Sorry Banks, Millennials Hate You

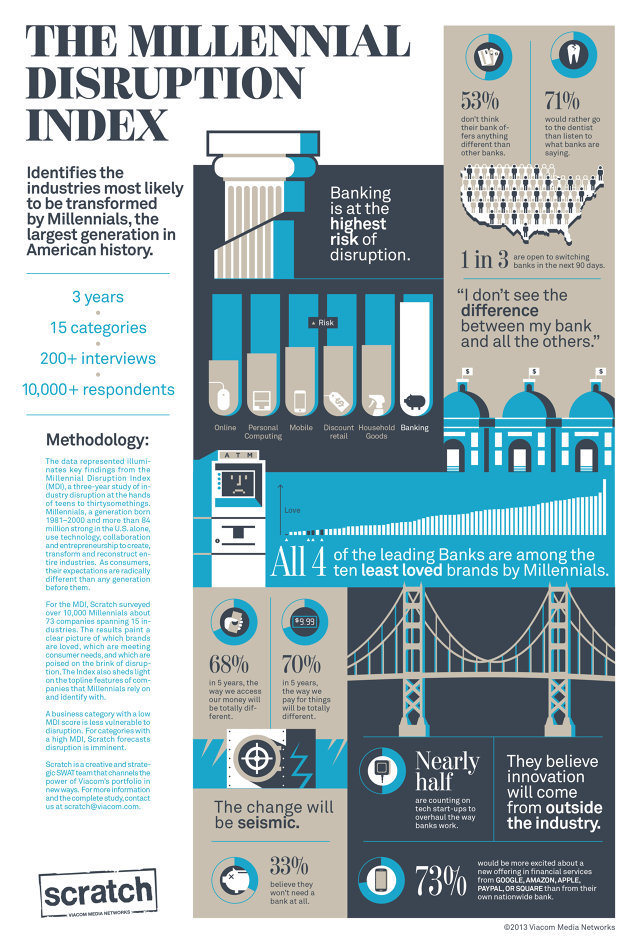

A three-year study involving 10,000 millennials (born 1981-2000) reveals an overwhelmingly negative sentiment toward banks:

- Banking is the most prime industry for disruption in millennials’ opinion

- Banks make up four of the top 10 most hated brands for millennials

- Millennials increasingly view banking institutions as irrelevant

Source: FastCo

Source: FastCo