529 Rollovers (coming soon)

529 accounts are getting a lot more powerful with the recent SECURE Act 2.0 legislation that went into effect on January 1st.

529 accounts are getting a lot more powerful with the recent SECURE Act 2.0 legislation that went into effect on January 1st.

Here’s what you need to know:

Typically, 529 money is dedicated to education expenses like college tuition. Taking money out for other “non-qualified” purposes generally triggers penalties and taxes.

Meaning that if your kid didn’t go to a qualified K-12 or college or didn’t use up the funds because they received a scholarship, you didn’t have a lot of choices for the money in the account that didn’t come with penalties.

Sure, you could change the beneficiary so the money went to pay for another child’s education, but that was about it.

Here’s some good news:1

Starting in 2024, 529 funds that don’t get used for education will be able to roll over to the beneficiary’s Roth IRA, free of taxes and penalties.

But — and there’s usually a but — there are some caveats and limitations we need to keep in mind:

- Rollovers will count as contributions and can’t exceed the annual IRA contribution limit ($6,500 in 2023)

- Rollovers can only be made to the beneficiary’s Roth IRA (i.e. the child’s) and not the account owner’s

- The 529 account must have been open for at least 15 years (and possibly be in the same beneficiary’s name for that period)

- You can’t roll over contributions (or their earnings) made in the last five years

- There’s a $35,000 lifetime cap on rollovers

Are 529 rollovers a big deal?

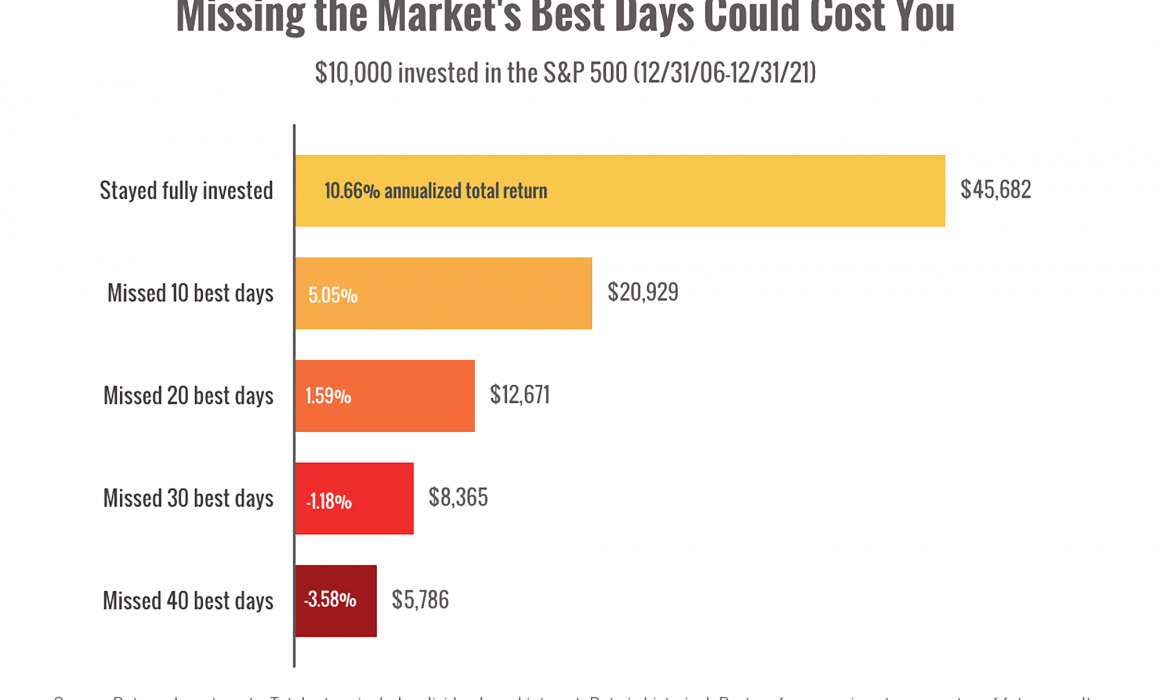

I think so. Simply because it opens the door to doing much more with your child’s education savings than simply paying for college.

Imagine the boost you could give your child’s retirement over their lifetime.

Imagine your child graduates college with funds still in their 529 account. So you roll the remainder to a Roth IRA in their name. Because you know that investing early in life is the best way to put time on their side. The money grows for the next 45 years, tax-free.

They could kick off their retirement with a sizable tax-free nest egg. All courtesy of you and your forethought.

Imagine the gift you could be giving your children (and grandchildren) by giving them such a head start.

What can you do with this information now?

If you have children and haven’t opened a 529 account, go ahead and establish one now, even if it’s for just a few bucks to get that 15-year clock started.

Scholastically,

Dr. Chris

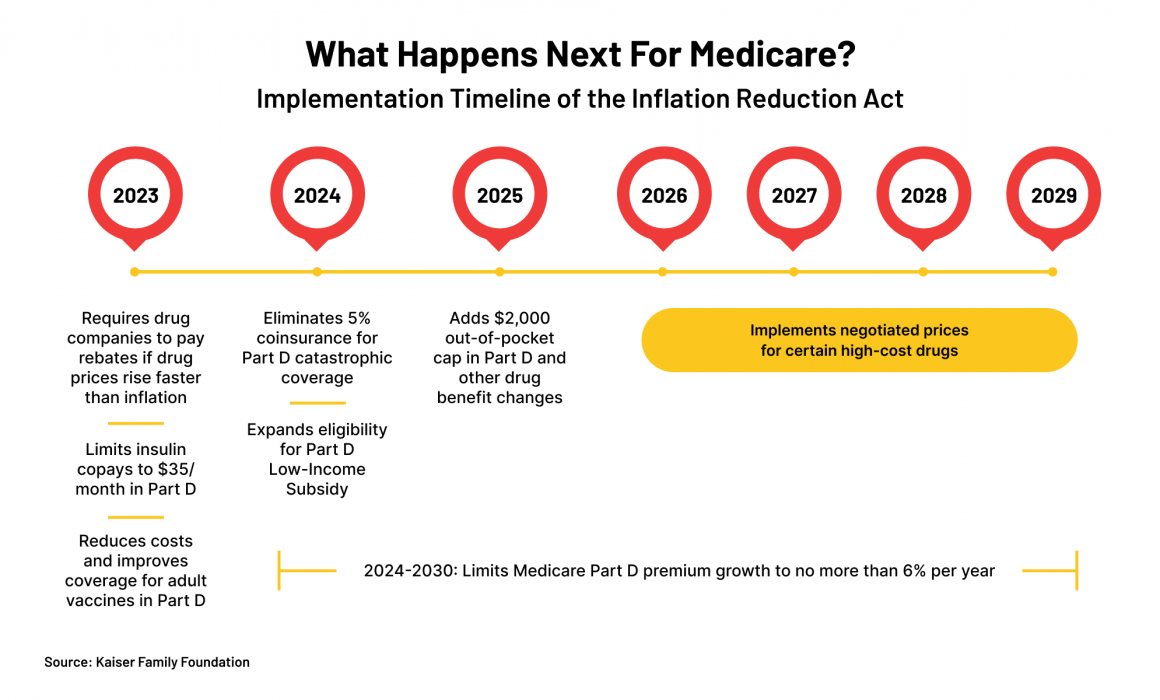

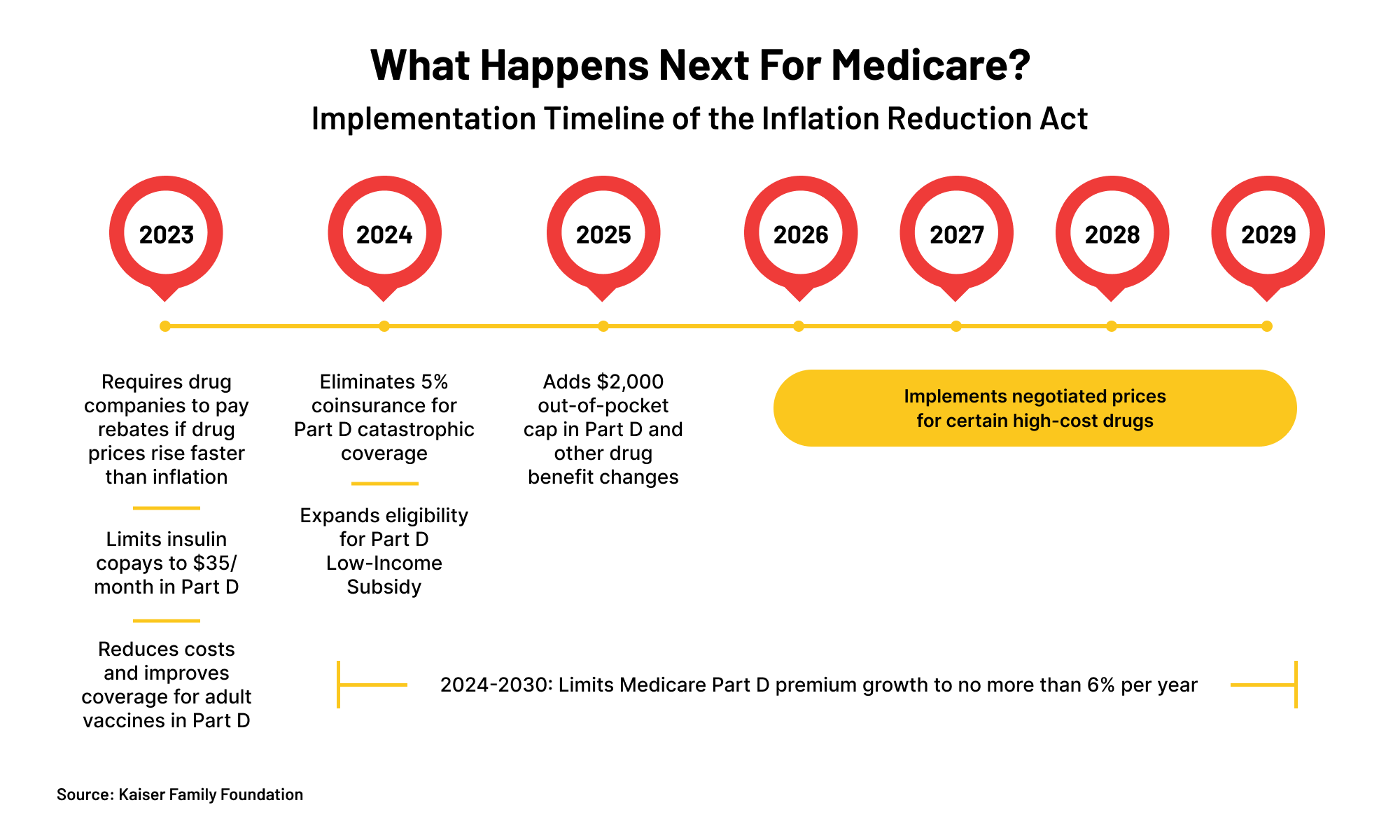

After months of debate, Congress finally passed some major changes to retirement laws at the end of 2022.1

After months of debate, Congress finally passed some major changes to retirement laws at the end of 2022.1