What the Fed sees…and why it matters

The Fed is sending up a flare: the economy may be softening.

In a recent speech, Federal Reserve Chair Jerome Powell signaled that interest rate cuts could be on the table soon.

He expressed rising concern about the job market, noting a sharp slowdown in hiring and the risk of further weakness ahead.

And he’s not alone. Other indicators have started pointing in the same direction.

Taken together, these signals point to potential shifts in economic momentum that could affect interest rates, the markets, and your financial plan.

Let’s start with what has the Fed most concerned: jobs.

In his speech, Powell highlighted several worrying trends in the labor market. Over the past three months, employers have added an average of just 35,000 jobs per month. That’s a steep drop from the 168,000 monthly average we saw in 2024.1

Long-term unemployment is rising too. Nearly 1.8 million Americans have been out of work for more than 27 weeks, up 20% from a year ago.2

In his words, “the stability of the unemployment rate allows us to proceed carefully,” but the recent data may “warrant adjusting our policy stance.”3

Translation: interest rate cuts are on the table.

But it’s not just the Fed chair who’s raising concerns about the economy. Other reports have started to echo that same message.

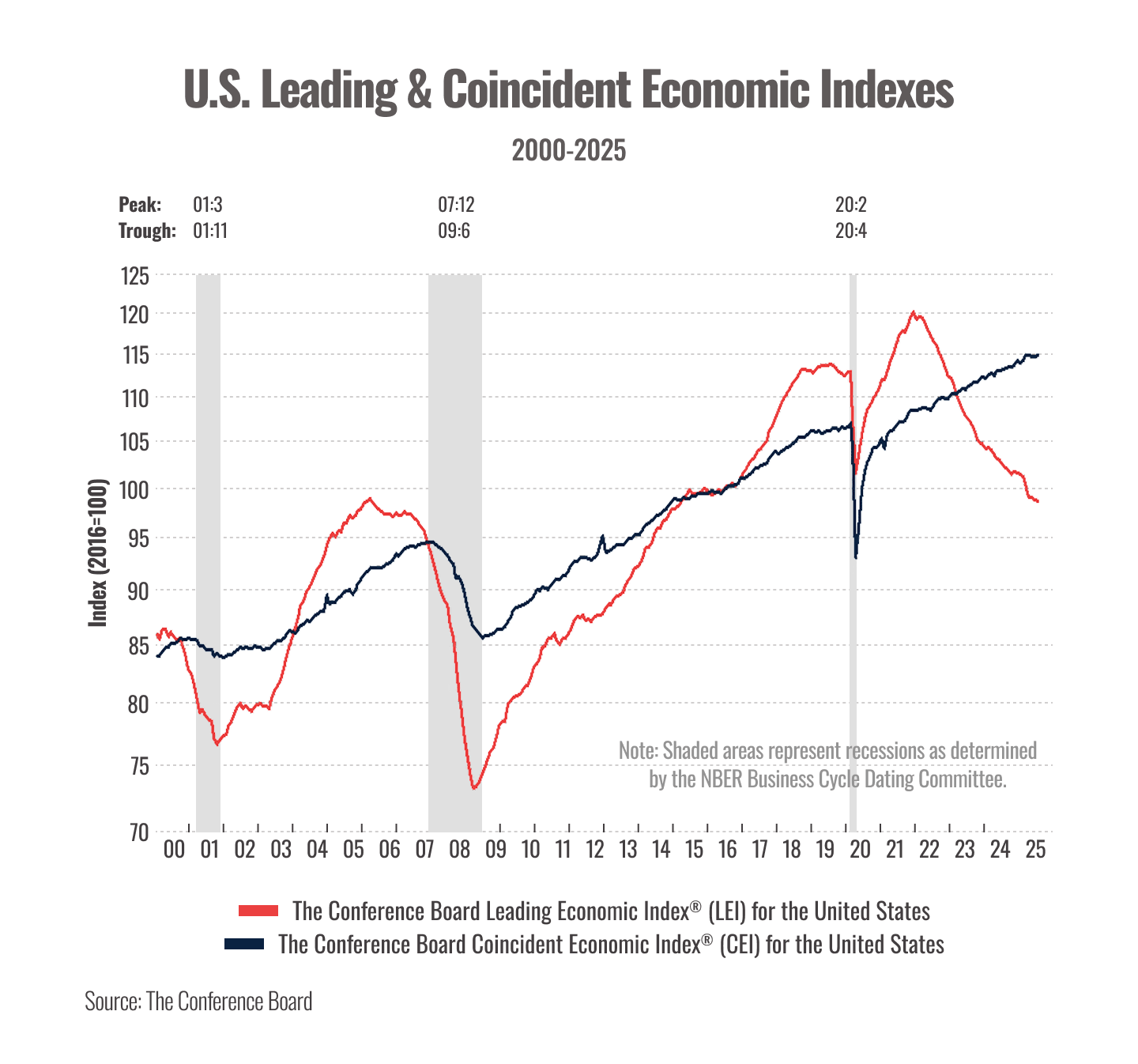

One of the most telling is the Conference Board’s Leading Economic Index, or LEI.

Think of the LEI like an early warning indicator on your car’s dashboard. It pulls together a range of forward-looking signals from across the economy like manufacturing orders, building permits, jobless claims, and consumer sentiment.

No single indicator tells the whole story. But when multiple indicators start showing similar warning signs, it’s worth paying attention.

In July, the LEI declined for the sixth month in a row.4

The chart below shows how sharp LEI declines like this have correlated with recessions over the past two decades.

So, what does this all mean?

For the economy, it suggests a shift toward slower growth (and possibly a mild recession) is becoming more likely. If that happens, the Fed may cut rates to help cushion the impact, making it cheaper to borrow and invest. But it’s also a sign that economic momentum is softening, which can affect businesses and workers alike.

For your personal finances, lower interest rates could reduce borrowing costs on things like mortgages, credit cards, or car loans. At the same time, savings accounts and other interest-based products may see lower yields. Managing cash flow and debt wisely becomes even more important in an environment like this.

For your investments, things can feel a bit counterintuitive. A slowing economy (which often triggers rate cuts) can sometimes be good for both stocks and bonds. Why? Because lower interest rates reduce borrowing costs, which can boost corporate profits and investor appetite, especially in sectors like real estate and technology. Bonds may also benefit as yields fall and existing bond prices rise. That’s why the S&P 500 closed at record high last week.5

While none of this calls for immediate action, it does call for attention.

A well-structured financial plan can help navigate market shifts like these.

But if anything in your life has changed (or if you just want to stress test your strategy), it’s a great time to talk with your advisor.

Source:

- The Federal Reserve, 2025 [URL: https://www.federalreserve.gov/newsevents/speech/powell20250822a.htm]

- CBS News, 2025 [URL: https://www.cbsnews.com/news/jobs-employment-slowdown-layoffs-federal-reserve-jerome-powell-charts/]

- The Federal Reserve, 2025 [URL: https://www.federalreserve.gov/newsevents/speech/powell20250822a.htm]

- The Conference Board, 2025 [URL: https://www.conference-board.org/topics/us-leading-indicators/]

- Reuters, 2025 [URL: https://www.reuters.com/business/dow-notches-record-high-wall-street-cheers-powells-speech-2025-08-22/]

New Tax Law: 7 Big Changes You Should Know About

You’ve likely heard about this from every possible media channel.

A sweeping new tax law just hit the books.

It’s called the “One Big Beautiful Bill Act,” and it could represent a big overhaul to household finances.

Think of it like a home renovation. The 2017 tax cuts laid the foundation. This law keeps the structure, adds new features, and rips out a few that may no longer fit.

We won’t dance around the issue: This bill is controversial.

Some people love it. Others don’t.

Yet no matter how you feel about the politics behind it, what I want to break down in this email is how it might affect you.

Your taxes, your savings, your financial future.

Here’s a general breakdown:1

Tax brackets will stay the same for now. Lower income tax rates and higher standard deductions are now permanent. In 2025, the deduction rises to $15,750 for single filers and $31,500 for married couples filing jointly.

State and local tax (SALT) deduction cap quadruples. It jumps from $10,000 to $40,000 in 2025, with annual increases through 2029.

Seniors get a bigger break. If you’re 65 or older, you may qualify for an extra $6,000 deduction, depending on income.

New help for families. The Child Tax Credit bumps up to $2,200. And every baby born between 2025 and 2028 gets a $1,000 “Trump Account” to start saving for the future.

Student loan system overhaul. Repayment plans like SAVE and PAYE are going away. PLUS loan caps are coming. The Grad PLUS program ends July 1, 2026.

529 plans just got more flexible. You can now use them for K–12 tuition (up to $20,000), educational therapies, and more.

Temporary perks, disappearing credits. New deductions apply to tipped income, overtime, and U.S.-made car loans. Credits for EVs and clean energy are being phased out.

It’s a lot.

This law is more than 900 pages long. Some changes start right away, others in 2026.

And while the headlines are political, the impact is personal. That’s the focus with this email.

The good news? You don’t have to navigate this alone.

With changes this significant, it can be helpful to review how they might affect your specific financial picture. Whether you’re adjusting your savings strategy or exploring how new tax breaks might apply to you, a conversation about your situation can help you stay ahead of these changes.

If you have questions about how this might impact you, we’re here to help walk through it. Just reach out and we’ll find a time to connect.

Sources:

- Congress.gov, 2025 [URL: https://www.congress.gov/bill/119th-congress/house-bill/1/text]

Markets at All-Time Highs: What Should You Do Now?

The S&P 500 just closed at another all-time high.

Cue the headlines. Cue the opinions.

And for many investors? Cue the hesitation.

When markets are setting records, it can feel like the worst possible time to put new money to work.

After all, nobody wants to buy at the top.

But here’s the thing: All-time highs are not rare.

In fact, they’re more like mile markers on a long journey.

Between 1950 and 2024, the S&P 500 has hit more than 1,250 of them. That’s over 16 new highs per year, on average.1

So if you’re thinking, “Maybe I’ll wait for a better entry point,” you’re definitely not alone.

But let’s break it down…

Investing at all-time highs has actually produced solid results, often not far off from investing at any random time.

Here’s how those returns compare:

- 1-year holding period: 11.2% after all-time highs vs. 12.6% for all periods

- 3-year holding period: 10.9% vs. 11.5%

- 5-year holding period: 10.3% vs. 11.3%2

In other words, investing at a market high has been just slightly below average… still solid, and far from concerning.

There’s more.

Since 1950, the market has dropped more than 10% in the year following an all-time high only 9% of the time.3

Look out 10 years, and the S&P 500 has never ended that period more than 10% down after any of its record highs.

That’s a powerful reminder for long-term investors.

Waiting to invest because prices are high is like waiting to fill your gas tank until prices drop.

You might save a little.

Or you might make the road trip take longer than planned.

Yes, the market could pull back. But it might not. And sitting on the sidelines while prices climb can be more costly than it seems.

So, what could you do?

We’re not saying to chase the highs.

We’re not saying you should try to time the market.

And we’re definitely not saying these historical returns will play out the same way in the future.

But we are saying this:

History shows that investing at all-time highs has not been as risky as many investors assume. It’s been, at least historically, a reasonable time to invest. And for long-term investors, it has often worked out just fine.

If you’re not sure what to do next, let’s talk about your options.

You don’t have to guess.

You don’t have to go it alone.

And you definitely don’t have to let fear steer your financial plan.

Thoughts on the shifting housing market

After years of runaway growth, the housing market is cooling…like a pot taken off the flame.

Still warm. Still active. But no longer boiling over. And the numbers back it up.

Across the U.S., 117,000 new single-family homes are sitting on the market. That’s the highest level since July 2009 and a 31% jump from last year.1

Regionally, some places are feeling it more than others:

- Texas: Active listings are 53% above normal2

- Florida: Tampa and Jacksonville lead the country in price cuts3

- California: Bay Area pending sales just saw their weakest March since 20124

Even luxury buyers are slowing down.

In April, sales of high-end homes dropped 10% year-over-year.5

That’s not about mortgage rates…many of these buyers pay cash.

It’s about confidence.

That said, prices haven’t plunged.

Home values in the 20 largest metro areas dipped just 0.12% in March.

That’s the first monthly decline after 15 straight gains.6

It’s a small move, but a clear signal that the heat is coming down.

So why does this matter?

Real estate isn’t just a reflection of the economy.

It’s often a preview.

Housing tends to be one of the earliest sectors to respond when things start to shift. That’s why many economists watch it closely. It affects jobs, consumer spending, and local tax revenues.

When people get cautious about housing, that caution can spread. We’re not sounding alarms, but we are paying attention.

So where do we go from here?

It’s tough to say.

There are many variables still in play. Interest rates. Inflation. Employment trends.

That’s why this is a good moment to pause, reassess, and make sure your financial strategy still fits the environment.

Thinking about buying or selling? Considering real estate as part of your portfolio? Just wondering how this fits into your bigger picture?

Let’s talk it through. Markets evolve. Plans adapt.

If you’re curious how the current changes in real estate could affect your future plans or investment strategy, we’re here to help you think it through.

Sources:

- Fast Company, 2025 [URL: https://www.fastcompany.com/91341501/housing-market-homebuilder-unsold-inventory-swells-to-2009-levels]

- Newsweek, 2025 [URL: https://www.newsweek.com/texas-faces-major-housing-market-correction-prices-drop-across-state-2070190]

- Realtor.com, 2025 [URL: https://www.realtor.com/research/april-2025-data/]

- San Francisco Chronicle, 2025 [URL: https://web.archive.org/web/20250602214059/https://www.sfchronicle.com/realestate/article/home-sale-price-bay-area-20296381.php]

- Redfin, 2025 [URL: https://www.redfin.com/news/luxury-homes-market-april-2025/]

- Marketwatch, 2025 [URL: https://www.marketwatch.com/story/home-prices-in-the-biggest-20-markets-decline-for-the-first-time-in-over-two-years-heres-where-theyre-expected-to-fall-the-most-14cebe4f]

The patience premium: What market history teaches us

“How long will this last?”

“Will markets bounce back?”

“Should I make a change now?”

These are some of the most common and understandable questions investors are asking right now. When the market takes a sharp turn, it’s only natural to wonder what comes next and how long it might take to feel confident in the markets and economy again.

Let’s start with where we are today.

Over the past two months, markets have fallen sharply. The S&P 500 is down more than 17% from its February highs, while the Dow has dropped over 7,000 points.

What’s driving the decline? It’s not one thing. It’s a mix of economic and political uncertainty.

Heightened trade tensions, aggressive new tariffs, public pressure on the Federal Reserve, and ambiguity around future rate cuts have all contributed. That cocktail of risk has pushed investors to the sidelines and sent volatility soaring.

But what everyone wants to know is, “When will things turn around?”

Of course, we don’t have a crystal ball. And you’ve heard this more than a few times before, but it’s worth repeating: past performance doesn’t guarantee future results. Markets don’t always follow historical patterns, and downturns can deepen before recovery begins. Still, looking at long-term data can offer some much-needed context and perspective.

For starters, markets tend to fall fast.

Historically, based on data from over a century of S&P 500 returns, adjusted for inflation and including dividends, it has taken as little as six months for a 20% decline to reach its bottom. Even deeper drops, like 40% or 50%, have often found their low point in under two years.1

But getting back to where we started? That takes longer. Much longer.

On average, a 20% drop has historically taken about four years to recover. A 30% decline stretches to over seven years. A 40% drawdown? Nearly nine.2

These numbers reflect the real emotional challenge of investing, not just the drop itself, but the long, patient climb back to previous highs.

In other words, recoveries are less like flipping a switch and more like repairing a home after a storm. The damage can be done quickly, but rebuilding confidence, earnings, and momentum takes time.

I’ll admit, it can be surprising how long it can take for markets to fully recover.

Since the end of the Great Financial Crisis, we’ve been fortunate. U.S. markets have generally bounced back quickly from declines, sometimes in just months. That kind of speed can create a false sense of how recoveries typically work.

But when you zoom out and look at a broader stretch of market history, it becomes clear that fast recoveries are the exception, not the rule.

Over nearly a century of S&P 500 data, the pattern is clear. Deep declines often take years, not months, to fully heal. And for investors who have only experienced the post-2008 era, this longer timeline can feel unexpectedly drawn out.

That said, there is reason to remain encouraged.

Historically, some of the strongest returns have come after the most difficult periods. Following the 10 worst calendar years since 1975, the S&P 500 delivered an average return of 17.5% one year later, compared to its average one-year return of 9.7% over the same broader time frame.

Over longer periods, the results are even more striking: an average 56% return after three years, and more than 200% after ten.3

Now we know you’ve heard this several times already, but here it is again: Past performance doesn’t guarantee future results. Markets don’t move in straight lines, and downturns can deepen before a recovery begins. Still, history provides helpful context, and it reminds us that long-term discipline has often been rewarded.

So what can you do right now?

Here are a few time-tested best practices we apply on behalf of our clients when markets turn volatile:

- Hunt for pockets of value: Look for areas of the market that may be undervalued or overlooked, where long-term potential outweighs short-term noise.

- Keep a diversified portfolio: Spreading investments across regions, sectors, and asset classes reduces your exposure to any single area.

- Avoid trying to time the market: Staying invested through downturns can yield better results than jumping in and out based on emotion.

- Rebalance when needed: Adjusting your mix of stocks and bonds can help manage risk and keep your plan aligned with your goals.

- Consider downside protection: In some cases, alternative strategies or specific investment products can help buffer volatility.

We can’t avoid market declines, but we can prepare for them, navigate through them, and stay focused on long-term outcomes.

Sources:

1. Shiller Data, 2025 [URL: https://shillerdata.com/]

2. Shiller Data, 2025 [URL: https://shillerdata.com/]

3. Market Declines: A History of Recoveries, 2025 [URL: https://www.mfs.com/content/dam/mfs-enterprise/mfscom/sales-tools/sales-ideas/mfse_resdwn_fly.pdf]

Chart sources:

Shiller Data, 2025 [URL: https://shillerdata.com/]

What’s next for markets and the economy?

Markets have been on a roller coaster, and investors are asking:1

Is a bear market on the way?

Let’s dive into what’s happening and what it might mean for your portfolio.

What’s driving these market swings?

In a word: uncertainty.

Anxiety over a potential trade war is causing a significant shift in business sentiment, with many corporate leaders bracing for a potential recession later this year.2

It’s a dramatic (and concerning) change from the outlook just a few months ago.

Three key worries seem to be driving markets:

1. Tariff uncertainty is causing anxiety – Analysts are concerned that widespread tariffs could increase costs and disrupt many industries.

However, recent remarks from the administration hint at a more flexible approach to negotiations that could blunt the full impact of tariffs.3

2. Sticky inflation persists – Many economists don’t expect us to hit the Fed’s 2% target until 2026 or later.2

If inflation doesn’t moderate, the Fed may get cold feet about lowering interest rates further.

3. Consumer spending is slowing – Fresh data shows Americans are tightening their belts as inflation and economic worries bite.4

Since consumer spending drives nearly 70% of the economy, this pullback raises real concerns.

Are there potential bright spots despite the noise?

The recent market bounce tells us something important: investors are ready to respond positively to policy clarity.

The push to strengthen domestic production could also unlock new opportunities in some sectors of the economy.

Our job is to spot those opportunities and stay nimble enough to use them when they emerge.

What could this mean for your portfolio?

Market volatility can be unsettling, especially alongside economic uncertainty. It’s perfectly normal to feel concerned when headlines turn gloomy.

We don’t know what will happen next, but I know this: Emotional reactions to market movements often lead to missed opportunities.

If you’re worried about what’s going on, please reach out—our role is to be your guide, thought partner, and a source of reassurance and perspective.

Your investment strategy was designed to account for market fluctuations.

Sources:

1. https://www.cnbc.com/2025/03/24/stock-market-today-live-updates.html

2. https://www.cnbc.com/2025/03/25/recession-is-coming-pessimistic-corporate-cfos-say-cnbc-survey.html

3. https://www.cnbc.com/2025/03/25/cnbc-daily-open-trump-winks-at-gentler-tariffs-boosting-markets.html

Navigating Financial Uncertainty Amid Federal Layoffs

| We know the news surrounding federal layoffs is unsettling, and if you’re feeling uncertain about what comes next, you’re not alone. Change like this can be overwhelming, but please know that you have options and support. Our goal is to help you navigate this transition with clarity and confidence so you can make informed decisions for yourself and your family.

Why Is This Happening? The federal workforce is experiencing significant changes due to budget reductions, workforce restructuring, and a shift toward modernization. Recent reports indicate that the Trump administration may require agencies to submit layoff plans by March 13, 2025, as part of an effort to cut costs and streamline operations.1 While these changes may feel sudden, they are part of a broader restructuring of government agencies. What You Can Do Now While you may not be able to control these changes, you can take steps to protect your financial future:

Managing Your Thrift Savings Plan (TSP) If you separate from federal service, you may still have options regarding your TSP, such as adjusting allocations, rolling funds into another qualified plan, or keeping your account active.2 If you have an outstanding TSP loan, you may need to explore repayment options. In some cases, unpaid loans could be treated as taxable distributions.3 We know this is a lot to process, but you don’t have to navigate it alone. If you have any questions or would like to talk through your financial options, we’re here to help.

|

|

Sources: 1. Politico, 2025 [URL: https://www.politico.com/news/2025/02/26/trump-administration-federal-agencies-mass-layoffs-00206222] 2. Plan Sponsor, 2025 [URL: https://www.plansponsor.com/what-happens-to-federal-workers-thrift-savings-plan-assets-after-being-terminated/] 3. TSP.gov, 2025 [URL: https://www.tsp.gov/publications/tspfs29.pdf] |

AI bubble burst? What’s next

After reaching new record highs in recent weeks, markets plunged on worries that cheaper AI competition from China could pose risks to U.S. tech companies.1

What caused the market reaction?

Let’s dive in.

What caused the tech market crash?

Much of the market run-up over the last two years has been driven by AI mania, with U.S. companies leading the charge.

However, this narrative faced a test when DeepSeek, a Chinese tech startup, released an advanced (much cheaper) AI model.

DeepSeek claims it was able to develop its advanced model for just $6 million using fewer hard-to-find computer chips, compared to the hundreds of billions collectively invested by U.S. rivals to develop their own AI models.1

If the buzz around DeepSeek R&D numbers turns out to be more than just hype, it raises questions about the efficiency and competitiveness of U.S.-based AI firms.

Why are AI models so expensive to train?

That is the trillion-dollar question.

The rising costs of AI development have been a key focus for investors.

Capital spending on AI model development is soaring, driven by the cost of the massive computing power needed to analyze data.2

The chart below shows the estimated costs to train some of the major models released over the last few years.

One major tech CEO estimated that training advanced AI models could cost anywhere from $10 billion to $100 billion.3

In contrast, DeepSeek claims to have developed its model for a fraction of the cost by using innovative ways to process data using fewer resources.

If their approach is validated, it shows that there may be alternative paths to AI innovation that require less upfront investment.

What will this AI “space race” mean for U.S. AI companies?

While the long-term potential for AI could be massive, it’s still a very new technology with a rapidly evolving landscape and not a lot of return to show for substantial investments.4

If DeepSeek’s approach can be replicated, the disruption could benefit the sector by making it faster and cheaper to release new models.

The new pressure would also force competitors to become more efficient in their operations.

Will the tech selloff trigger a bear market?

Market adjustments like this are not unusual, particularly after periods of strong performance.

Stocks have been riding high on soaring tech firm valuations, and the pullback could be the reset the sector needs to return to Earth.

Looking ahead, we can expect more volatility as investors adjust expectations and digest new data.

Bear markets are always a risk, and it’s wise to stay flexible and be prepared for one to strike.

That said, we see plenty of growth opportunities ahead despite the short-term uncertainty.

As always, we’re watching closely and monitoring trends.

Sources

1. CNBC, 2025 [URL: https://www.cnbc.com/2025/01/27/how-the-buzz-around-chinese-ai-model-deepseek-sparked-a-massive-nasdaq-sell-off.html]

2. Stanford, 2024 [URL: https://aiindex.stanford.edu/wp-content/uploads/2024/05/HAI_AI-Index-Report-2024.pdf]

3. IBD, 2024 [URL: https://www.investors.com/news/technology/ai-stocks-openai-artificial-intelligence-models-big-tech-google-meta/]

4. Goldman Sachs, 2024 [URL: https://www.goldmansachs.com/images/migrated/insights/pages/gs-research/gen-ai–too-much-spend,-too-little-benefit-/TOM_AI 2.0_ForRedaction.pdf]

Chart sources:

Stanford, 2024 [URL: https://aiindex.stanford.edu/wp-content/uploads/2024/05/HAI_AI-Index-Report-2024.pdf]

CNN, 2025 [URL: https://www.cnn.com/2025/01/27/tech/deepseek-stocks-ai-china/index.html]

Recent Posts

-

Timing Social Security and Taming Scary Markets March 5,2026

-

Don’t Make These Mistakes on Your Tax Return February 19,2026

-

Estimated Taxes, Marriage 2.0 and Cosmic Bumper Cars January 8,2026

Archives

- March 2026

- February 2026

- January 2026

- December 2025

- November 2025

- October 2025

- September 2025

- August 2025

- July 2025

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- May 2022

- April 2022

- March 2022

- February 2022

- December 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- November 2019

- October 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- November 2010

- October 2010

- September 2010

- August 2010

Categories

- 401(k)

- Annuities

- Behavior

- Best Practices

- Bonds

- Charitable Donations

- Economy

- Fees

- Fiduciary

- Financial Planning

- Investing 101

- Live Well

- Market Outlook

- Mutual Funds

- NorthStar

- Performance

- Personal Finance

- Planning

- Retirement

- Saving Money

- Scams & Schemes

- Seeking Prudent Advice

- Tax Planning

- Uncategorised

- Uncategorized

- Weekly Market Review