Managing Your Portfolio: One Father’s Advice

Arthur Zeikel, president of Merrill Lynch Asset Management, sent his daughter a letter teaching her some investing basics.

Arthur Zeikel, president of Merrill Lynch Asset Management, sent his daughter a letter teaching her some investing basics.

Enjoy!

———

Personal portfolio management is not a competitive sport. It is, instead, an important individualized effort to achieve some predetermined financial goal by balancing one’s risk-tolerance level with the desire to enhance capital wealth. Good investment management practices are complex and time consuming, requiring discipline, patience, and consistency of application. Too many investors fail to follow some simple, time-tested tenets that improve the odds of achieving success and, at the same time, reduce the anxiety naturally associated with an uncertain undertaking.

I hope the following advice will help:

A fool and his money are soon parted. Investment capital becomes a perishable commodity if not handled properly. Be serious. Pay attention to your financial affairs. Take an active, intensive interest. If you don’t, why should anyone else?

There is no free lunch. Risk and return are interrelated. Set reasonable objectives using history as a guide. All returns relate to inflation. Better to be safe than sorry. Never up, never in. Most investors underestimate the stress of a high-risk portfolio on the way down.

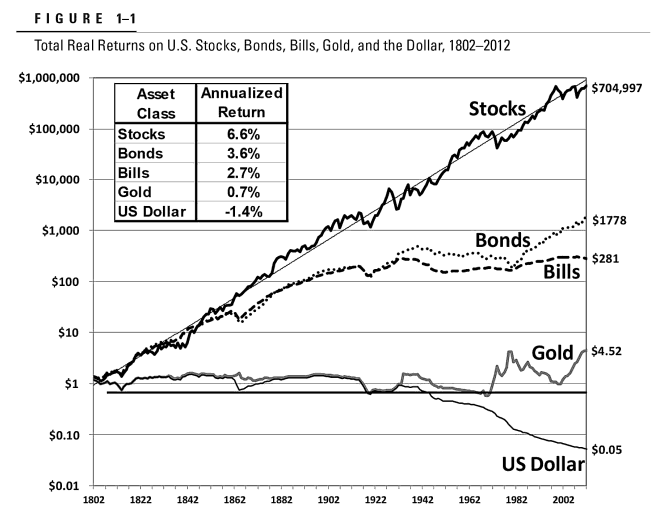

Don’t put all your eggs in one basket. Diversify. Asset allocation determines the rate of return. Stocks beat bonds over time.

Never overreach for yield. Remember, leverage works both ways. More money has been lost searching for yield than at the point of a gun (Ray DeVoe).

Spend interest, never principal, If at all possible, take out less than comes in. Then a portfolio grows in value and lasts forever. The other way around, it can be diminished quite rapidly.

You cannot eat relative performance. Measure results on a total return, portfolio basis against your own objectives, not someone else’s.

Don’t be afraid to take a loss. Mistakes are part of the game. The cost price of a security is a matter of historical insignificance, of interest only to the IRS. Averaging down, which is different from dollar cost averaging, means the first decision was a mistake. It is a technique used to avoid admitting a mistake or to recover a loss against the odds. When in doubt, get out. The first loss is not only the best, but is also usually the smallest.

Watch out for fads. Hula hoops and bowling alleys (among others) didn’t last. There are no permanent shortages (or oversupplies). Every trend creates its own countervailing force. Expect the unexpected.

Act. Make decisions. No amount of information can remove all uncertainty. Have confidence in your moves. Better to be approximately right than precisely wrong.

Take the long view. Don’t panic under short-term transitory developments. Stick to your plan. Prevent emotion from overtaking reason. Market timing generally doesn’t work. Recognize the rhythm of events.

Remember the value of common sense. No system works all of the time. History is a guide, not a template.

This is all you really need to know.

When this article was originally published in 1995, Arthur Zeikel was president of Merrill Lynch Asset Management in New Jersey.

Source: Forbes