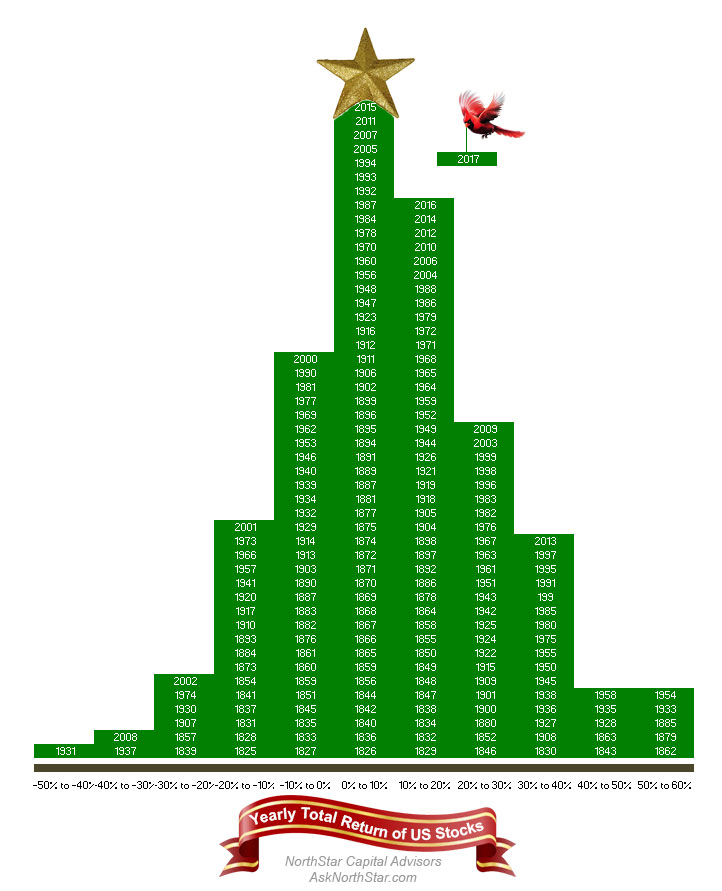

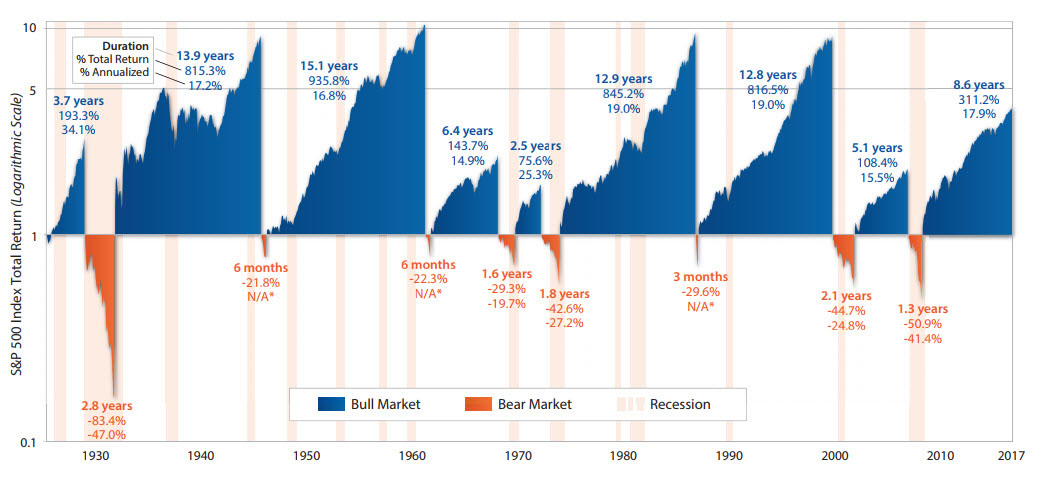

| Professionals take this opportunity to manage client expectations, pointing out that 2017’s returns were above average (by about triple) and unlikely to represent an average annual return going forward. | Amateurs use the returns of last year to raise more money. “I made you 18% in 2017, let’s talk about the assets you’re still holding away from me. And maybe some referrals.” |

| Professionals maintain allocations through the start of January, with perhaps some rebalancing. | Amateurs turn over positions, incurring commissions and possibly taxes, and start to talk about the “playbook” for the New Year. |

| Professionals point to the holdings that didn’t keep up with US and global stocks as a teachable moment and a reminder that for diversification to work, not everything can be going up at the same time. | Amateurs look for replacements for the holdings that are “disappointing” the clients, switch out managers based on last year’s performance and cut down exposure to asset classes that aren’t “working.” |

| Professionals review client financial plans and have uncomfortable but essential conversations with households that are falling short of their stated goals. | Amateurs traffic in “Five Hot Stocks for 2018” and send out three-year return charts for funds they want to add to portfolios. |

| Professionals talk to clients who are far outpacing their goals about enjoying life more now. | Amateurs talk to clients about adding new hedging strategies and more alternatives. |

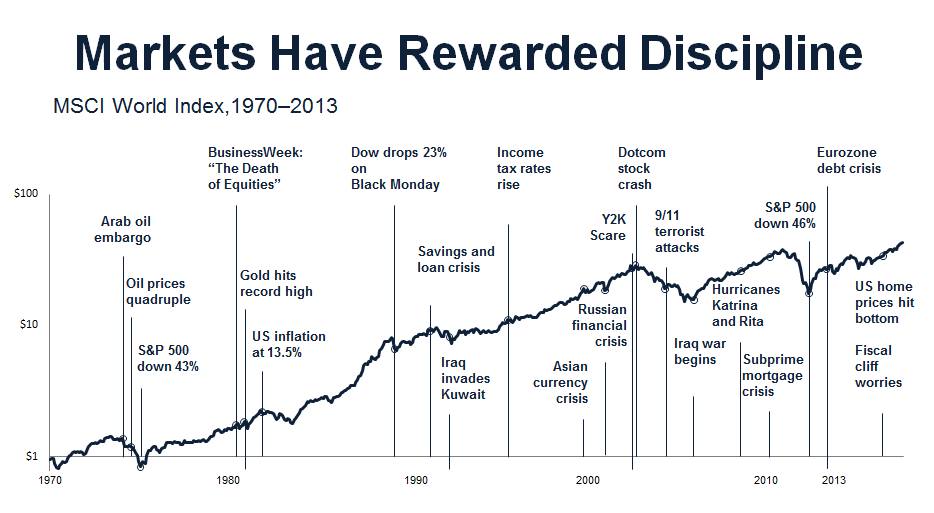

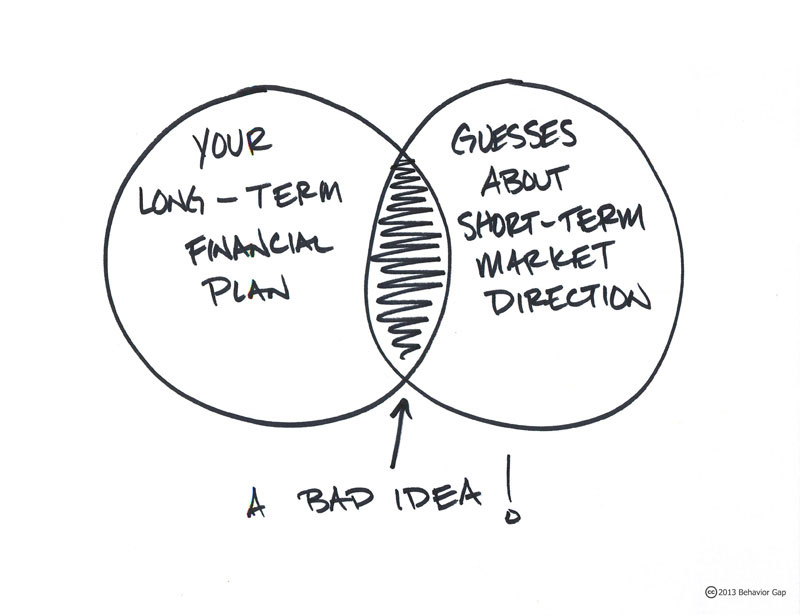

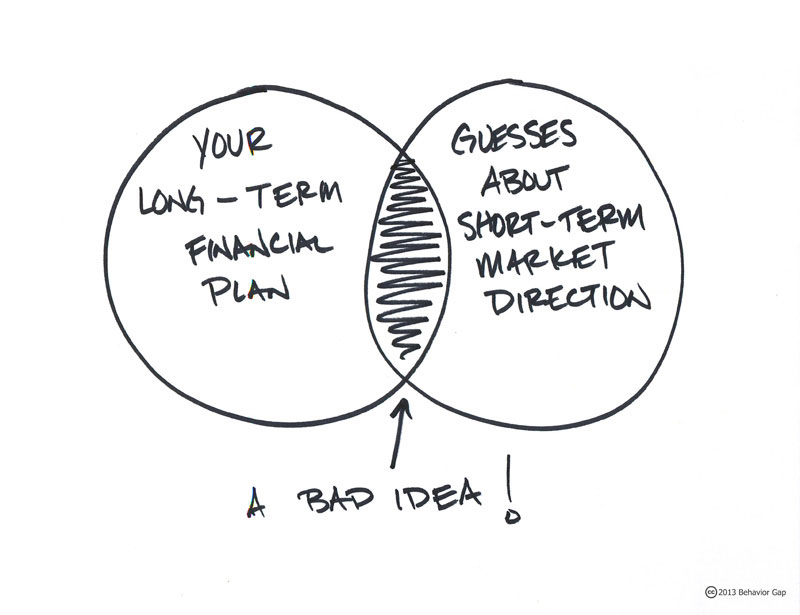

| Professionals admit they don’t know what the new year will bring, and focus instead on the durability of what they’re doing. | Amateurs have year-end price targets and can’t-miss sector bets. |

| Professionals will keep clients focused on the important stuff and get the job done in 2018, come what may. | Amateurs will direct client attention to all the wrong metrics and inevitably fall short, which means more prospecting come 2019 to replace disenchanted and under-served clients. |