Can the bulls keep running?

The bull market has officially turned two.

Markets have also had an impressive run since the bottom of the bear market.

Since October 12, 2022, the S&P 500 has gained over 60%.1

Can the bulls keep running?

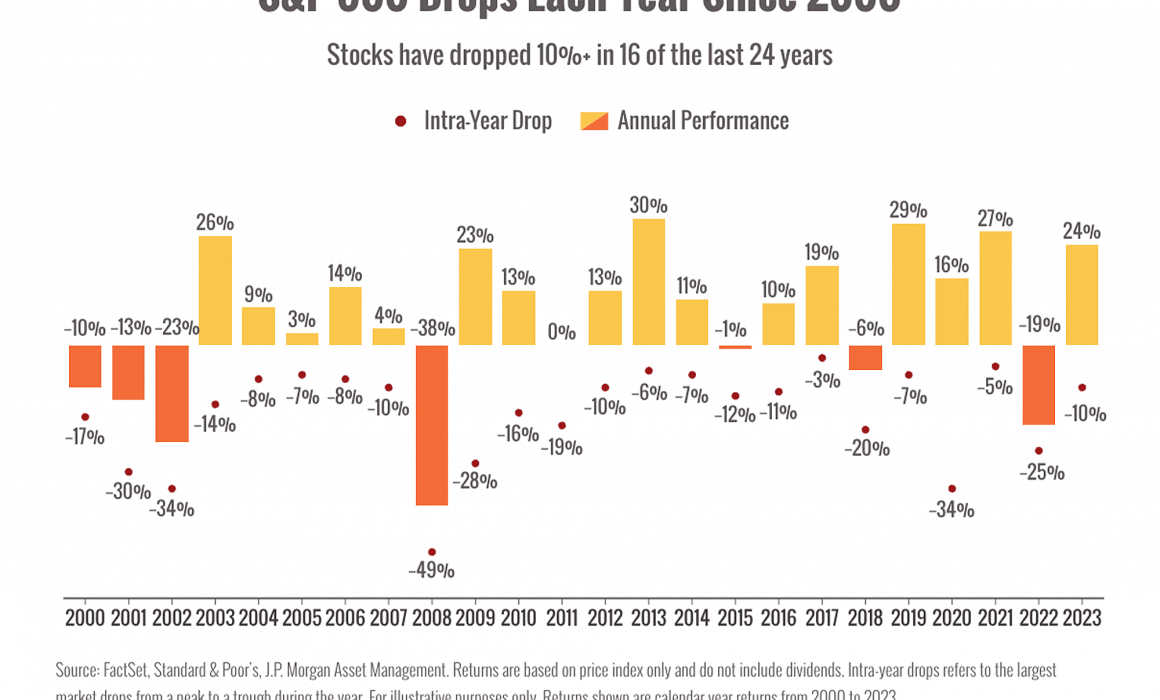

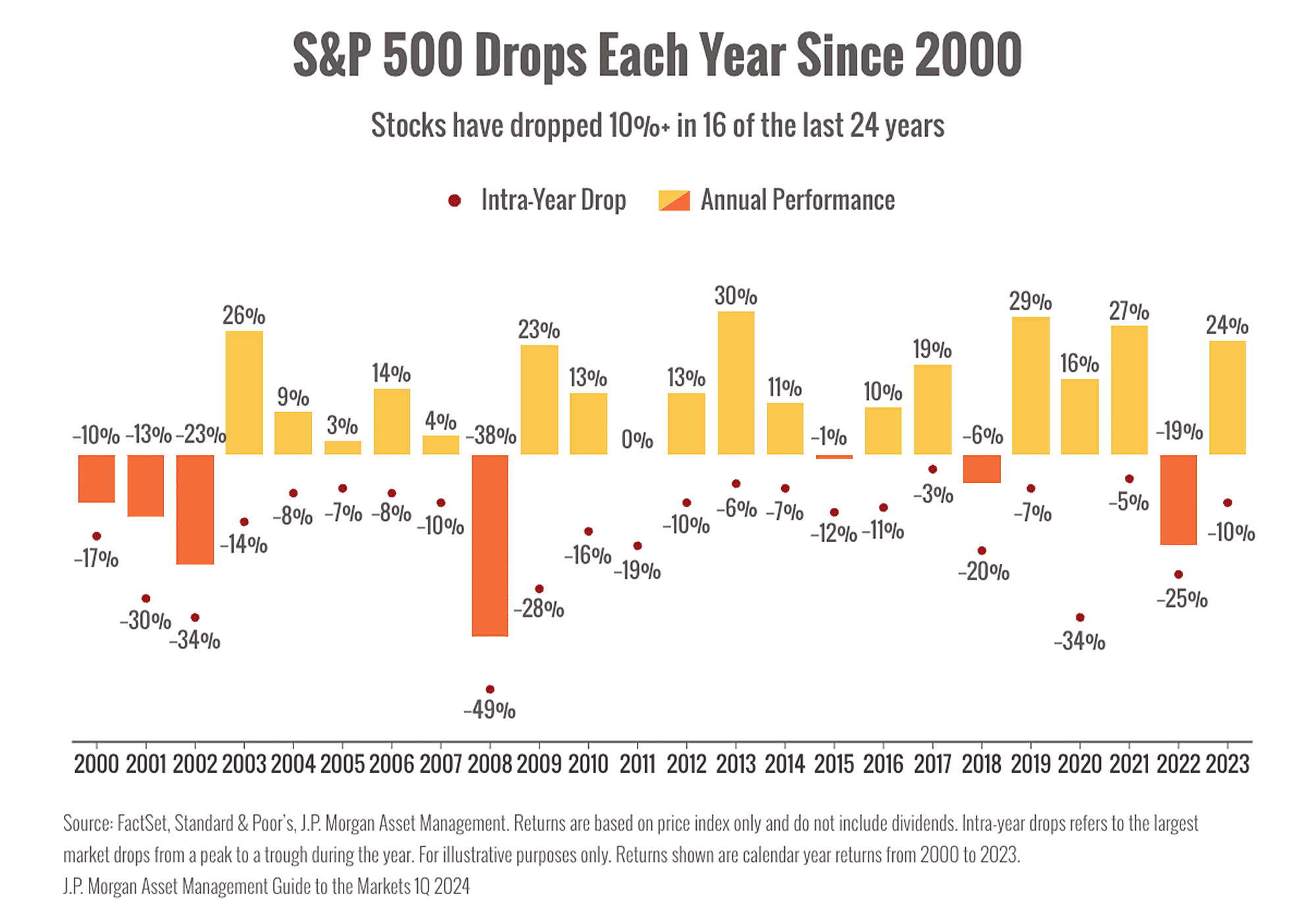

Given the strong performance in 2023 and the strong 2024 we’re having, it’s reasonable to worry that markets might retreat.

You can see in the chart below that consecutive strong years have happened before.2

That said, past performance doesn’t guarantee that optimists will continue to drive markets.

In fact, it wouldn’t be a surprise to see a pullback ahead.

However, there’s reason to hope for continued optimism.

The bull run we’ve experienced this year has a strong grounding in economic factors.

Factor #1: A growing economy generally boosts markets.

While markets are often impacted by short-term trends and investor psychology, stocks generally follow the economy.

The latest data shows that economists are upbeat about where economic growth is headed.3

Since the stock market is forward-looking, that’s a positive for the bulls.

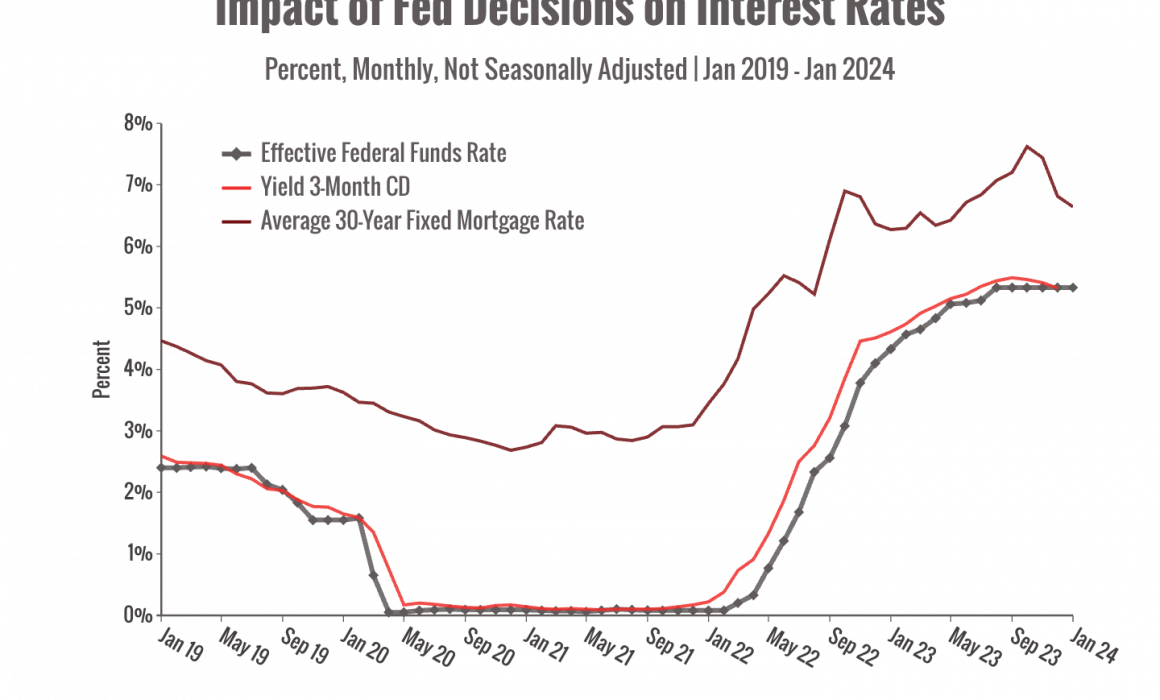

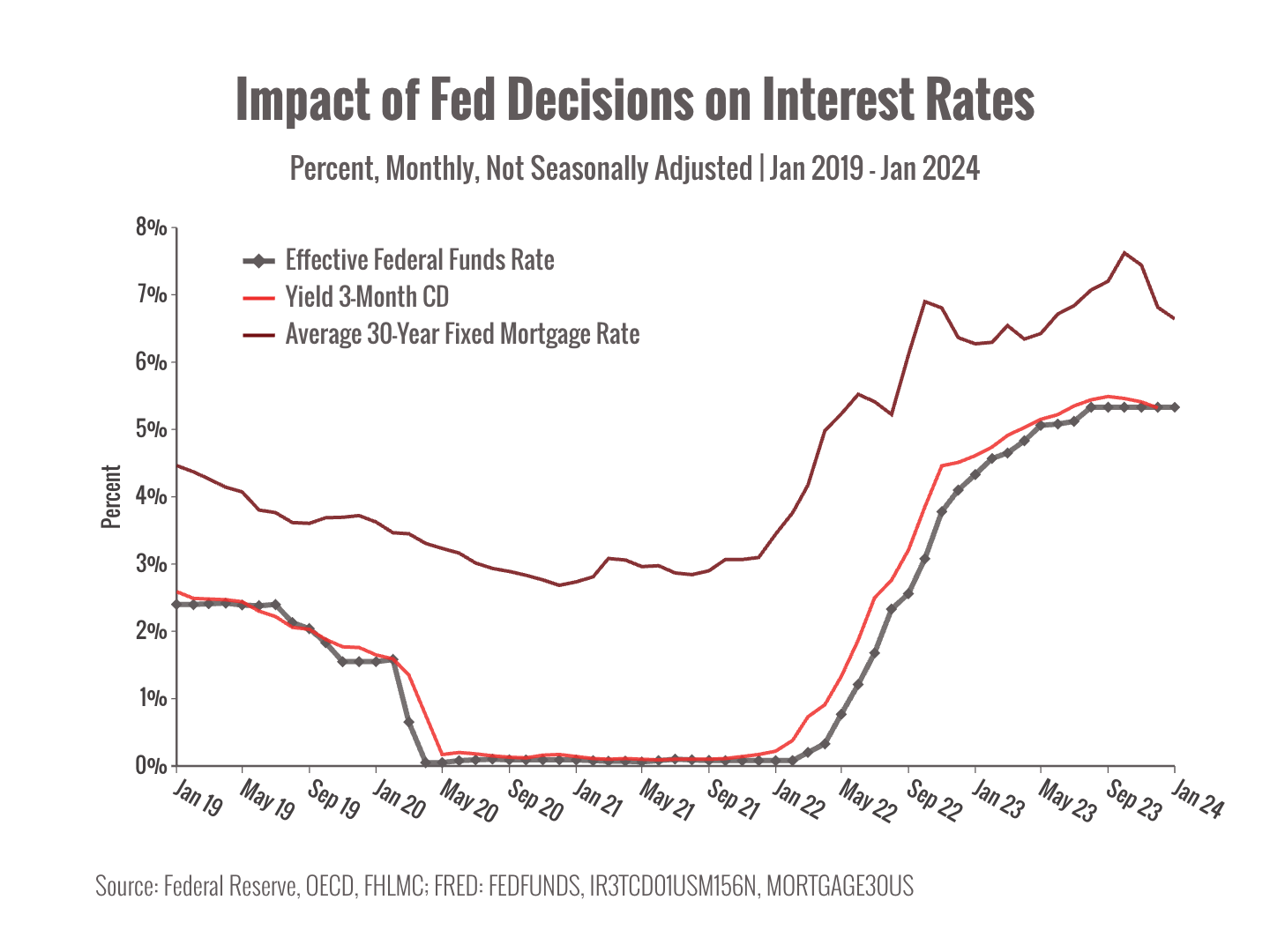

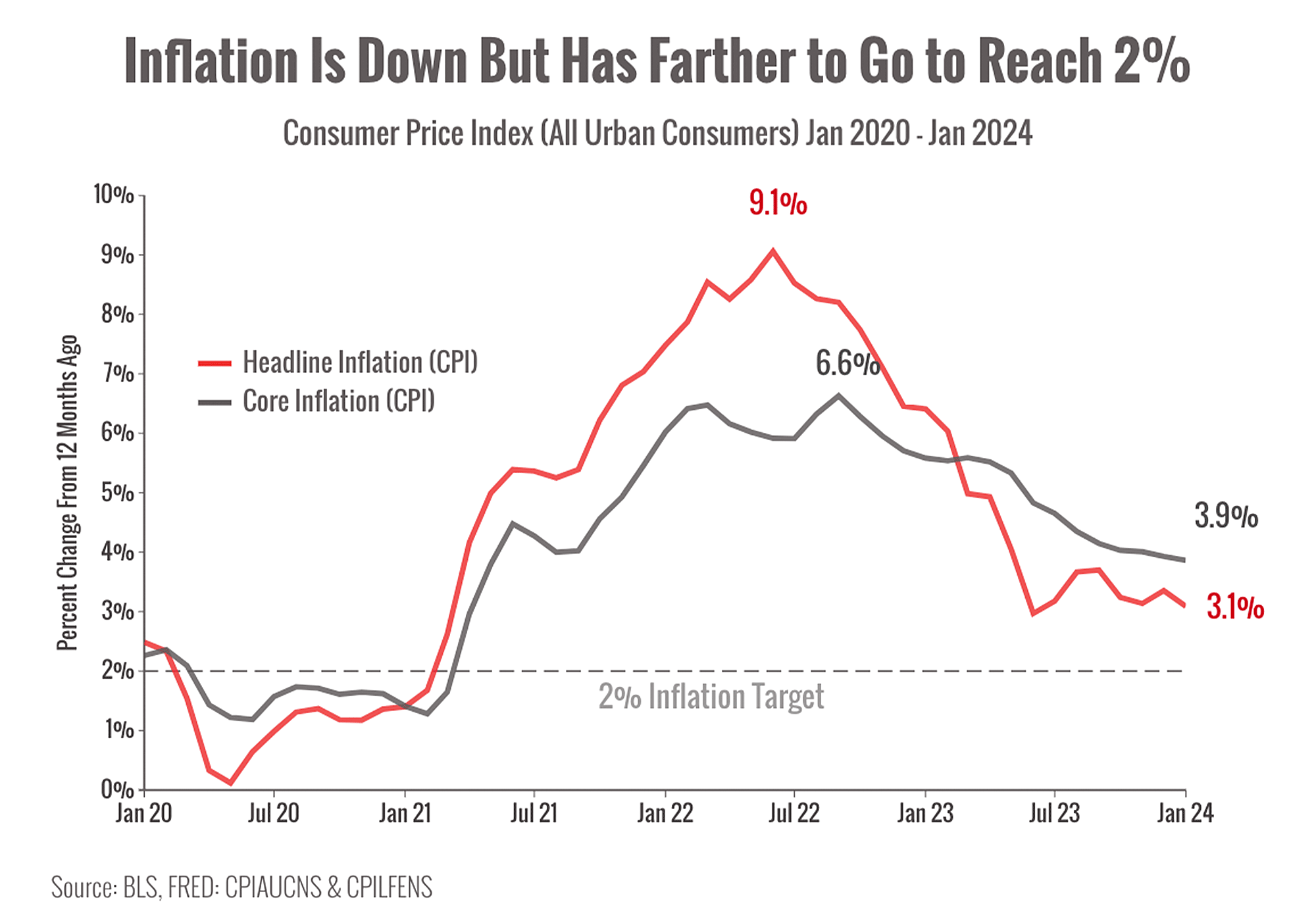

Factor #2: The Federal Reserve’s interest rate policy is loosening.

A big part of the market story this year is the hope that the Fed will be able to lower interest rates without causing inflation to spike or tipping the economy into recession.

Lower interest rates are generally positive for markets because they make it cheaper for firms and consumers to borrow money.

Lower corporate borrowing costs can fuel growth, R&D, acquisitions, and other capital-intensive projects that boost stock prices.

Factor #3: Optimism about corporate earnings.

While earnings season is still underway, the general consensus is that corporate earnings are looking solid so far.4

That’s great news for markets.

A recent survey of corporate leaders also found that the majority expect company profits to increase.5

Taken together, that’s a positive for the bulls.

However, there are a number of risks we’re watching.

With markets regularly testing new highs, stock valuations are also high.

That means some stocks may be overvalued.

If investors lose optimism about growth, markets will likely retreat.

Uncertainty surrounding American politics and global geopolitics is also high.

While elections and conflicts generally don’t have long-term effects on markets, they can certainly trigger selloffs.6

Overall, we’re still cautiously optimistic about where markets are going in the final months of the year.

It can be tempting to look at market highs and decide to sell and stand on the sidelines.

However, timing markets perfectly is impossible and you risk missing out on future growth.

Sources

2. https://am.jpmorgan.com/us/en/asset-management/adv/insights/market-insights/guide-to-the-markets/

3. https://www.wsj.com/economy/economists-predictions-survey-charts-68ba82d6?mod=article_inline

4. https://www.nasdaq.com/articles/stocks-edge-higher-solid-corporate-earnings-boost-market-optimism

6. https://www.nytimes.com/2024/10/15/business/stock-market-valuation-outlook.html

Chart sources: https://am.jpmorgan.com/us/en/asset-management/adv/insights/market-insights/guide-to-the-markets/