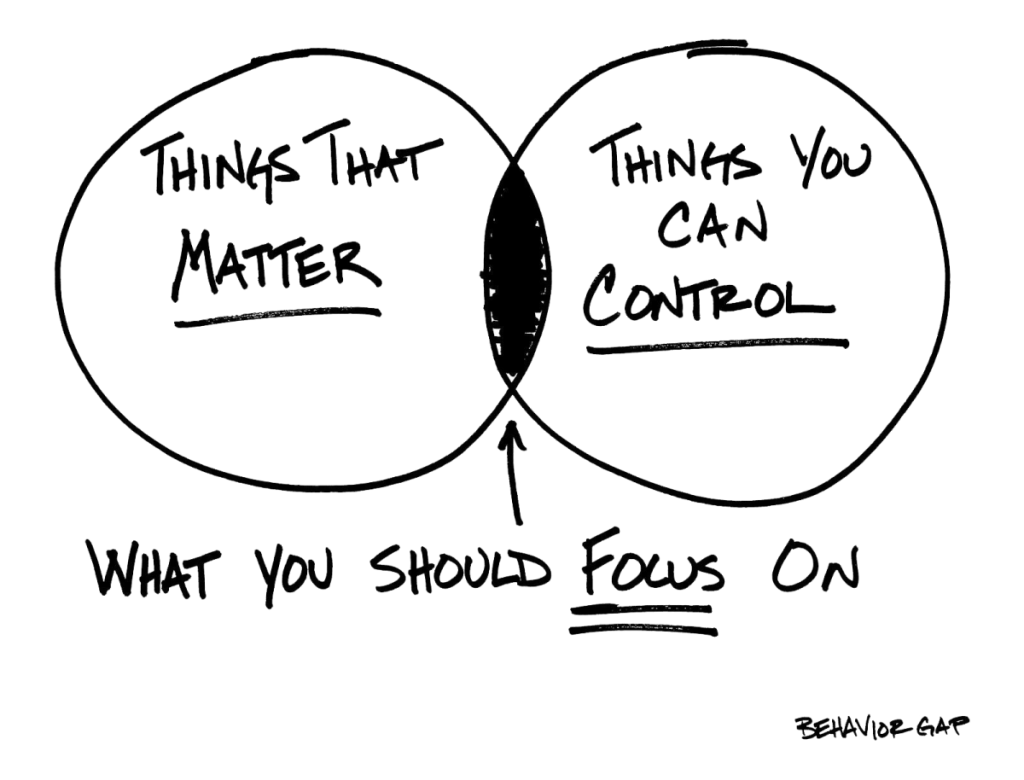

What You Should Focus On

We all want to live a great life. The path to achieve that life relies, in part, on knowing what to focus on and what to ignore. Focusing on the things you can’t control is a waste: a waste of time, energy, and often, money. Here’s a list of things that matter, things you can control, and the things you should focus on.

We all want to live a great life. The path to achieve that life relies, in part, on knowing what to focus on and what to ignore. Focusing on the things you can’t control is a waste: a waste of time, energy, and often, money. Here’s a list of things that matter, things you can control, and the things you should focus on.

Things that matter:

- Health

- Human progress

- Long-term market returns

Things that you can control:

- How you treat people

- Feeling good about yourself

- Making smart financial decisions

What you should focus on:

- Living a happy, productive life

- Surrounding yourself with good people

- Not letting a long-term plan be derailed by the current market environment

Source: Carl Richards, Michael Batick