Your Projected Medical Costs in Retirement Will Surprise You!

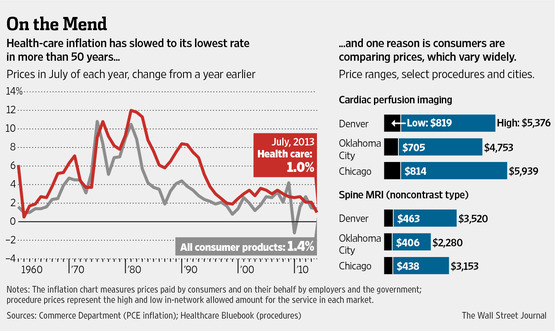

It’s important to be aware of what healthcare costs will look like in your future retirement budget.

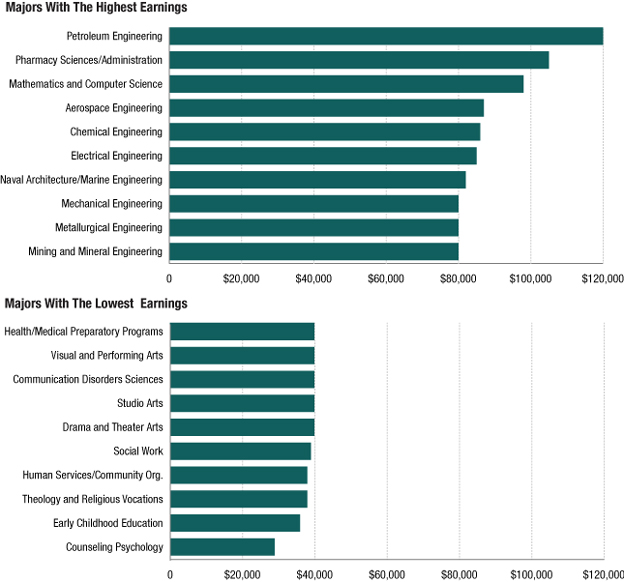

The following statistics effectively guarantee the need to emphasize portfolio growth as opposed to income for many investors:

According to an AARP study released early this year, titled “What are the Retirement Prospects of Middle-Class Americans,” rising out-of-pocket medical costs are the prime factor threatening retirement security.

The report notes that median out-of-pocket medical expenses for 70-year-olds currently come to $2,800, or 8.2% of annual income.

For middle-income workers aged 45 to 54 in 2012, that figure should rise to $5,600, or 15.3% of income, when they reach 70,

while for those between ages 25 and 34, those expenses are likely to rise to $11,000, or 20% of income.

With those rising medical outlays, the AARP study concluded “future retirees are less likely than current retirees to maintain their standard of living during retirement.”

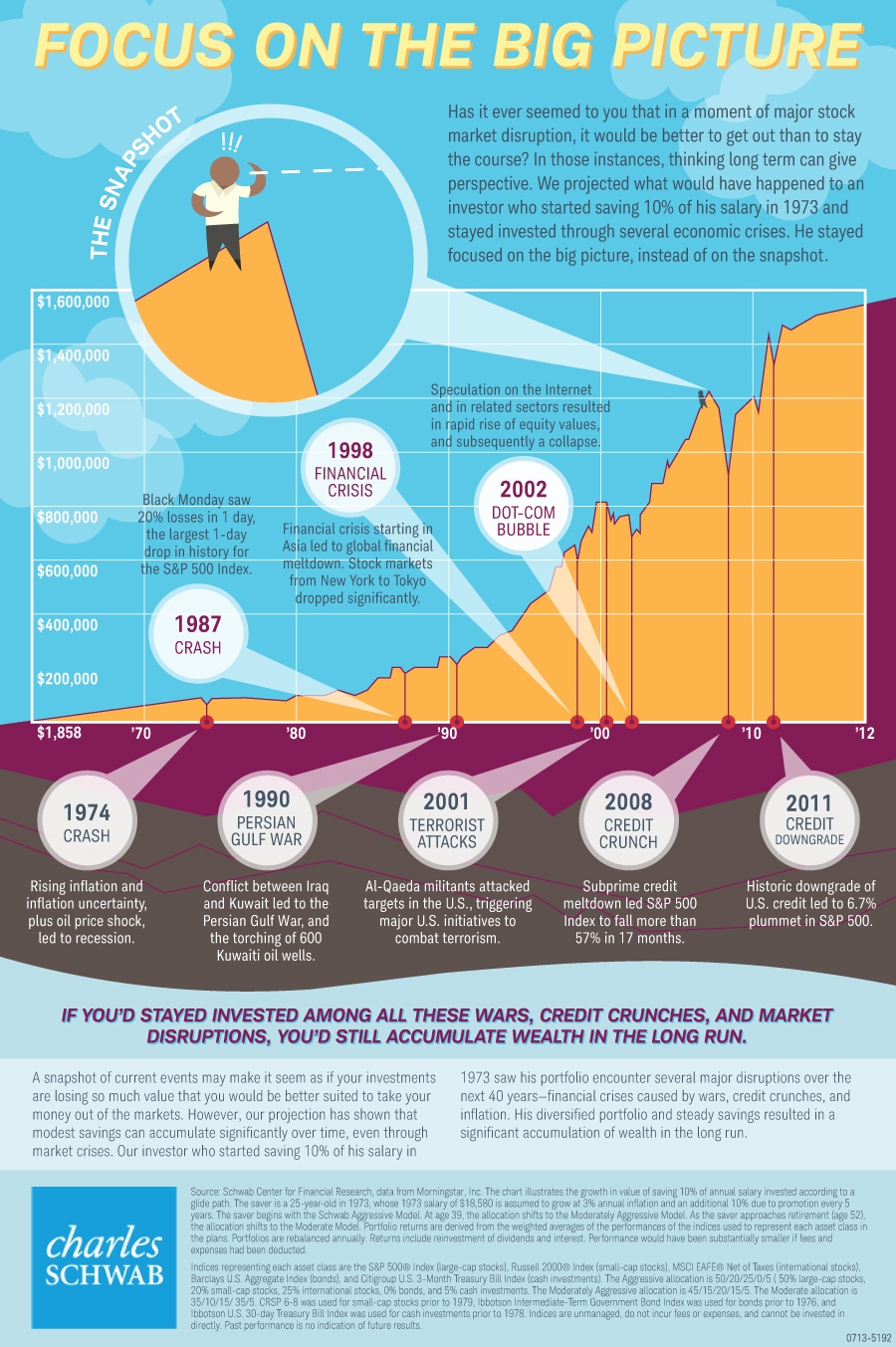

The takeaway for this is that the real risk for many future retirees will not be volatility – it will be the real threat of running out of money before running out of life. To combat this, it’s prudent to build up your pre-retirement savings and assure you have sufficient stock holdings even during retirement.

Source:

Not Your Father’s Retirement