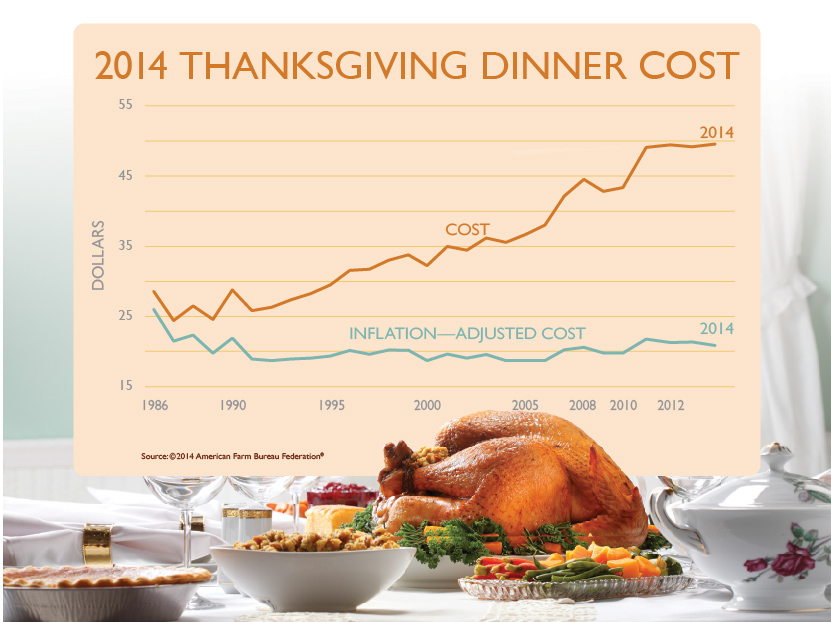

Thanksgiving Dinner Up 37 Cents

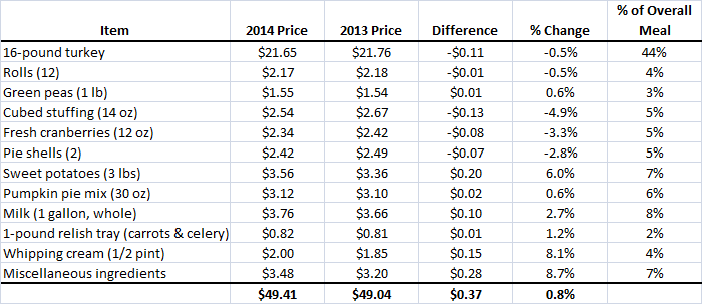

This year’s turkey dinner will cost you an extra $0.37 compared to last year. The average cost of a classic Thanksgiving Dinner for 10 people is $49.41 according to the American Farm Bureau Federation’s survey. That’s a 37-cent or 0.8% price increase from last year.

The bird soaks up the lion’s share of the budget at 44% of the meal’s cost. The 16-pound turkey came in at $21.65 this year or $1.35 per pound. The biggest year-over-year change on a percentage basis were the miscellaneous ingredients whose cost increased 8.7%. The stuffing contributed the biggest percentage drop at -4.9%.

The average cost of a turkey dinner has hovered around $49 since 2011. The relative price stability of the turkey index mirrors the government’s Consumer Price Index for food eaten at home which increased 3% compared to last year.

Happy Thanksgiving!

Source: AFBF