Asset Allocation in Thirty Seconds

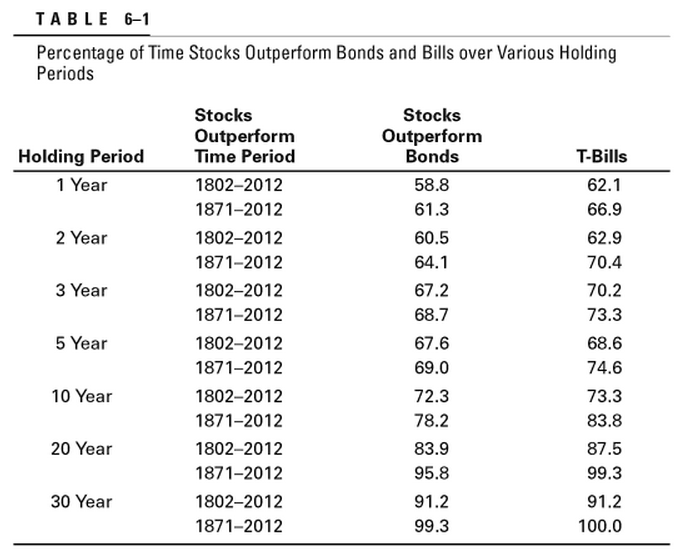

If you’ve only got 30 seconds to understand asset allocation, spend those precious seconds staring at the table below. The main takeaway: stocks beat Treasury bonds and T-Bills on average. For example, over a 1-year period, stocks outperform 61.3% of the time during the last 210 years. Over a longer 30-year period (typical for retirement portfolios) stocks came out on top 91.2% of the time.

This table is from Jeremy Seigel’s book, Stocks for the Long Run.

This table is from Jeremy Seigel’s book, Stocks for the Long Run.