Oh Baby! You’re Expensive

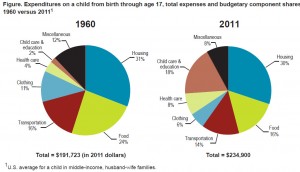

Many parents worry about saving for college, but don’t forget about the proceeding 17 years! Food, clothing, shelter, and other necessities will cost $234,900 for a child born in 2011 to a middle-income family.

Many parents worry about saving for college, but don’t forget about the proceeding 17 years! Food, clothing, shelter, and other necessities will cost $234,900 for a child born in 2011 to a middle-income family.

Today the the U.S. Department of Agriculture released their annual report where they total up the cost that parents pay to raise a child from birth to age 17.

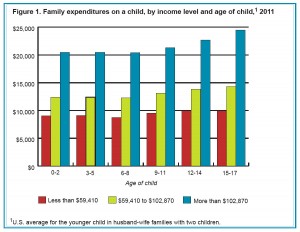

- The annual expense per child ranges from $8,760 to $9,970 on average (depending on age) for households with an annual income less than $59,410.

- The annual cost increases to $12,290 to $14,320 for households with income up to $102,870.

- The annual cost increases yet again to $20,420 to $24,510 for households with annual income greater than $102,870.

Housing, childcare & education, and food comprise 64% of the expenses.

It’s interesting to compare the costs of raising a child born in 1960 (the year the USDA study first started) to a child of 2011. The total cost has increased 22% from $191,723 in 1960 (in 2011 dollars) to $234,900 in 2011.

- Food has decreased from 24% of the cost in 1960 to 16% in 2011

- Clothing has shrunk from 11% in 1960 to 6% in 2011

- Childcare & education has surged from only 2% in 1960 to 18% in 2011

- Healthcare has doubled from 4% in 1960 to 8% in 2011

Expenditures on a child from birth through age 17, total expenses and budgetary component shares, 1960 versus 2011 (CLICK TO ENLARGE)