5 Big Retirement Mistakes

#1 Not paying for financial guidance

#1 Not paying for financial guidance

People who have no problem paying for the services of an accountant or lawyer often balk at the prospect of cutting a check to pay for investment advice. Instead, they rely on “free” help from retirement advisers they meet at banks, brokerage firms and retirement seminars.

#2 Investing in something you don’t understand

If your financial adviser recommends an investment you can’t explain to someone else, just say no. It will likely carry steep fees (to pay steep commissions) and be less wonderful than it is touted to be.

#3 Supporting your adult children

You might be tempted to help them with a down payment or living expenses, but unless you are certain that you have enough to ensure your own survival, don’t do it.

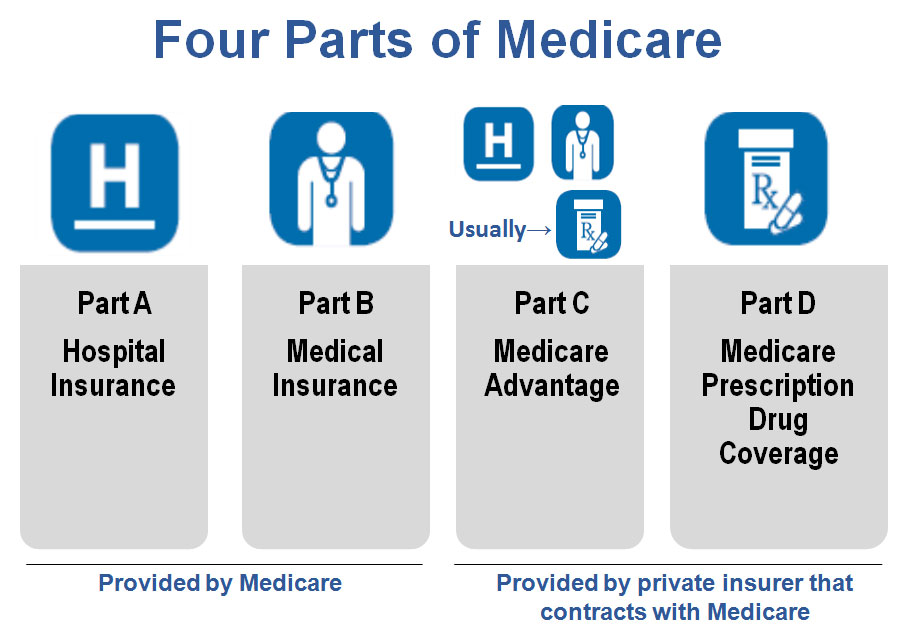

#4 Low-balling elder-care costs

When planning for retirement, few people think about how much they might end up spending to support elderly parents. Inflation and longevity could erase the purchasing power of the children’s pension and savings, leaving them with too little to live on, let alone cover medical expenses.

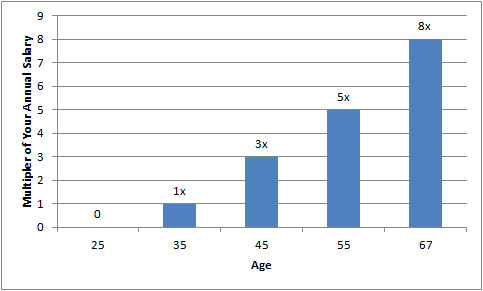

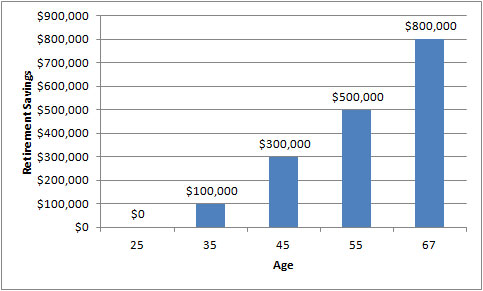

#5 Underestimating how much you will need

It is easy to underestimate the impact of inflation and longevity, or the cost of health care, supporting family members or caring for a spouse with Alzheimer’s disease or cancer.

Source: Wall Street Journal