How Will Gen X Retire?

The Pew Charitable Trust released a report last week detailing the impact of the financial crisis and specifically the damage to Generation X defined as those born between 1966 and 1975.

The Pew Charitable Trust released a report last week detailing the impact of the financial crisis and specifically the damage to Generation X defined as those born between 1966 and 1975.

The bad news

- The typical Gen Xer now in his or her late 30s to late 40s saw their net worth drop by a larger proportion than older Americans during the crisis.

- Generation X suffered losses amounting to 45% of median net worth between 2007 and 2010.

- Gen Xers are now less prepared for retirement than the post-World War II boomer generation.

- Gen Xers are on track to replace only 50% of their pre-retirement income if they stop working at age 65. Boomers (borned 1946-1955) are set to replace 82% of income while Late Boomers (1956-1965) are tracking to replace 59%.

What’s working against Generation X?

- Gen X will bear the full brunt of the decision made decades ago to raise the age at which beneficiaries can get full Social Security benefits to 67 up from 65.

- Life expectancy is rising meaning retirement assets will have to last longer.

- Most Gen Xers will have to rely on defined-contribution plans (e.g., 401(k)s), instead of traditional pension plans.

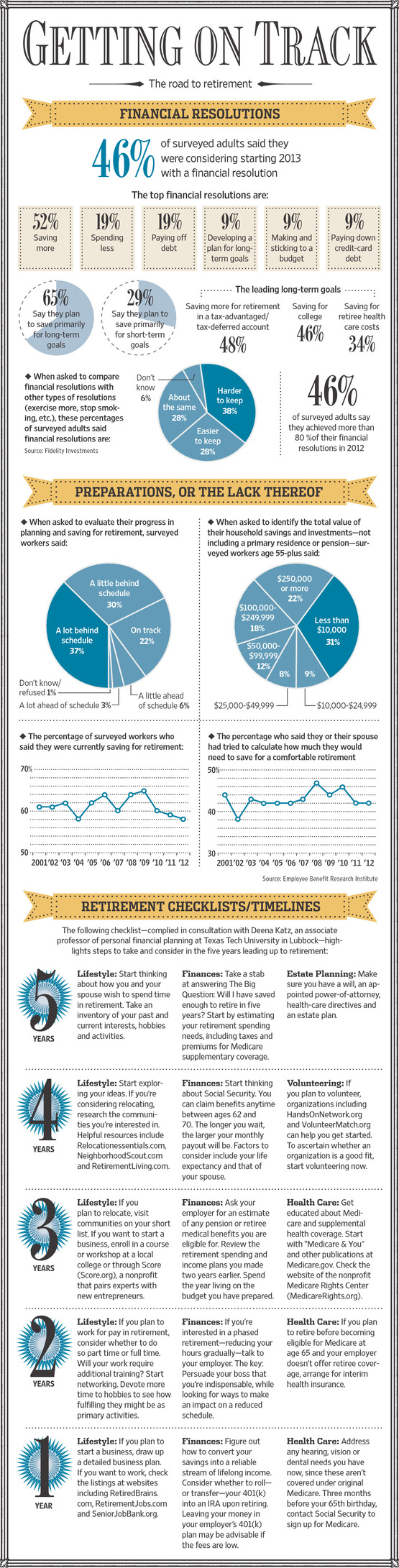

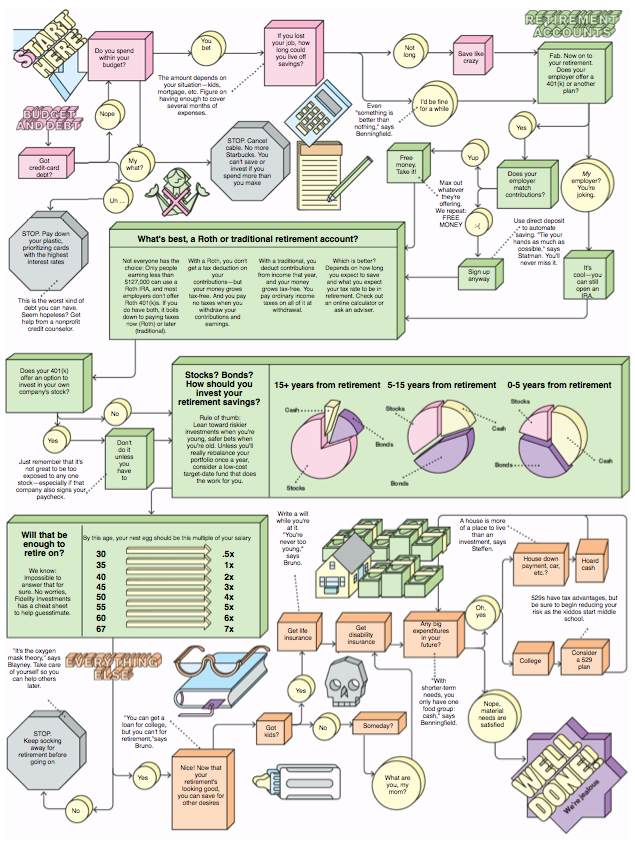

What do Gen Xers need to do?

- Gen Xers are facing a genuine possibility of downward mobility, if they don’t change course.

- Generation X needs to take steps such as saving more, investing more wisely, and borrowing less to maintain their living standard in retirement.

- There’s additional reason to be optimistic because many Gen Xers may have been fairing better in the last few years following the 2010 cutoff of the Pew study.

- Home prices and the stock market have been rebounding in recent years.

- As long as Gen Xers didn’t sell stock and they continued to contribute to their retirement accounts through the recession they will be in a reasonably good position.

- That’s a prudent lesson to remember when inevitable occurs and we face another recession.

Source: Wall Street Journal