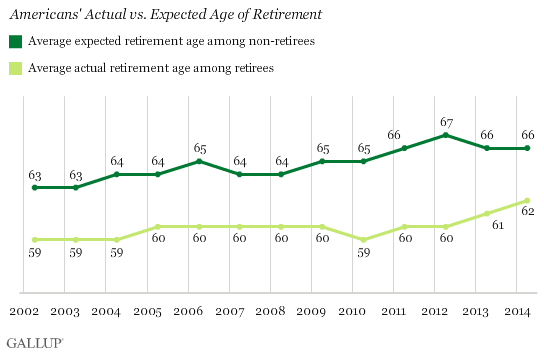

Average U.S. Retirement Age Rises to 62

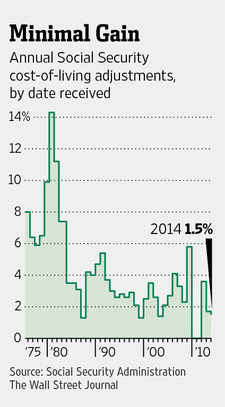

The average age at which U.S. retirees report retiring is 62, the highest Gallup has found since first asking Americans this question in 1991. Current expectations for retirement have increased to age 66, up from 63 in 2002.

The average age at which U.S. retirees report retiring is 62, the highest Gallup has found since first asking Americans this question in 1991. Current expectations for retirement have increased to age 66, up from 63 in 2002.

Why is retirement age on the rise?

- Living longer – lifespans in the U.S. have increased

- Better health – Americans are in better health in their senior years than ever before and better able to work later in life

- More service and office jobs – less manual labor allows folks to stay working longer

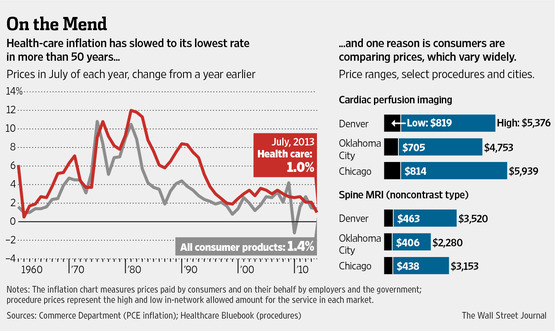

- Financial needs – not having enough cash to retire is another reason people retire later