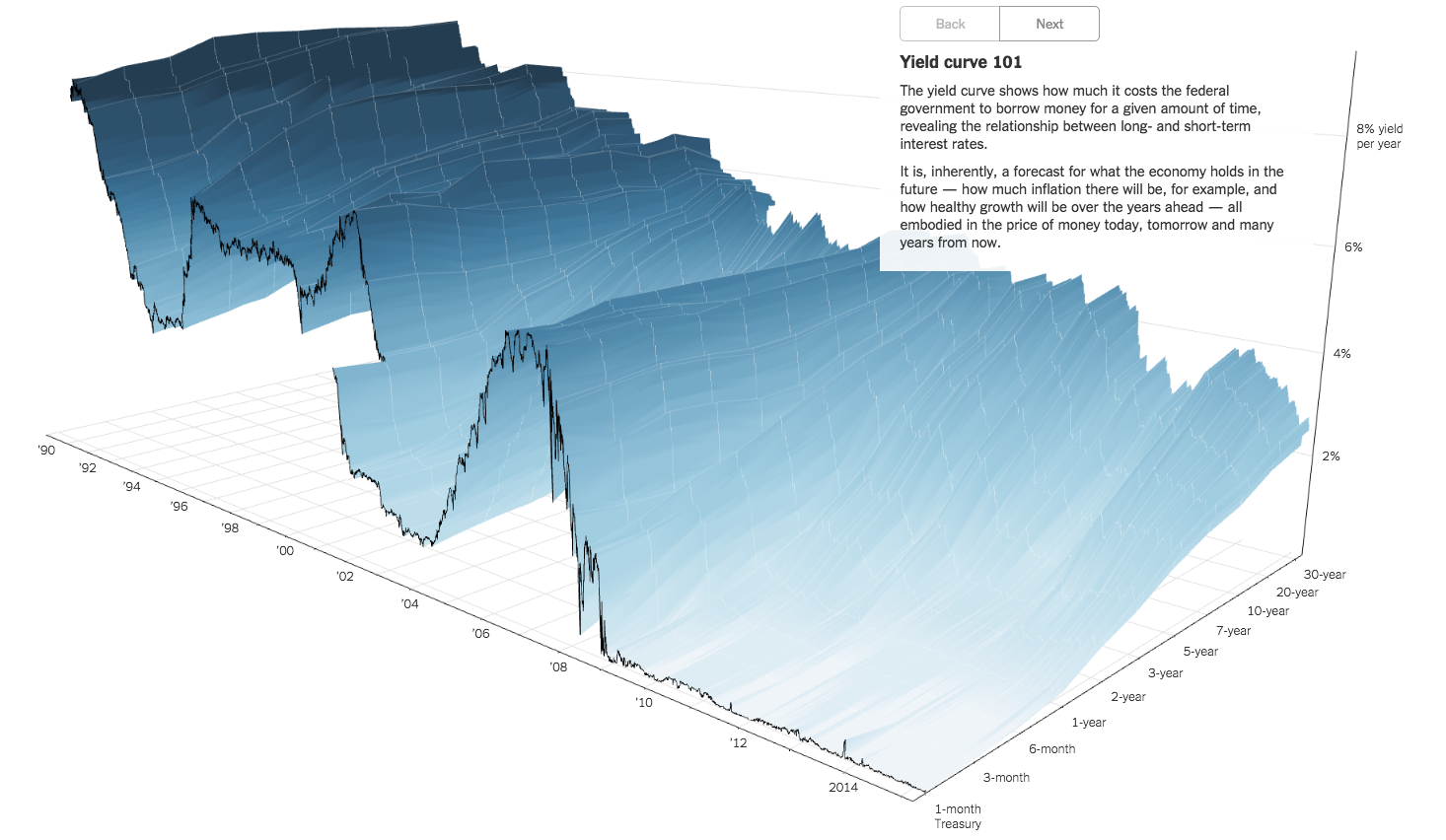

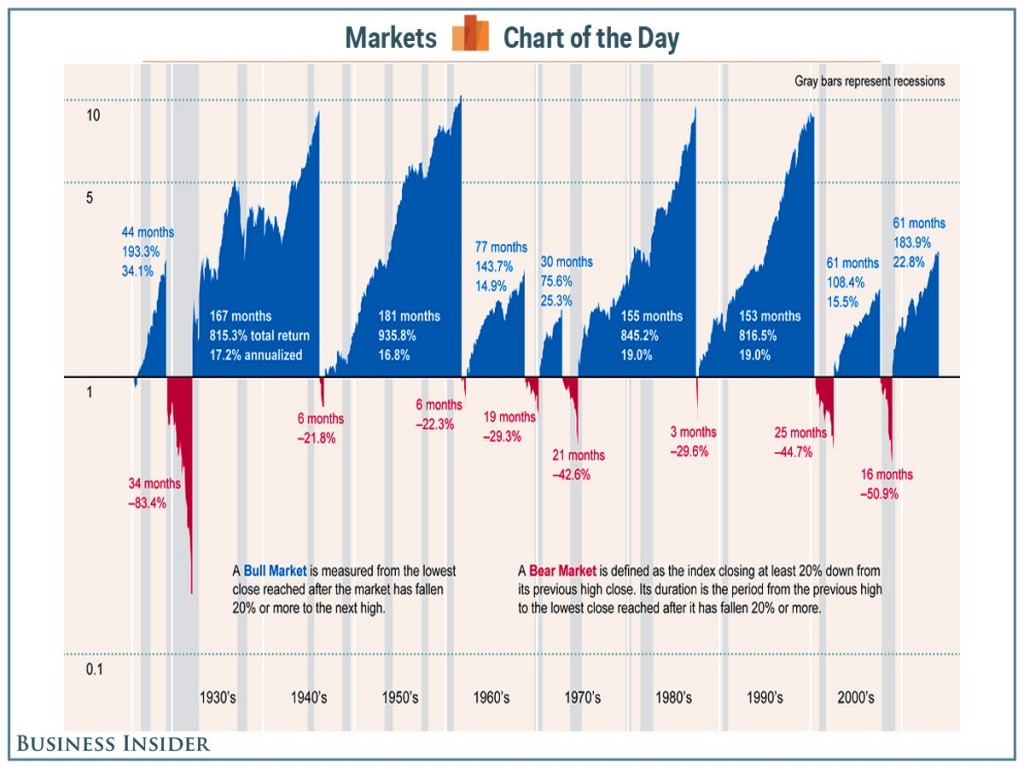

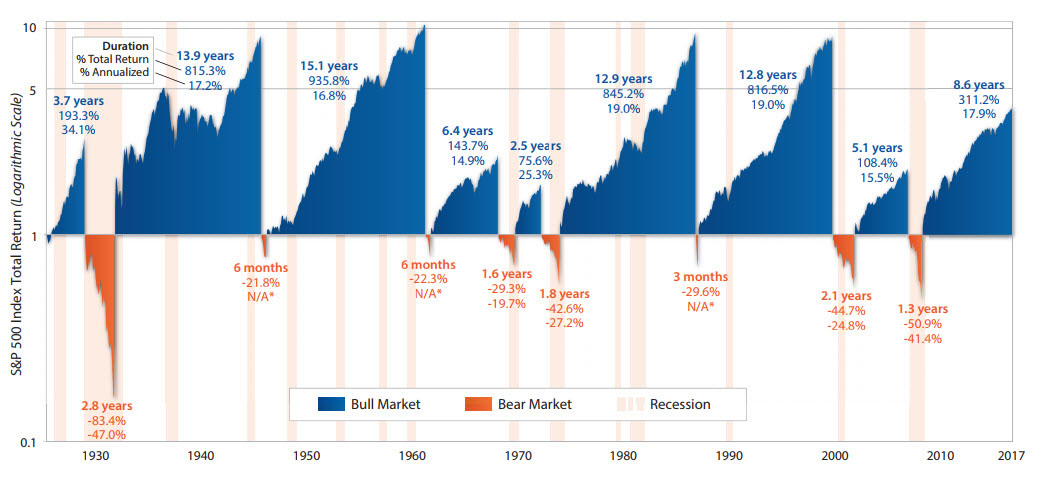

Best Illustration of Bull & Bear Markets

Here’s the best illustration we’ve ever seen of history’s bull and bear markets. This chart shows the performance of the S&P 500 Index from 1926 through September 2017. Blue denotes past bull markets’ durations and returns (total and annualized). Orange denotes the bear markets. The pink vertical bars delineate recessions.

Here’s the best illustration we’ve ever seen of history’s bull and bear markets. This chart shows the performance of the S&P 500 Index from 1926 through September 2017. Blue denotes past bull markets’ durations and returns (total and annualized). Orange denotes the bear markets. The pink vertical bars delineate recessions.

At a 100,000-ft level, this chart underscores the benefits of investing for the long-term. Two specific takeaways:

- There’s a lot more blue than orange meaning stocks tend to spend more time going up in value than going down.

- The current bull market might feel long, but by historical standards, the length and strength of this bull is not exceptional

Source: First Trust