Where Not to Die

Federal estate taxes are no longer a problem for all but the extremely wealthy. In 2016, as much as $5.45 million in assets will be exempt from federal estate taxes—double that for a married couple. However, state estate taxes, which kick in for estates valued at only $1 million or less in several states, could take a big bite out of your legacy.

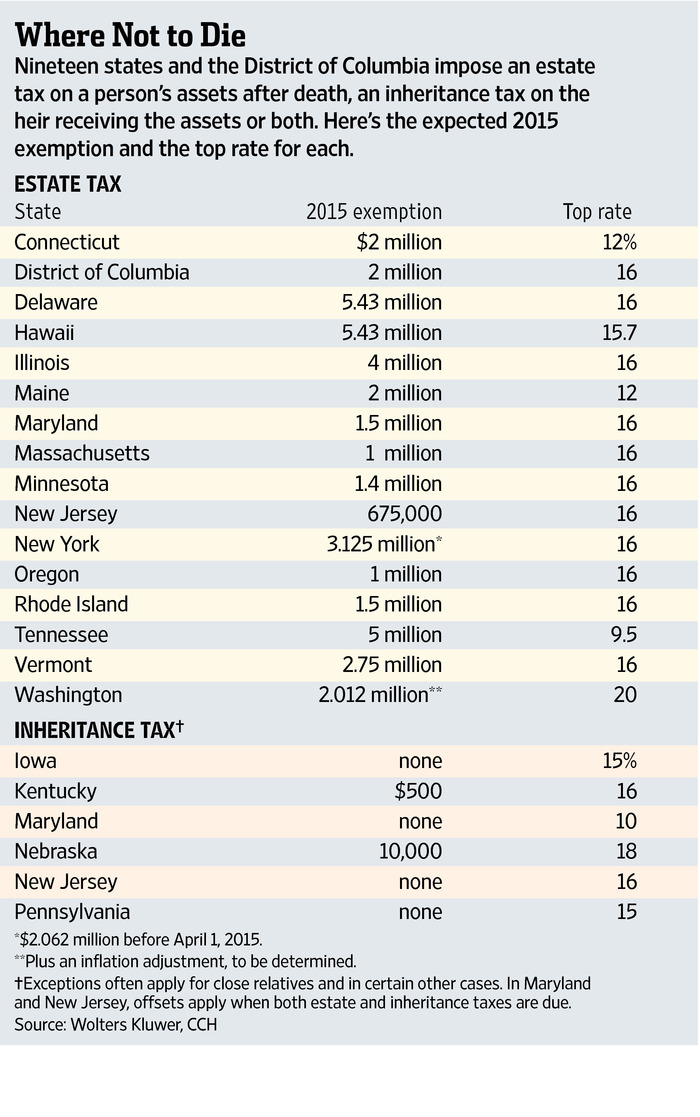

Nineteen states and the District of Columbia—home to about one-third of the U.S. population—levy an estate tax on the assets of people who die or an inheritance tax on those receiving the assets, or both.

Source: WSJ

Source: WSJ